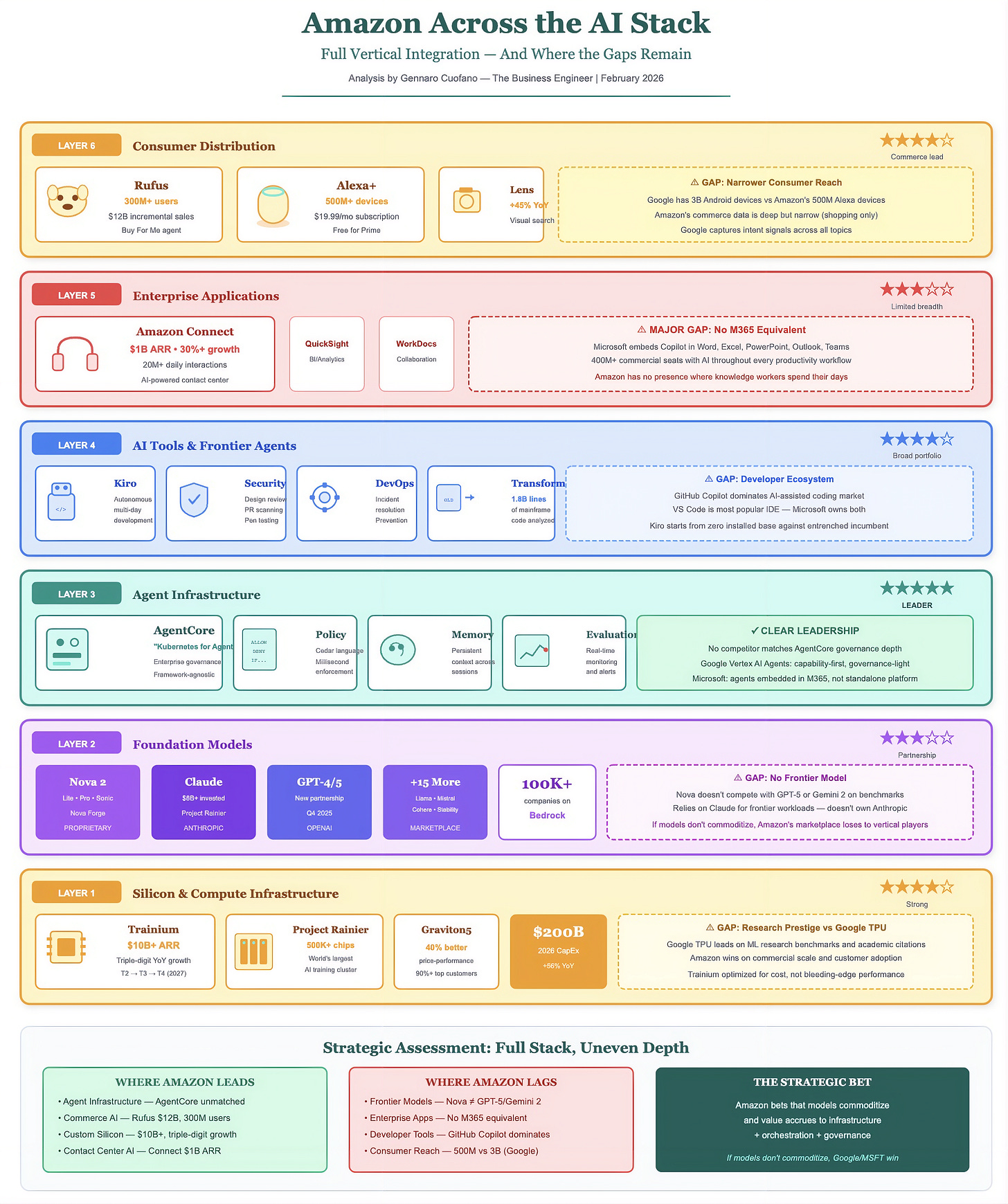

Amazon’s Full-Stack AI Bet

Amazon is attempting something only Google has tried before: full vertical integration across the entire AI stack. From custom silicon at the bottom to consumer applications at the top, Amazon wants to own or control every layer where value accrues.

The Q4 2025 earnings reveal how far this integration has progressed. Custom silicon hit $10 billion+ in annual revenue. Foundation models span proprietary (Nova), partnership (Claude), and marketplace (OpenAI, Llama, Mistral).

Agent infrastructure reached production maturity. Enterprise applications crossed the billion-dollar threshold. Consumer distribution touches 300 million users monthly.

But vertical integration is not vertical excellence. Amazon leads at some layers, competes adequately at others, and lags significantly at a few. Understanding where Amazon is strong, where it’s sufficient, and where it’s weak reveals both the opportunity and the risk in the agentic bet.

The Six-Layer AI Stack

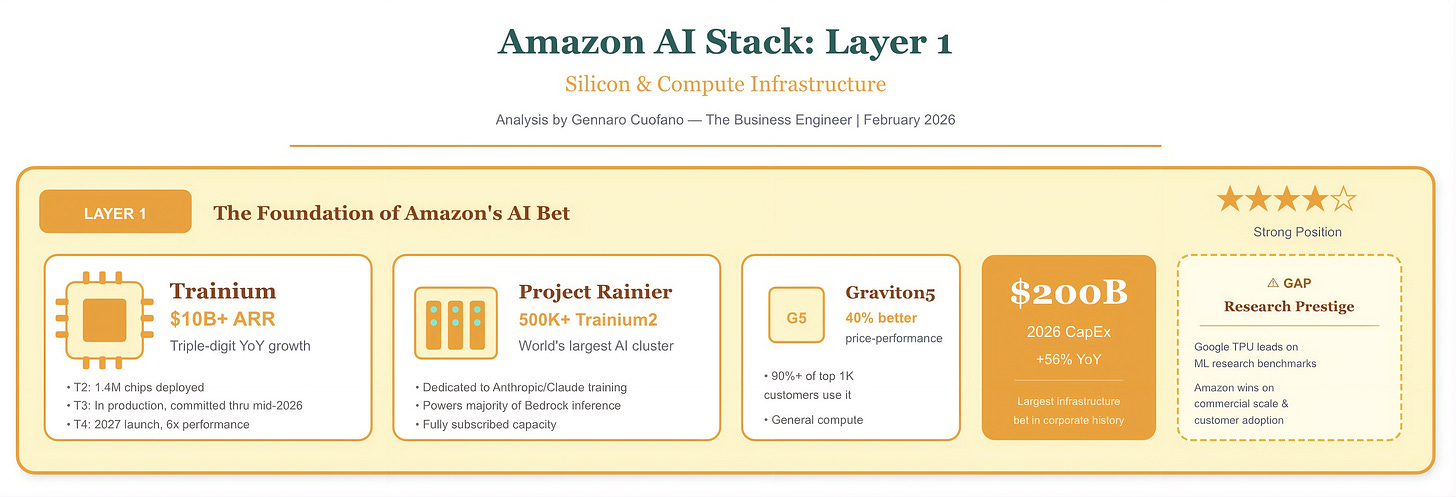

Layer 1: Silicon and Compute Infrastructure

What It Is: The physical foundation—chips designed for AI workloads, data centers housing them, and the power infrastructure keeping them running.

Amazon’s Position: Strong and strengthening.

Trainium and Graviton now generate over $10 billion in annual revenue, growing at triple-digit percentages. This isn’t a research project—it’s a scaled business larger than most enterprise software companies.

