asymmetric bets!

the framework to unlock experiments that can have unbound outcomes, and limited risks for your business

After analyzing thousands of companies over the years.

From tiny businesses that I helped convert to digital distribution.

For more prominent public companies that I broke down, the concept of asymmetry has become clearer and clearer.

Indeed, I realized that this was the main distinction across business models and that we could break them down into symmetrical and asymmetrical business models.

Below, I'll explain the framework I use for that.

But let me give you the whole picture.

One of my interests is asymmetry in the business world and what I call asymmetric business models, which are among the most scalable ever created!

The concept of asymmetry in business is explained in detail in Business Engineering.

But how do you develop a strategy to unlock opportunities with limited downside and maximum impact?

To be "soul in the game," you also need to look for asymmetric outcomes

As author Nassim Nicholas Taleb would say, real entrepreneurs are "soul in the game." They are not just all-in with their entrepreneurial idea; they thrive and perish with it.

That might apply well also to business executives.

When you're an entrepreneur or ambitious business executive, your business or career might be on the line as you move fast to achieve goals for the company.

For such reason, I believe it's critical to balance this aggressive approach, with what I like to call asymmetric betting!

Let me explain.

Asymmetric Betting

There was a time when the motto for Facebook was "move fast and break things." This was the foundation of the "Hacker's mindset."

Over the years, as Facebook scaled up, its motto also changed. And it went from "move fast and break things" to "move fast with stable infrastructure."

In short, when a company has scaled at a certain size, it loses the ability to experiment fast because almost all the experiments it undertakes are hardly reversible.

For a company like Facebook, even a small experiment targeting a few thousand users will be under journalists' radar, amplifying the experiment if it goes wrong.

That is why - I argue - scale, to a certain extent, reduces the ability of companies to experiment.

Yet, if you're just building a company, and your scale is limited, I think you have a valuable opportunity. As you can undertake, I like to call "asymmetric bets."

