This Week In AI Business: AI Technology Bubble Analysis [Week #35-2025]

For people like me working in tech, we believe technology is everything and that it drives change from the inside out.

Truth is, it’s mostly not.

And not in the short term, as a tech revolution can be easily killed by exogenous factors that have nothing to do with the tech itself.

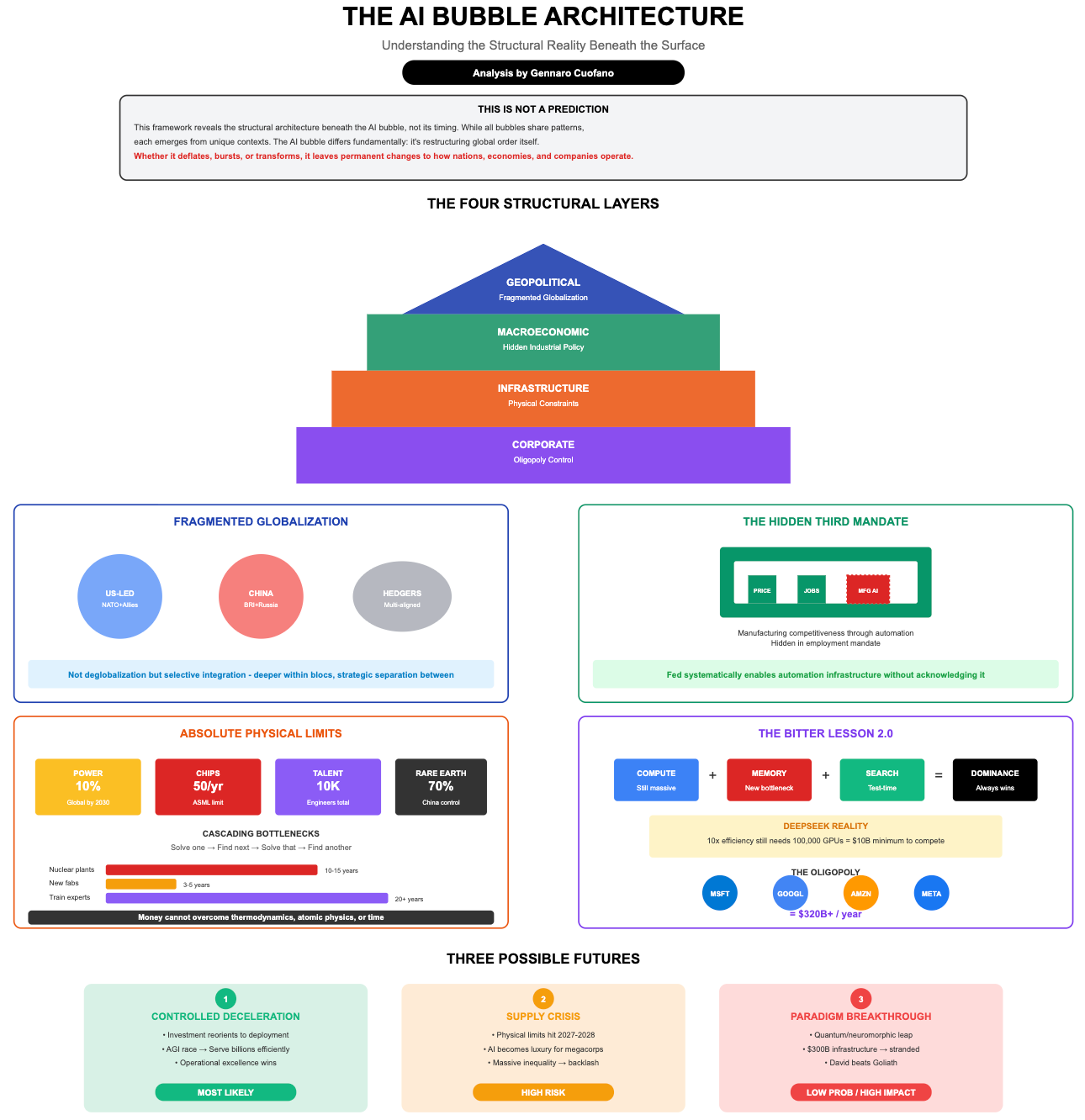

Technology is part of a much larger structural reality, comprising several layers above, which determine what happens within the tech landscape.

This analysis isn't about predicting whether or when the AI bubble will burst - no framework can time markets with precision.

Instead, it reveals the structural architecture beneath the bubble's surface.

While all bubbles share specific patterns in their inflation and deflation, each emerges from unique technological, economic, and geopolitical contexts that shape its character and consequences.

The AI bubble differs fundamentally from its predecessors because it's restructuring the foundations of global order itself.

Whether this bubble deflates gradually, bursts spectacularly, or transforms into something entirely different, it will leave behind lasting changes to how nations compete, how economies function, and how companies operate.

Understanding these structural shifts matters more than timing the market.

Top Latest Issues:

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.

![This Week In AI Business: AI, The Bubble That Can’t Burst (Just Not Yet) [Week #34-2025]](https://substackcdn.com/image/fetch/$s_!6c8k!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd09a8b79-1900-48be-a4cd-4de9fbeb3755_1322x1626.png)