The roadmap demonstrates sustained commitment. Trainium2 has 1.4 million chips deployed, powering the majority of inference on Bedrock. Project Rainier clusters 500,000+ Trainium2 chips into the world’s largest operational AI training facility. Trainium3 entered production this quarter with supply committed through mid-2026. Trainium4 arrives in 2027, promising 6x performance improvement.

Graviton5 delivers 40% better price-performance than x86 alternatives, with adoption across 90%+ of AWS’s top 1,000 customers. Amazon controls its silicon destiny in a way that Microsoft cannot match and that rivals even Google’s TPU program.

The $200 billion 2026 CapEx guidance—up 56% from 2025’s already record-breaking spend—flows primarily into this layer. Amazon is building infrastructure that competitors cannot replicate on any reasonable timeline.

Competitive Assessment: Amazon trails Google’s TPU program in research prestige and benchmark performance, but leads in commercial deployment and customer adoption. Microsoft’s Maia chip remains early-stage. NVIDIA dependency gives Amazon structural advantage over competitors still waiting in allocation queues.

Verdict: ★★★★☆ — Strong position, approaching leadership.

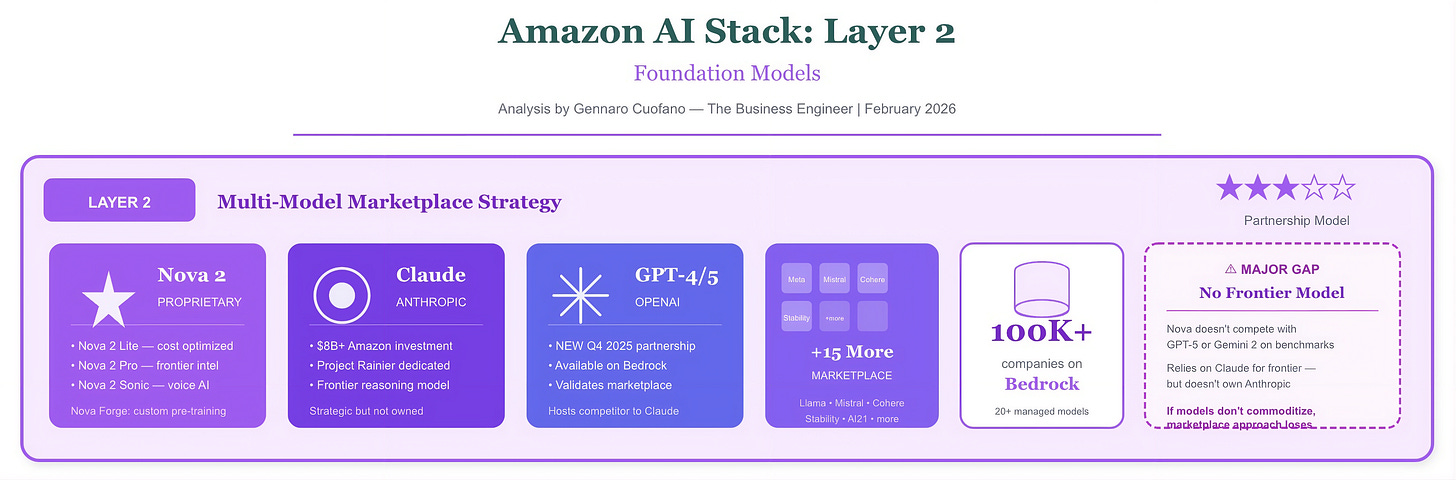

Layer 2: Foundation Models

What It Is: The large language models and multimodal systems that provide core intelligence—the “brains” that power everything above.

Amazon’s Position: Adequate but not leading.

Amazon pursues a multi-model strategy rather than betting everything on proprietary development. Bedrock now serves 100,000+ companies with access to 20+ models: Amazon’s Nova family, Anthropic’s Claude, OpenAI’s GPT models (new this quarter), Meta’s Llama, Mistral, Cohere, and others.

The Nova family expanded significantly. Nova 2 Lite and Nova 2 Pro target frontier intelligence at a competitive cost. Nova 2 Sonic handles multilingual conversational AI. Nova Forge enables custom pre-training with proprietary data. Nova Act powers agents for UI-based workflows.

But Nova doesn’t lead on benchmarks. It competes on price-performance and integration rather than raw capability. When enterprises need the most advanced reasoning, they choose Claude or GPT-4, which Amazon happily hosts through Bedrock.

The Anthropic partnership provides the flagship model. Amazon’s $8 billion+ investment and the dedicated Project Rainier cluster ensure Claude remains available and optimized on AWS. But Amazon doesn’t own Anthropic, and Claude’s roadmap isn’t Amazon’s to control.

The OpenAI addition this quarter proves the marketplace thesis. Amazon now hosts the three leading model families—Nova, Claude, and GPT—through a single platform. Customers choose; Amazon collects infrastructure fees regardless.

Competitive Assessment: Google’s Gemini 2 and OpenAI’s GPT-4/GPT-5 lead on capability benchmarks. Claude competes at the frontier but belongs to Anthropic, not Amazon. Nova is cost-competitive but not capability-leading. Amazon wins on selection and flexibility, not on having the best model.

The Gap: Amazon lacks a proprietary frontier model that competes head-to-head with Gemini or GPT-5. If model quality proves decisive—if one model becomes so superior that customers accept vertical lock-in to access it—Amazon’s marketplace approach becomes a vulnerability rather than a strength.

Verdict: ★★★☆☆ — Adequate through partnerships, but proprietary models lag the frontier.

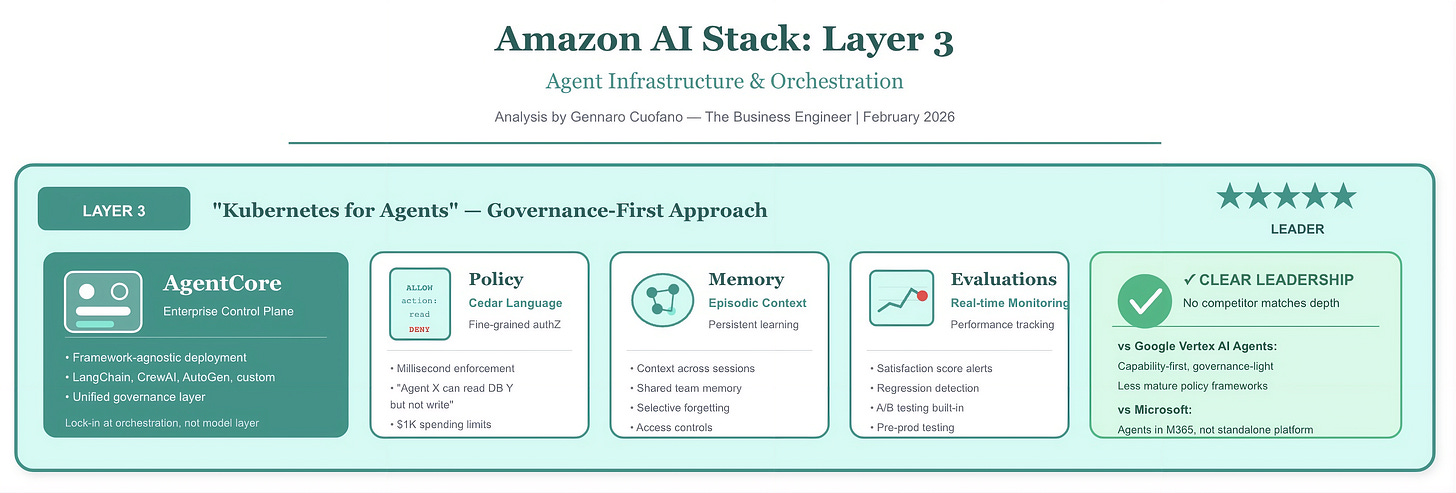

Layer 3: Agent Infrastructure and Orchestration

What It Is: The control plane that governs how agents operate—policy enforcement, memory management, evaluation frameworks, and orchestration across multi-agent systems.