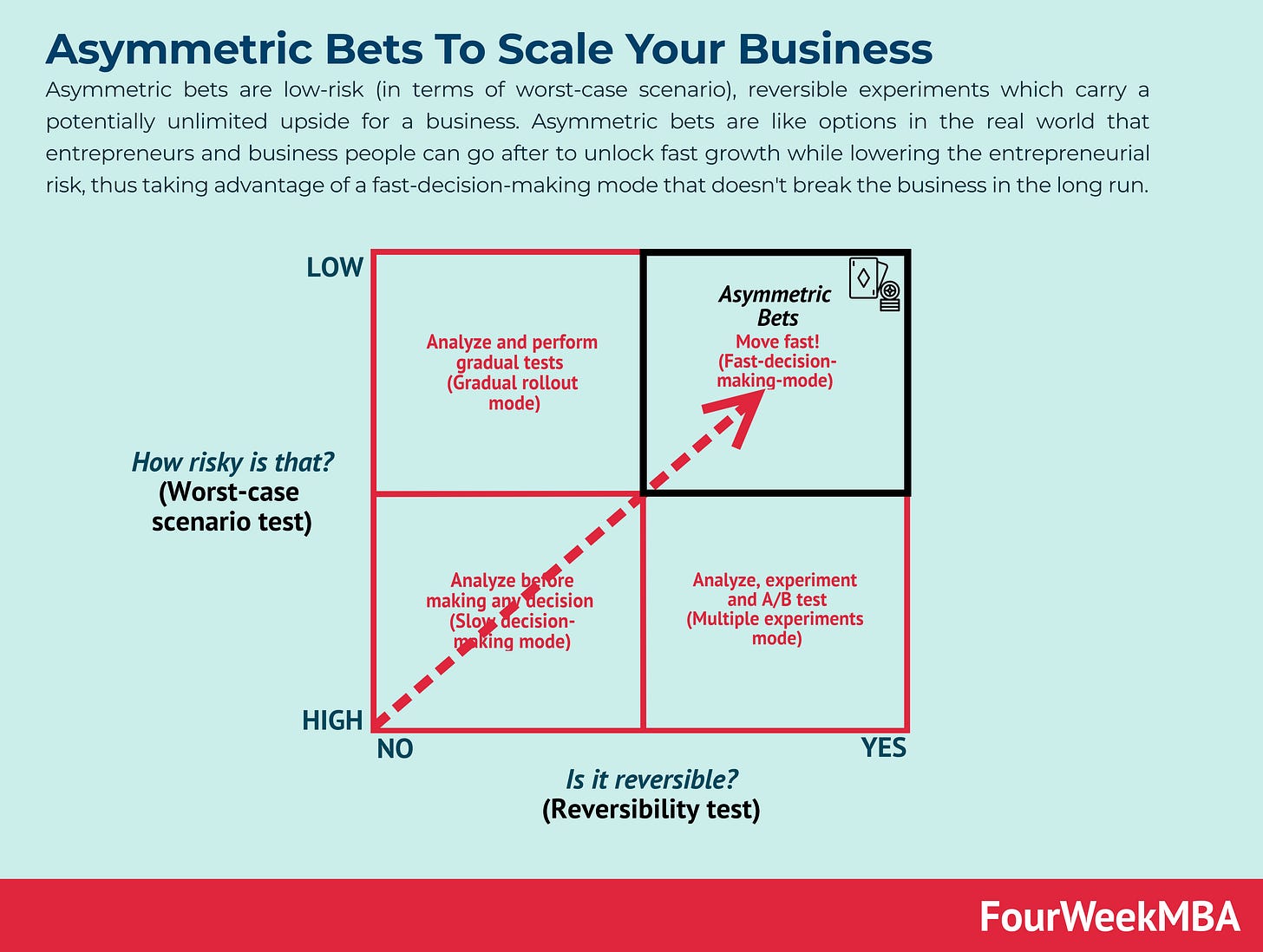

Asymmetric bets are experiments, which are quick to implement, while they carry a very low downside, a potentially high/or unlimited upside, and they are reversible!

These, to me, are the goldmine for business people, and I've been obsessed with this concept for years. Indeed, my main argument for why small startups can undertake large players is that those small startups have in their favor these asymmetric bets.

As we saw, it is very hard to take advantage of large, scaled-up companies (like Facebook) because they are under the radar, and any experiment they undertake will be overseen by millions of people.

Speed vs. Reversibility

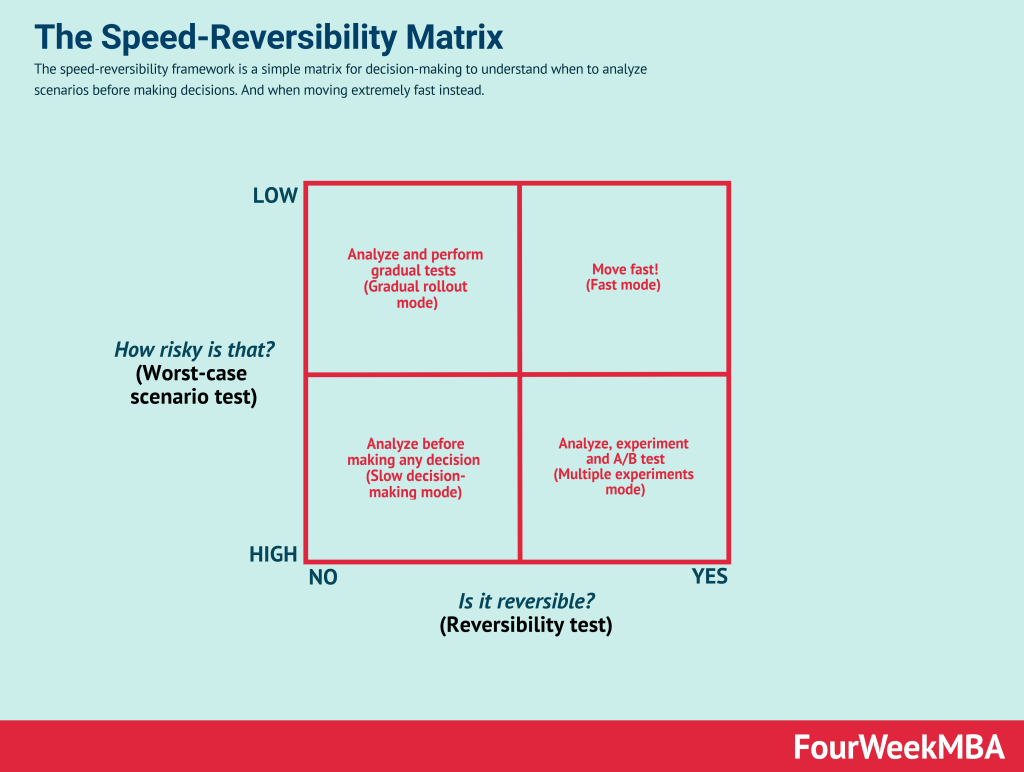

In the speed vs. reversibility matrix, I defined four main decision-making models of action.