Amazon’s Position: Leading and extending.

AgentCore represents Amazon’s most differentiated offering in the stack. It answers the enterprise question that matters most: how do I deploy autonomous agents without losing control?

The components work together as an integrated governance system. AgentCore Policy uses the Cedar language to define fine-grained permissions—what actions an agent can take, what data it can access, what spending limits apply.

Decisions are executed in milliseconds, enabling real-time governance without latency penalties. AgentCore Evaluations continuously monitors agent performance, triggering alerts when satisfaction scores drop or behavior deviates from expected patterns.

AgentCore Memory provides persistent context across sessions, enabling agents to learn from experience while respecting data boundaries and compliance requirements.

The framework-agnostic approach creates switching costs at the right layer. Enterprises can deploy agents built on LangChain, CrewAI, AutoGen, LlamaIndex, or custom frameworks—all governed by AgentCore’s policy engine. This means customers aren’t locked into Amazon’s models or agent frameworks, but they are locked into Amazon’s governance infrastructure.

New this quarter: AgentCore expanded to support the “frontier agent” class—agents that operate autonomously for extended periods, handling multi-day tasks without human intervention. The governance requirements for autonomous agents exceed those for copilot-style assistants, and AgentCore’s maturity enables deployment that competitors cannot yet match.

Competitive Assessment: Google’s Vertex AI Agents focuses on capability (grounding, reasoning, extensions) rather than governance. Microsoft’s agent infrastructure embeds within M365 rather than offering standalone orchestration. Neither competitor has shipped production-grade policy enforcement comparable to Cedar.

Verdict: ★★★★★ — Clear leadership in enterprise agent governance.

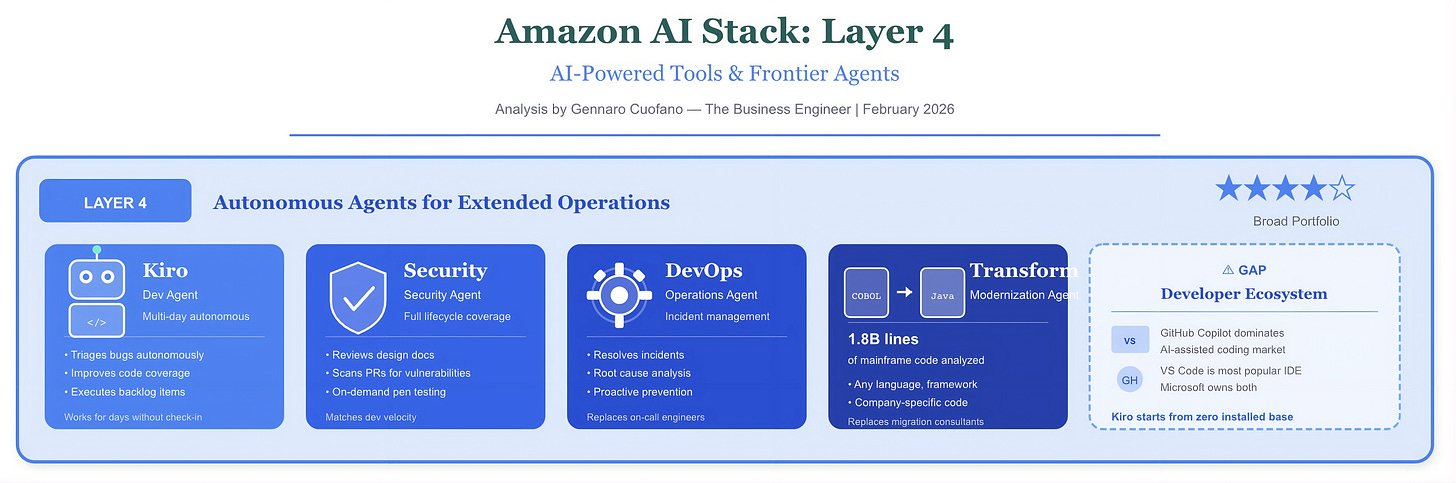

Layer 4: AI-Powered Tools and Agents

What It Is: Specific agents and AI-powered tools that perform defined tasks—the products that enterprises actually deploy.

Amazon’s Position: Expanding rapidly across domains.

Amazon launched “frontier agents” this quarter—a new class designed for autonomous, extended operation.

Kiro handles software development tasks without human intervention. Developers describe a problem or assign backlog items, and Kiro independently triages bugs, improves code coverage, and delivers working solutions. The agent works for days on complex tasks, checking in only when blocked or complete.

The AWS Security Agent embeds throughout the development lifecycle. It reviews design documents against security requirements, scans pull requests for vulnerabilities, and transforms penetration testing from a weeks-long engagement into an on-demand capability. Security expertise scales with development velocity rather than constraining it.

The AWS DevOps Agent handles incident response—detecting issues, performing root cause analysis, and executing remediation. It operates proactively, preventing incidents before they impact customers.

AWS Transform has analyzed 1.8 billion lines of mainframe code since launch, accelerating modernization across any language, framework, or architecture. Enterprises use it to escape legacy systems without the traditional years-long migration consulting engagements.

Beyond frontier agents, Amazon offers specialized AI tools across domains. Amazon Q provides AI assistance for developers and business users. CodeWhisperer handles code completion and generation. Bedrock Agents enables custom agent development on the platform.

Competitive Assessment: Microsoft leads in developer tooling through GitHub Copilot’s market penetration and VS Code integration. Google offers strong research-driven capabilities but fewer production-ready enterprise agents. Amazon’s breadth across security, DevOps, and modernization exceeds competitors, but Microsoft’s depth in the developer workflow remains formidable.

The Gap: Amazon lacks a dominant position in the developer IDE market. Kiro competes against GitHub Copilot’s installed base and mindshare. Microsoft’s ownership of GitHub and VS Code creates distribution advantage that Amazon cannot easily replicate.

Verdict: ★★★★☆ — Strong breadth, but trails Microsoft in developer ecosystem.