By looking at two main variables.

On the one hand, assessing an experiment's risk is simply based on the worst-case-scenario test.

In short, the question there is, what happens if the experiment goes wrong?

In a scenario where you know that if the experiment goes wrong, it will have a limited downside on the business, then the risk is low.

In the opposite scenario, where the worst-case scenario test can have a large negative impact on the business, the risk is high.

On the other hand, we want to ask whether the experiment is reversible.

In short, can you go back to how things were before the experiment? If the answer is "yes," then you have a reversible experiment. If the answer is "no," you have a non-reversible experiment.

Now, we can define where asymmetric bets sit on top of this matrix!

Asymmetric bets: the sweet spot between speed, reversibility, and potential impact

Asymmetric bets live at the intersection of low-risk, highly reversible experiments with a potentially unlimited upside.

But if these asymmetric bets are so powerful, why doesn't everyone uses them?

1. Smart business people use asymmetric bets in combination with bolder bets to lower entrepreneurial risk. In short, asymmetric bets serve as a way to balance out other risks you might have to undertake as an entrepreneur.

2. Asymmetric bets require a specific mindset. You need to be wired to understand problems in the real-world (rather than looking for problems for your solutions). You need to understand that the world of perception can be more powerful than the engineering side. In short, things like UX can impact your bottom line as hard code changes the core functionalities of the product.

3. When you find these asymmetric bets, others might start to copy and paste them, thus making them less effective over time. In short, asymmetric bets follow the law of diminishing returns.

4. Those asymmetric bets might be highly contextual. Testing is critical because some tests might work in one domain, not in another.

5. Asymmetric bets work depending on the scale of the business. Certain asymmetric bets work until a certain size of the company. They kind of stop being effective.

With that in mind, let's see some of these asymmetric bets in action!

Unlocking a fast-decision-making mode of action!

With that in mind, let's see some of these asymmetric bets in action!