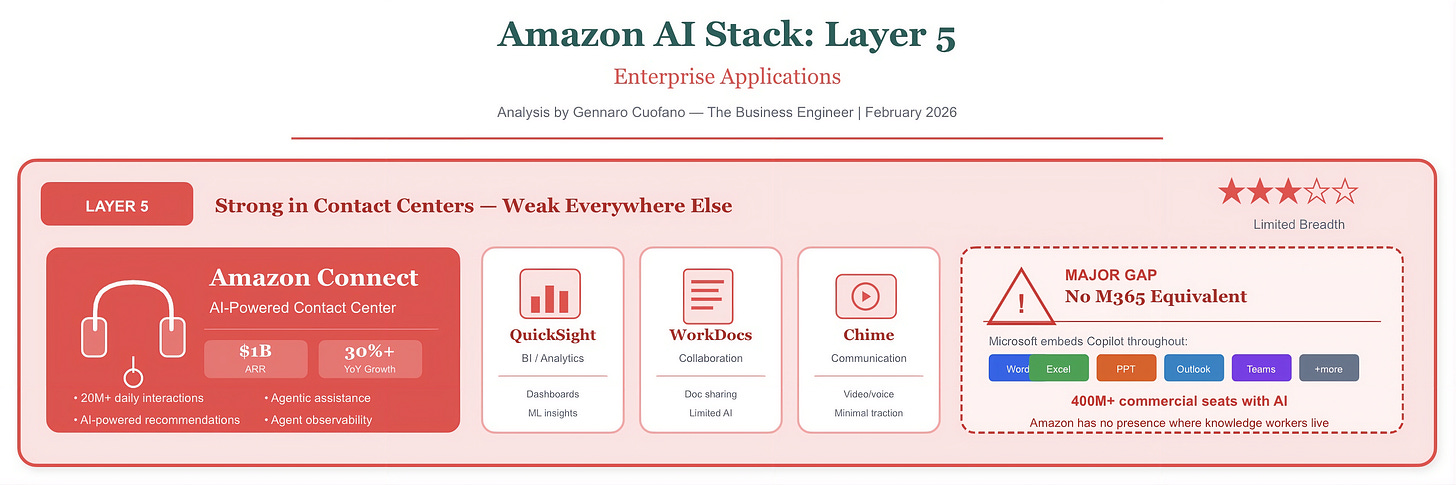

Layer 5: Enterprise Applications

What It Is: Complete applications that solve business problems—contact centers, analytics platforms, productivity suites.

Amazon’s Position: Proven in specific domains, but narrow.

Amazon Connect demonstrates the agentic application model at scale. The AI-powered contact center platform reached $1 billion in annualized revenue this quarter, growing over 30%. It handles an average of 20 million+ customer interactions daily.

New capabilities make Connect increasingly autonomous. Advanced speech models achieve higher accuracy in understanding customer intent. Agentic assistance handles routine issues without human involvement. AI-powered recommendations guide human agents during escalations. Observability dashboards enable supervisors to monitor AI agent performance in real time.

Connect proves the unit economics work. AI agents handling 20 million daily interactions at $1 billion ARR represent cost structures that human-staffed contact centers cannot match. This is the template Amazon wants to replicate across enterprise workflows.

Beyond Connect, Amazon’s enterprise application portfolio remains limited. QuickSight provides business intelligence. WorkDocs handles document collaboration. Chime offers communication. But none approaches the scale or AI integration of Connect.

Competitive Assessment: Microsoft dominates enterprise applications through M365—400+ million commercial seats, with Copilot increasingly embedded across them. Google Workspace reaches 3 billion users but trails on enterprise penetration. Salesforce, ServiceNow, and other SaaS players own specific workflow categories.

The Gap: Amazon lacks the enterprise application breadth that Microsoft commands. M365 Copilot embeds AI into the applications where knowledge workers spend their days—Word, Excel, PowerPoint, Outlook, Teams. Amazon has nothing comparable. Connect succeeds in contact centers, but that’s one workflow among hundreds that enterprises need.

Verdict: ★★★☆☆ — Strong in contact centers, but lacks breadth across enterprise workflows.

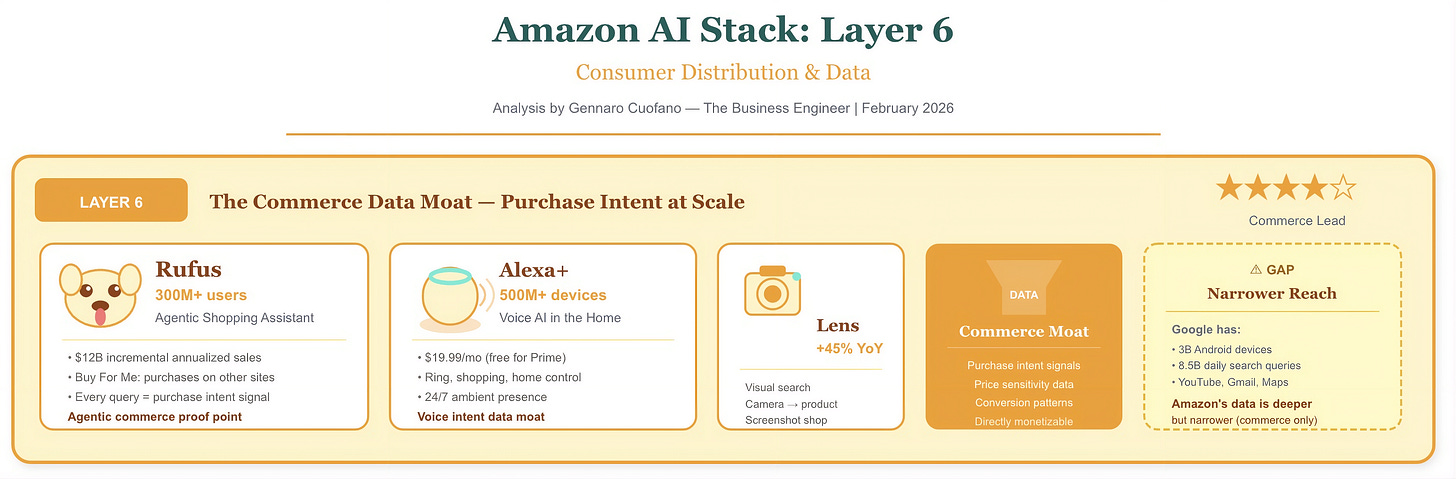

Layer 6: Consumer Distribution and Data

What It Is: Consumer-facing products that generate usage data, training signal, and distribution for AI capabilities.

Amazon’s Position: Unique advantages in commerce, significant presence in home.

Rufus represents agentic commerce in production. The AI shopping assistant reached 300 million+ users and drove nearly $12 billion in incremental annualized sales—the first time Amazon disclosed this revenue impact. The Buy For Me feature enables Rufus to shop across other websites and make purchases on behalf of customers, demonstrating agent purchasing authority at scale.

The commerce data moat has no equivalent. Every Rufus interaction reveals purchase intent. Product comparisons expose price sensitivity. Search-to-purchase journeys train recommendation models. Returns and reviews provide outcome feedback. This data makes AI systems better at driving commerce, which generates more data.

Alexa+ extends AI presence into the home. With 500 million+ devices sold, Amazon has achieved an ambient computing distribution that competitors cannot replicate. The $19.99 monthly subscription (free for Prime members) adds revenue while the always-on presence generates continuous interaction data. New capabilities include Ring doorbell integration, expanded shopping features, and home automation.

Amazon Lens grew 45% year-over-year as visual search became habitual. Amazon Haul expanded to 25+ countries with over 1 million items under $10.

Competitive Assessment: Google has a broader consumer reach—3 billion+ Android devices, 8.5 billion daily search queries, and YouTube’s 2.5 billion monthly users. But Google’s data captures information intent rather than purchase intent. Amazon’s commerce data is directly monetizable; Google’s requires the intermediate step of advertising.

Apple controls the premium consumer segment but hasn’t deployed AI aggressively. Meta has social graph data but limited commerce integration.

The Gap: Amazon trails Google in raw consumer reach and mobile OS market share. Android’s 3 billion devices dwarf Alexa’s 500 million. Google Search captures intent signals across every topic; Rufus captures intent signals only within shopping contexts. Amazon’s data is deeper in commerce but narrower overall.

Verdict: ★★★★☆ — Unique commerce moat, but narrower reach than Google.

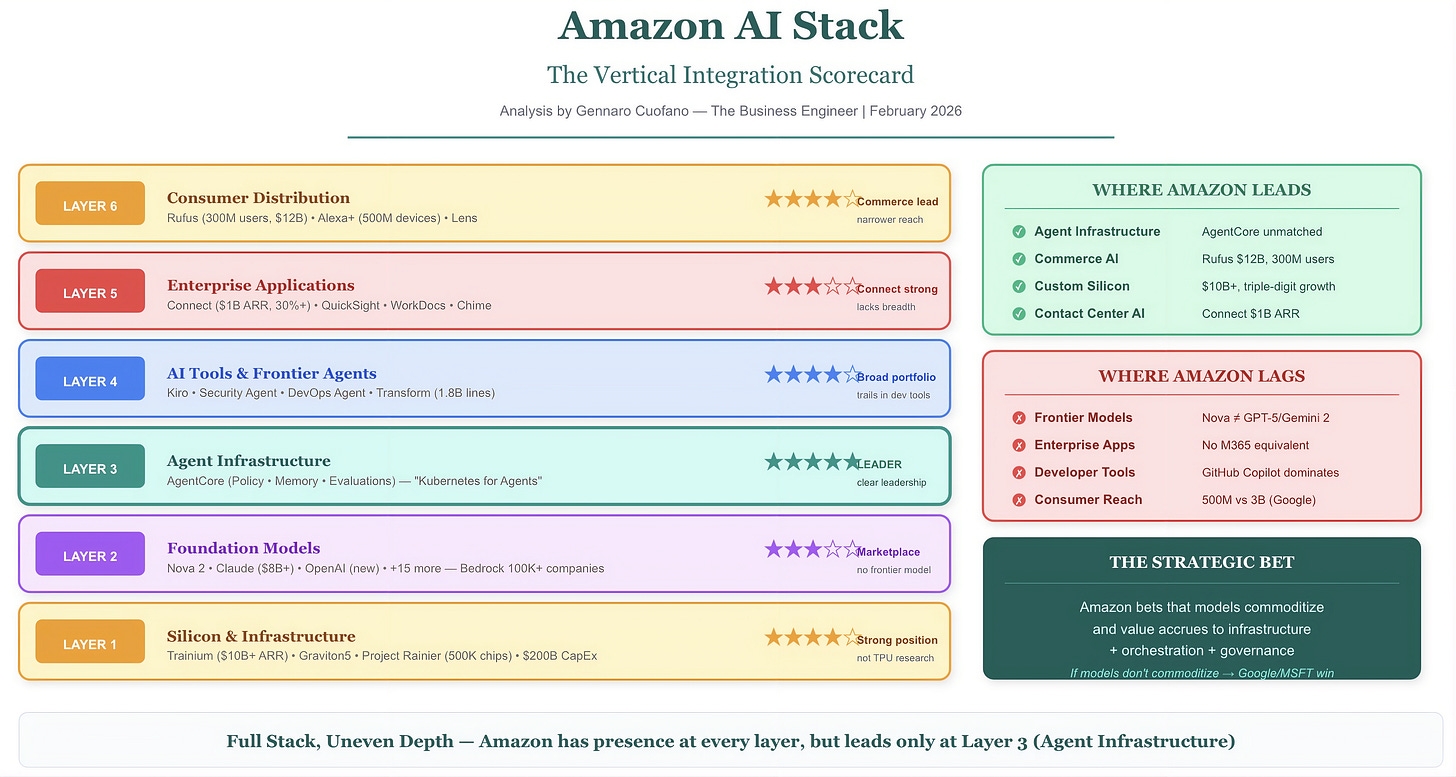

The Vertical Integration Scorecard

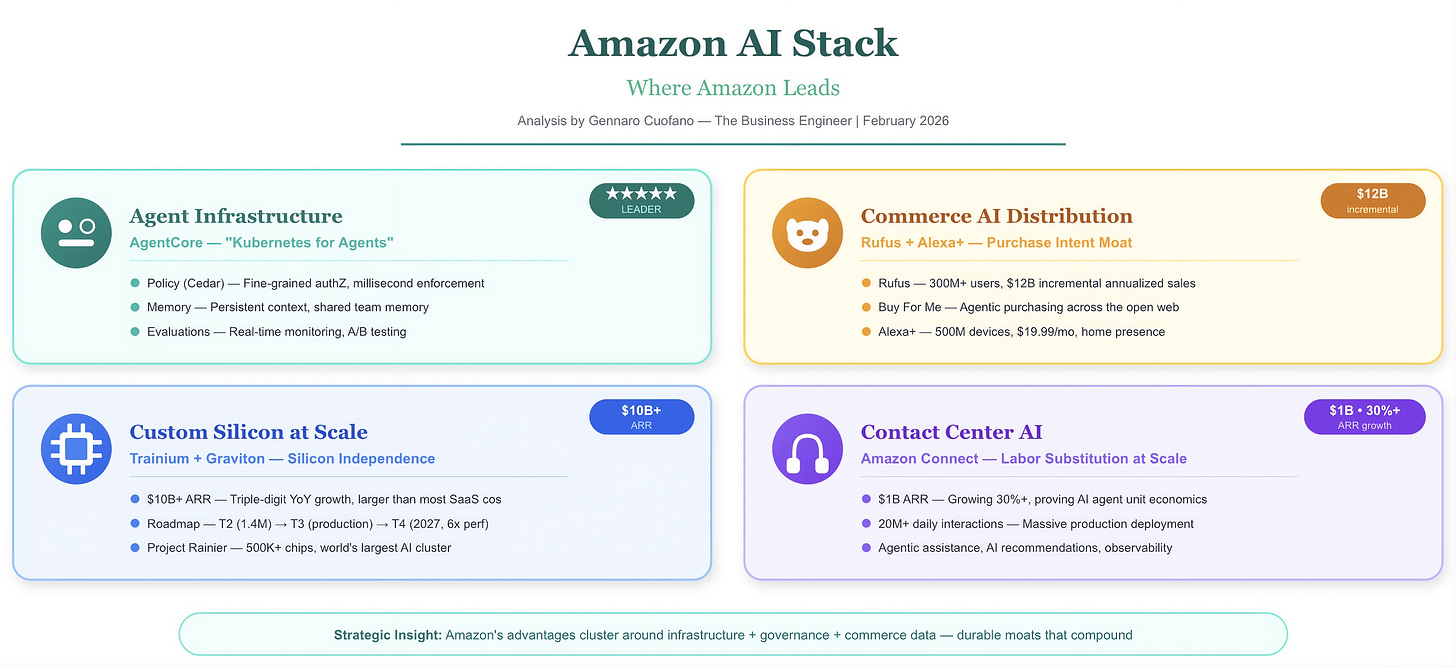

Where Amazon Leads

Agent Infrastructure (Layer 3): AgentCore’s governance capabilities—policy enforcement, evaluation frameworks, memory management—exceed anything competitors offer. Enterprises deploying autonomous agents need these controls, and Amazon provides them at production scale.

Commerce AI Distribution (Layer 6): No competitor has 300 million users with purchase intent interacting with an AI shopping agent. Rufus’s $12 billion incremental sales proves the economic model. Buy For Me demonstrates agent purchasing authority. This data and distribution moat cannot be replicated.

Custom Silicon Scale (Layer 1): $10 billion+ in revenue at triple-digit growth, with a clear roadmap through Trainium4. Amazon has achieved commercial scale in AI silicon that only Google’s TPU program approaches. Microsoft and others remain years behind.

Contact Center AI (Layer 5): Connect’s $1 billion ARR at 30%+ growth handling 20 million daily interactions proves AI can replace human labor in customer service at enterprise scale. This is the template for labor substitution.