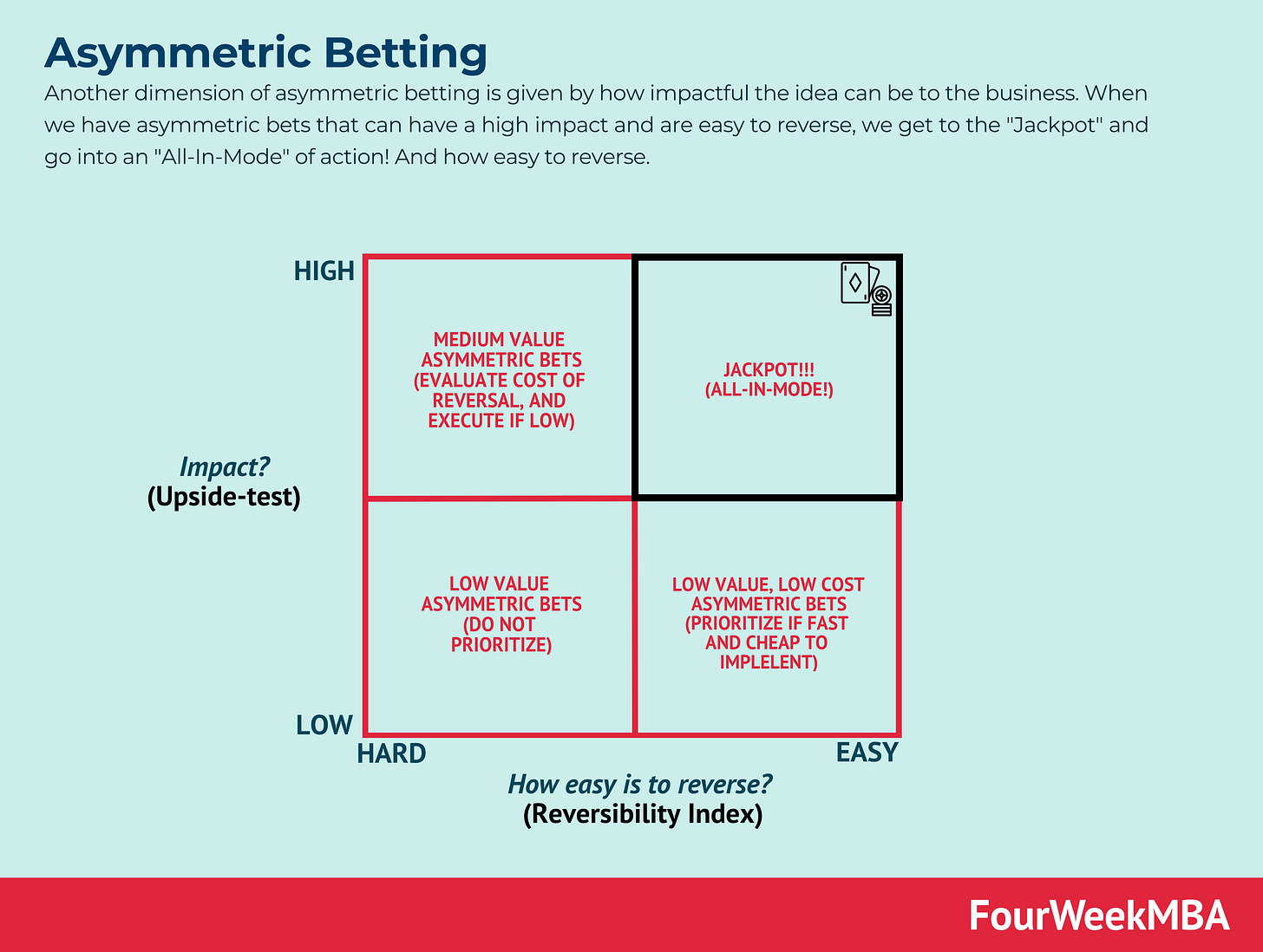

But before that, let's give some priorities. Within the asymmetric betting model, we want to look for the "Jackpot" or those asymmetric bets that will unlock the "All-In-Mode!" To scout them, we'll use two more dimensions:

1. How impactful can it be? We have either low or high-impact ideas.

2. How easy is it to reverse? In this case, we have ideas and experiments which are hard to reverse vs. the ones that are much easier to reverse.

Based on that, we try to give maximum priority to the "pure asymmetric bets."

What do you think? Let me know if you use this framework and how it's helping you identify these asymmetric bets!

Some Simple Asymmetric Bets Examples And Ideas for Startups!

Beta Testing: Launching a beta version of their product to a select group of users to gather feedback, refine the product, and understand user preferences before a full-scale launch.

Landing Page Tests: Before developing a product, startups might create landing pages to gauge interest. By promoting the page and measuring sign-ups or interest, they can estimate demand without having a full product ready.

Pivot: Many startups begin with one idea but pivot to another when they realize the original concept isn't working. This flexibility allows them to adapt to market feedback without starting from scratch.

Referral Programs: To grow user bases quickly, startups might offer referral incentives. This method has a low downside (cost of acquisition per user) but a potentially high upside if it leads to viral growth.

Freemium Models: Offering a free version of their product to attract users and then upselling them to a premium version. This strategy lowers the barrier to entry and can lead to a broader user base and subsequent revenue from conversions.

Hackathons: Hosting or participating in hackathons to develop new features or products in a short amount of time. It's a low-risk way to innovate and can lead to breakthrough ideas.

Collaborative Partnerships: Partnering with other startups or established companies to offer bundled services or products. This approach can increase reach and offer value to both parties with limited downside.

Pop-Up Events: Hosting temporary events or booths to showcase their products, gather feedback, and engage with potential customers directly.

Flash Sales: Offering limited-time discounts to boost sales and attract new customers. While it may reduce margins temporarily, it can lead to increased volume and customer acquisition.

User Feedback Loops: Actively seeking feedback from early users and iterating on the product based on that feedback. This approach can lead to a more market-fit product faster.

Diverse Monetization Streams: Experimenting with different revenue models (e.g., advertising, subscription, pay-per-use) to see which resonates best with their user base.

Remote Work Models: Especially relevant in the post-pandemic era, startups might experiment with fully remote, hybrid, or co-located teams to find the most efficient and productive model for their operations.

Community Building: Engaging with and building a community around the product or service, which can offer feedback, evangelize the product, and contribute to its development.

Microservices Architecture: Instead of building a monolithic application, startups can develop using microservices. This allows them to experiment with and scale specific parts of their service without affecting the whole system.

Crowdsourcing: Engaging the user base or public to contribute ideas, designs, or solutions. This approach can lead to innovative ideas without significant R&D costs.

Real World Case Studies For Asymmetric Bets To Unlock Outsized Growth!

Amazon

Beta Testing: Amazon Web Services (AWS) started as a side project to make sense of the jumbled mess that had become Amazon's e-commerce backend infrustructure. Today AWS is a behemoth!