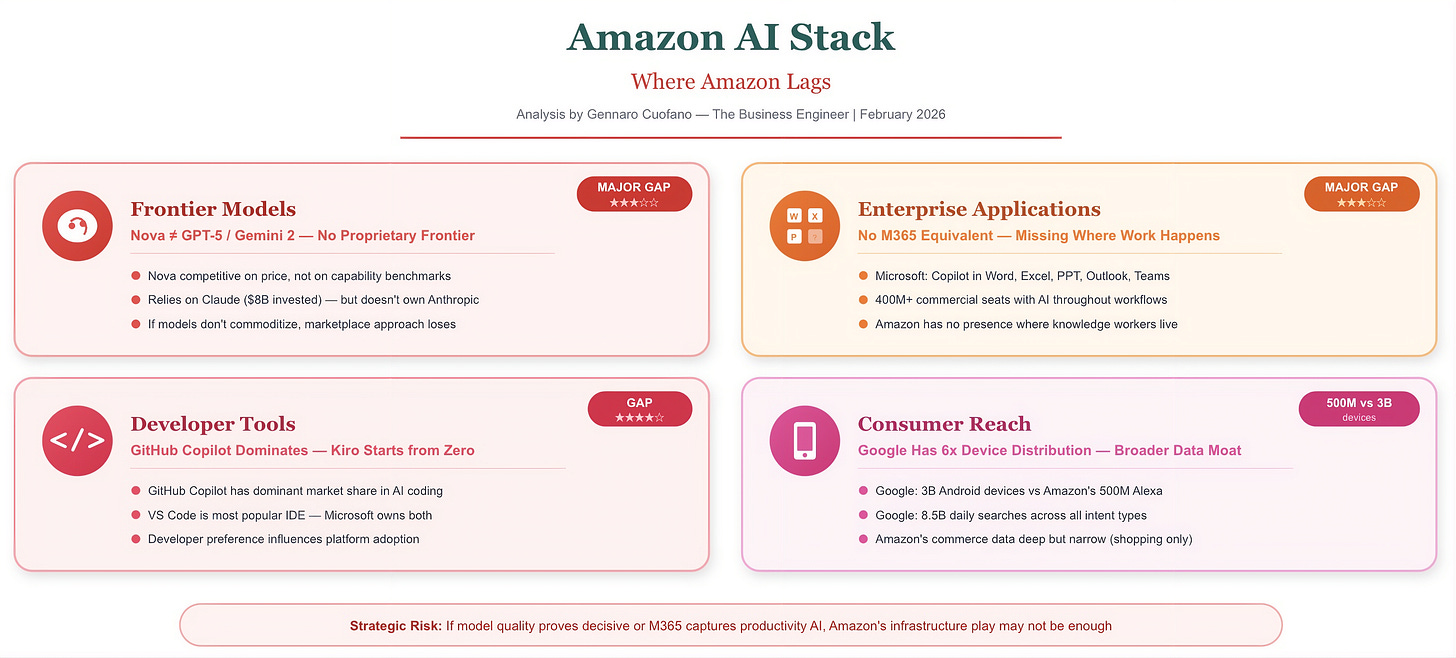

Where Amazon Lags

Frontier Foundation Models (Layer 2): Nova doesn’t compete with GPT-5 or Gemini 2 on capability benchmarks. Amazon relies on Claude (which it doesn’t own) for frontier workloads. If model quality proves decisive, Amazon’s marketplace approach becomes a liability.

The risk: a customer needing the absolute best AI capabilities might choose Google (for Gemini) or Microsoft (for OpenAI exclusivity) despite preferring AWS infrastructure. Amazon is betting this won’t happen—that models commoditize and infrastructure value exceeds model value. That bet isn’t proven yet.

Enterprise Application Breadth (Layer 5): Microsoft embeds Copilot into Word, Excel, PowerPoint, Outlook, and Teams—applications that hundreds of millions of knowledge workers use daily. Amazon has nothing comparable. Connect succeeds in contact centers, but that’s one workflow. Amazon doesn’t compete where most enterprise work happens.

The risk: enterprises standardize on M365 Copilot for productivity AI, and that relationship extends into adjacent areas. Microsoft’s application breadth creates cross-sell opportunities that Amazon cannot match.

Developer Ecosystem (Layer 4): GitHub Copilot has dominant market share in AI-assisted coding. VS Code is the most popular IDE. Microsoft owns both. Kiro competes but starts from zero installed base against an entrenched incumbent.

The risk: developers adopt Copilot habits, prefer the Microsoft toolchain, and pull their organizations toward Azure for AI infrastructure. Developer preference influenced cloud adoption in the 2010s; it may influence AI platform adoption in the 2020s.

Consumer Reach (Layer 6): Google has 3 billion Android devices versus Amazon’s 500 million Alexa devices. Google Search captures intent signals across every topic; Rufus captures only shopping intent. Amazon’s data is more commercially valuable per interaction, but Google has far more interactions.

The risk: Google’s broader data advantage translates into better foundation models, which attract more users, which generate more data—a flywheel Amazon cannot match in general AI. Amazon’s moat protects commerce AI specifically, but may not extend beyond it.

The Vertical Integration Comparison

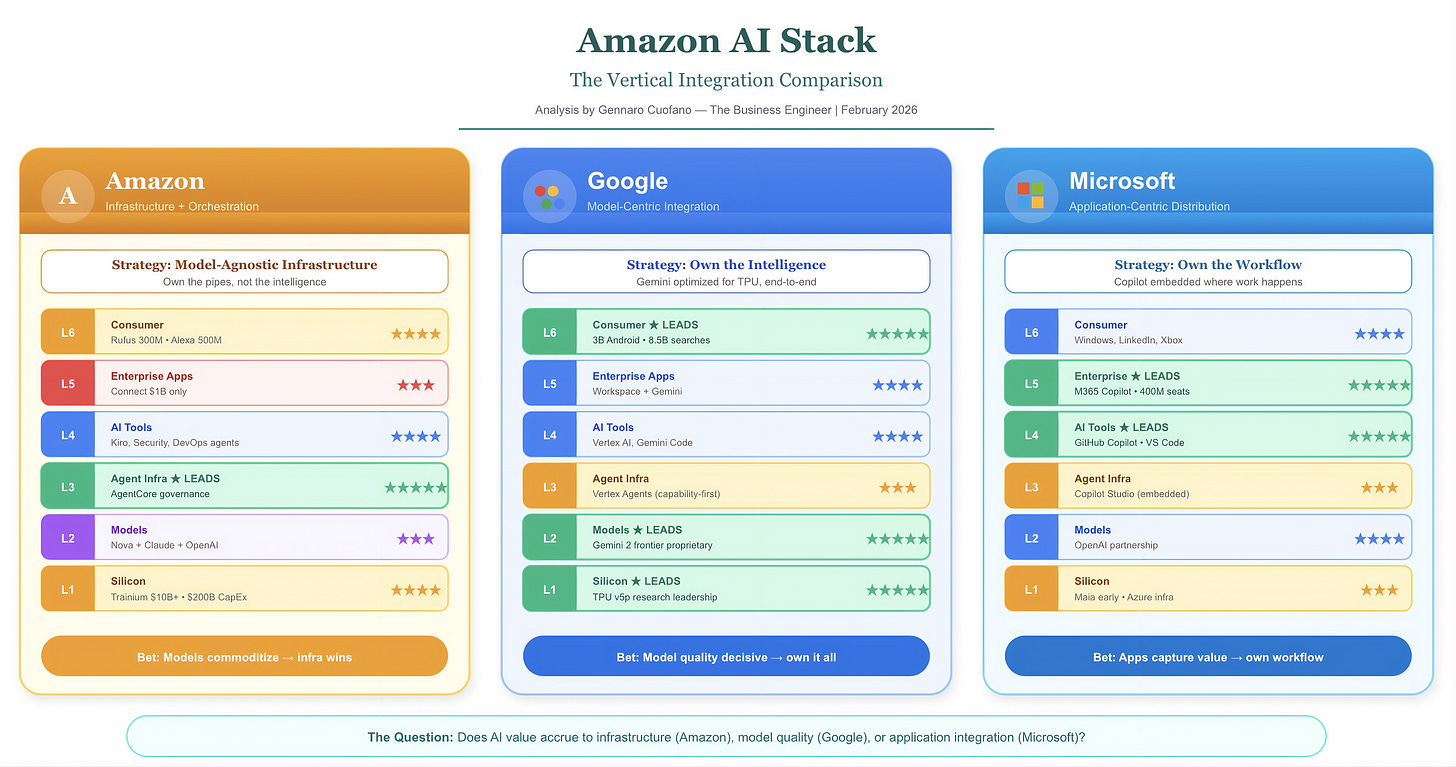

Amazon vs. Google: Two Approaches to Full-Stack AI

Both companies pursue vertical integration, but with different philosophies.

Google’s Approach: Proprietary excellence at every layer. Google builds TPUs (Layer 1), develops Gemini in-house (Layer 2), creates Vertex AI Agents (Layer 3), offers AI-powered tools (Layer 4), embeds AI in Workspace (Layer 5), and distributes through Android and Search (Layer 6). Every layer features Google-built technology optimized to work together.

Amazon’s Approach: Owned infrastructure, partnered intelligence, governed orchestration. Amazon builds Trainium and Graviton (Layer 1), partners for models while developing Nova (Layer 2), leads in agent governance (Layer 3), builds specialized agents (Layer 4), excels in specific applications (Layer 5), and dominates commerce distribution (Layer 6). Amazon owns the infrastructure and orchestration layers but accepts partnership at the model layer.

The Tradeoff: Google’s approach maximizes integration and optimization but requires winning the model race. Amazon’s approach sacrifices some integration for optionality—if Claude beats Gemini, Amazon benefits; if GPT-5 beats Claude, Amazon hosts that too.

Where Google Leads Amazon

Google’s vertical integration is tighter at the model layer. Gemini is optimized for TPUs in ways that third-party models on Trainium cannot match. Google can move faster on capability improvements because it controls the entire stack from silicon to model to application.

Google’s consumer reach far exceeds Amazon’s. Search, Android, YouTube, Gmail, Maps—Google touches more humans more frequently than any company except perhaps Meta. This data advantage could prove decisive for foundation model training.

Where Amazon Leads Google

Amazon’s agent infrastructure surpasses Google’s. AgentCore’s governance capabilities—Cedar policy language, real-time evaluation, persistent memory—exceed anything in Vertex AI Agents. Enterprises care about control, and Amazon provides it.

Amazon’s enterprise relationships run deeper. AWS has spent two decades building trust with CIOs and CISOs. Google Cloud is growing fast but started later and smaller. When enterprises deploy mission-critical AI agents, relationship depth matters.

Amazon’s commerce data has no equivalent. Google has more data overall, but Amazon has the data that matters for commerce AI—purchase intent, price sensitivity, conversion patterns. For agentic commerce specifically, Amazon’s data moat is unassailable.

Strategic Implications

The Model Commoditization Question

Amazon’s vertical integration strategy depends on a key assumption: foundation models will commoditize, and value will accrue to infrastructure and orchestration rather than model capability.

If this assumption proves correct, Amazon wins. AgentCore governance, Trainium economics, and Bedrock’s multi-model marketplace become the durable advantages. Model providers compete for slots on Amazon’s platform, margins compress at the model layer, and Amazon collects infrastructure rent regardless of which model leads.

If this assumption proves wrong—if one model achieves sustained, decisive superiority—Amazon’s position weakens. Enterprises might accept Google’s vertical lock-in to access Gemini, or pay Microsoft’s premium for OpenAI exclusivity. Amazon’s marketplace becomes a collection of second-best options.

Current evidence slightly favors Amazon’s thesis. Models have converged significantly over the past two years. Claude, GPT-4, and Gemini perform comparably on most enterprise tasks. The gaps that exist matter at the margin but don’t drive platform selection for most use cases.

The Enterprise Application Gap

Amazon’s weakest layer is enterprise applications (Layer 5). Connect proves the model works for contact centers, but Amazon lacks presence in the workflows where most knowledge work happens—document creation, email, spreadsheets, presentations, collaboration.

Microsoft’s M365 Copilot embeds AI into these workflows. Google’s Workspace AI does the same at smaller scale. Amazon has no equivalent. An enterprise could use AWS infrastructure, Bedrock models, and AgentCore governance while doing all its productivity AI through Microsoft.

This gap limits Amazon’s ability to capture value from the largest AI use case: augmenting knowledge workers. Amazon can power the agents, but Microsoft hosts the applications where those agents deliver value.

The Developer Ecosystem Risk

Developer preference shaped cloud adoption in the 2010s. Startups chose AWS because developers knew it and liked it. Enterprise IT followed where developers led.

AI platform adoption may follow a similar pattern. Developers choosing GitHub Copilot, working in VS Code, and deploying on Azure create momentum that influences enterprise decisions. Amazon’s Kiro competes from a standing start against an installed base of millions.

Amazon partially mitigates this through the framework-agnostic approach. Developers can build agents on whatever framework they prefer and deploy on AgentCore. But the IDE and code assistant layers—where developers spend their time—favor Microsoft.