Freemium Models: Amazon Prime offers a free 30-day trial to users, giving them a taste of the benefits before they commit to the subscription.

Affiliate/Referral Programs: The Amazon Associates program is one of the most extensive affiliate marketing programs, allowing members to earn by referring products.

Landing Page Tests: Google often tests new product features and user interfaces using A/B testing on a small subset of users to gather feedback before a global rollout.

Pivot: Google Video was the company's original video service, but they quickly pivoted and acquired YouTube to dominate the video-sharing market.

Hackathons: Google hosts regular internal hackathons, resulting in new features and services, like Google News.

Dropbox

Referral Programs: Dropbox's growth exploded with their referral program, where both the referrer and referee got additional storage space.

Freemium Models: Dropbox offers a free tier with basic storage and then upsells to their premium versions with more features and space.

Slack

Beta Testing: Before its public release, Slack was beta-tested extensively with various companies to refine the product and ensure it met the needs of diverse teams.

Pivot: Slack began as a gaming company named Tiny Speck, but when the game didn't take off, they pivoted to the communication tool, leveraging their internal tool into what Slack is today.

Airbnb

Landing Page Tests: Airbnb often tests variations of their landing pages to optimize user conversions.

Pop-Up Events: In the early days, Airbnb hosted meetups and events to educate hosts and create a sense of community.

Spotify

Freemium Models: Spotify operates primarily on a freemium model, allowing users to access a basic version for free and then upselling the premium ad-free version.

Microservices Architecture: Spotify uses a microservices architecture, allowing teams ("squads") to own and operate their services, promoting innovation and rapid development.

Tesla

Beta Testing: Tesla vehicles frequently receive over-the-air updates, some of which are initially released to a smaller group of users for testing before a broader release.

Flash Sales: Tesla has occasionally adjusted prices or offered promotions, such as free Supercharging, to boost sales.

Netflix

User Feedback Loops: Netflix's recommendation engine constantly evolves based on user feedback and viewing habits.

Hackathons: Netflix holds regular hackathons, leading to innovations like better encoding algorithms to save bandwidth.

Microsoft

Beta Testing: Microsoft releases early versions of its software, like Windows Insider previews, to gather feedback and refine the final product.

Freemium Models: Products like OneDrive or their Office suite for mobile devices follow a freemium model.

Zoom

Freemium Models: Zoom offers a free version of its conferencing software, with limitations, and then upsells users to their premium tiers.

Remote Work Models: During the pandemic, Zoom quickly became the go-to tool for remote work, showing adaptability and meeting the demands of a rapidly changing work environment.

Recap In This Issue

Asymmetry in Business Models: Here, I highlighted a key distinction in business models, categorizing them as either symmetrical or asymmetrical. Asymmetrical business models are considered the most scalable and offer significant opportunities.

Soul in the Game: I also emphasized the importance of having a vested interest and being fully committed to the success of one's entrepreneurial or executive endeavors.

Balancing An Aggressive Business Betting Strategy with Asymmetric Betting: To minimize downside risks and maximize impact, I suggest employing asymmetric betting strategies alongside an aggressive approach. Asymmetric bets refer to experiments that are quick to implement, have low downside risks, potentially high or unlimited upside, and are reversible.

Scale and Reduced Experimentation: As companies scale up, their ability to experiment rapidly diminishes due to increased scrutiny and irreversible consequences. Smaller startups have an advantage in undertaking asymmetric bets compared to larger, more established companies. That is where you want to take advantage of this framework.

Speed vs. Reversibility Matrix: I introduced a decision-making model that assesses experiments based on two variables: the risk associated with the worst-case scenario and the experiment's reversibility. Asymmetric bets reside in the low-risk, highly reversible quadrant of the matrix.

Benefits and Challenges of Asymmetric Bets: Asymmetric bets offer a way to balance out entrepreneurial risks and can be a powerful tool when combined with other bolder bets. However, they require a specific mindset and are subject to diminishing returns when widely adopted, and their effectiveness depends on the context and the scale of the business.

Unlocking Fast Decision-Making: The concept of asymmetric betting enables businesses to make fast decisions by focusing on high-impact, easily reversible ideas or experiments, also known as "pure asymmetric bets." Those can be the growth engine of a business, provided you can keep up with product velocity, fast iteration, experimentation, and execution!

Read Also:

Ciao!

With ♥️ Gennaro, FourWeekMBA