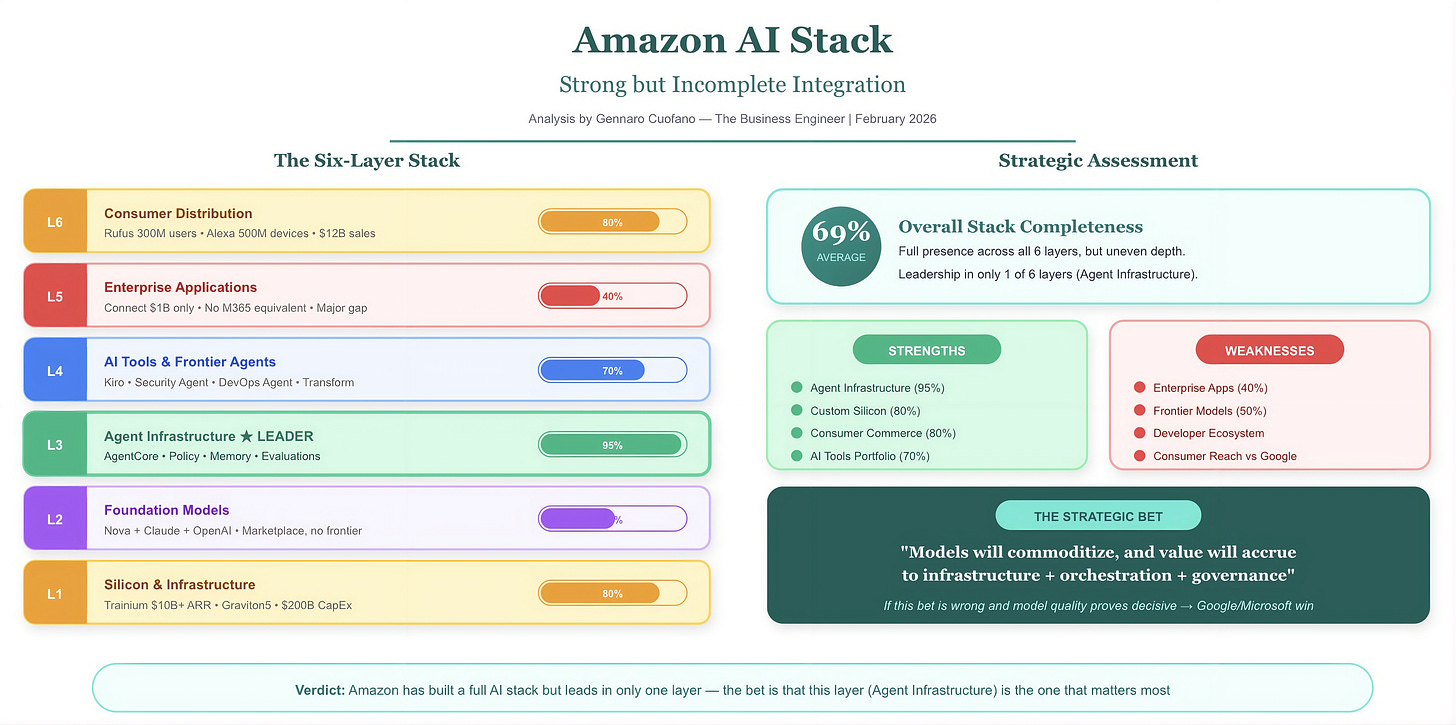

Strong but Incomplete Integration

Amazon has achieved vertical integration across all six layers of the AI stack—a position only Google matches. Custom silicon, foundation models, agent infrastructure, AI tools, enterprise applications, and consumer distribution all exist within Amazon’s ecosystem.

But integration breadth doesn’t equal integration depth. Amazon leads clearly at Layer 3 (agent infrastructure) and Layer 6 (commerce distribution). It competes effectively at Layer 1 (silicon) and Layer 4 (tools). It lags at Layer 2 (frontier models) and Layer 5 (enterprise applications).

The strategy makes sense given Amazon’s starting position. Rather than trying to out-research Google on models or out-distribute Microsoft on enterprise apps, Amazon focuses on infrastructure and orchestration—the layers that benefit from its existing strengths in cloud computing and operational scale.

The risk is that the layers where Amazon lags prove more important than the layers where it leads. If frontier-model capability drives platform selection, Google and Microsoft have an advantage. If enterprise application integration drives platform selection, Microsoft has an advantage. Amazon’s bet is that infrastructure and governance drive platform selection—that enterprises want control over their AI deployments more than they want marginally better models or tighter application integration.

The Q4 2025 results support this thesis so far. AWS growth accelerated to 24%. AgentCore adoption is expanding. Connect proved AI labor substitution at a billion-dollar scale. Rufus demonstrated agentic commerce economics. The full-stack strategy is working.

But the competition is just beginning. Google and Microsoft are investing at similar scale with different theories of victory. The next two years will reveal whether Amazon’s governance-first, infrastructure-centric vertical integration captures more value than Google’s model-centric or Microsoft’s application-centric alternatives.

Amazon has built the stack. Now it must prove the stack wins.

Recap: In This Issue!

Amazon is attempting what only Google has done credibly: vertical integration across the AI stack. From silicon to consumer distribution, it wants control over every layer where value accrues.

Q4 2025 shows meaningful progress: custom silicon is now a material business, Bedrock has become a model marketplace, agent infrastructure is production-ready, at least one enterprise app has crossed $1B scale, and consumer touchpoints are large enough to generate real interaction data. The key nuance is that integration breadth is not excellence at every layer.

The six-layer stack

Layer 1: Silicon and compute infrastructure

Verdict: Strong, approaching leadership (★★★★☆)

Amazon is building a durable base: custom silicon (Trainium, Graviton), capacity buildout, and capex intensity that most competitors cannot match on timeline. This layer matters because it sets the cost floor for every product above it.

Mechanism: lower cost per unit of inference and training → lower prices or higher margins → more volume → more capex → reinforcing scale.

Layer 2: Foundation models

Verdict: Adequate via portfolio, not leading on proprietary capability (★★★☆☆)

Amazon’s strategy is multi-model, not winner-take-all: proprietary Nova plus Claude partnership plus a broader marketplace. That is commercially sensible if models converge and customers prioritize governance, cost, and deployment over marginal benchmark deltas.

Core risk: if frontier model superiority becomes decisive and sticky, Amazon becomes “best place to run someone else’s brain,” not “the brain.”

Layer 3: Agent infrastructure and orchestration

Verdict: Clear leadership (★★★★★)

This is Amazon’s most defensible differentiated layer: governance-first agent infrastructure. Enterprises do not just want agents. They want agents that can operate with controls, auditability, policy enforcement, and predictable behavior.

Mechanism: the more autonomy agents have, the more governance becomes the bottleneck. Owning the bottleneck is where platform power sits.

Layer 4: AI tools and agents

Verdict: Strong breadth, distribution-disadvantaged in developer workflow (★★★★☆)

Amazon is building a portfolio of specialized agents (security, devops, modernization, dev productivity). Breadth helps because enterprise adoption occurs via specific use cases, not abstract “AI platforms.”

Gap: Microsoft’s GitHub and VS Code create an embedded distribution edge for developer tooling that Amazon cannot easily replicate. Amazon can compete on capability, but it is late to the default workflow surfaces.

Layer 5: Enterprise applications

Verdict: Proven in one domain, narrow overall (★★★☆☆)

Amazon has a credible “proof point” in at least one enterprise workflow category (contact center). But it lacks broad daily workflow ownership relative to Microsoft M365 and, to a lesser degree, Google Workspace.

Mechanism: app-layer dominance creates habit, switching costs, and data exhaust, which then feeds agent usage and platform lock-in.

Layer 6: Consumer distribution and data

Verdict: Unique strength in commerce, narrower reach than Google (★★★★☆)

Amazon has something rare: purchase-intent-native consumer interactions at scale. That data is higher signal per interaction than general information intent. But the total surface area is narrower than Google’s search + Android + YouTube footprint.

Mechanism: commerce agents improve conversion → conversion produces outcome feedback (returns, reviews, repeat purchase) → feedback improves ranking, recommendations, and agent performance.

Amazon’s vertical integration scorecard

Leads: Agent infrastructure (Layer 3), commerce distribution signal quality (Layer 6)

Strong: Silicon scale (Layer 1), agent/tool portfolio (Layer 4)

Adequate: Foundation models via partnerships/marketplace (Layer 2)

Weakest: Enterprise application breadth (Layer 5)

Where the bet either wins or breaks

The hinge assumption: model commoditization

Amazon’s stack strategy works if foundation models commoditize enough that enterprises choose platforms based on cost, governance, integration, and reliability. In that world, Amazon taxes deployments through silicon economics plus orchestration control.

It breaks if one or two models become so superior that customers accept lock-in to access them. Then Amazon’s portfolio strategy becomes a structural concession.

The structural drag: application-layer absence

Even if Amazon powers agents, Microsoft owns the daily workflow surfaces where most knowledge work happens. If the primary monetization and data exhaust sit inside productivity apps, Amazon risks being upstream infrastructure while value capture concentrates downstream.

Bottom line

Amazon has built a credible full-stack posture, but it is asymmetric:

Best-in-class governance layer

Very strong infrastructure layer

Commerce-native consumer data advantage

Not yet a proprietary frontier model story

No broad enterprise productivity application footprint

This is a coherent strategy: Amazon is trying to own the layers that become mandatory as agents get autonomous. The open question is whether the market values control and cost more than model supremacy and workflow embedding over the next two years.

With massive ♥️ Gennaro Cuofano, The Business Engineer