Charlie Munger's mental models

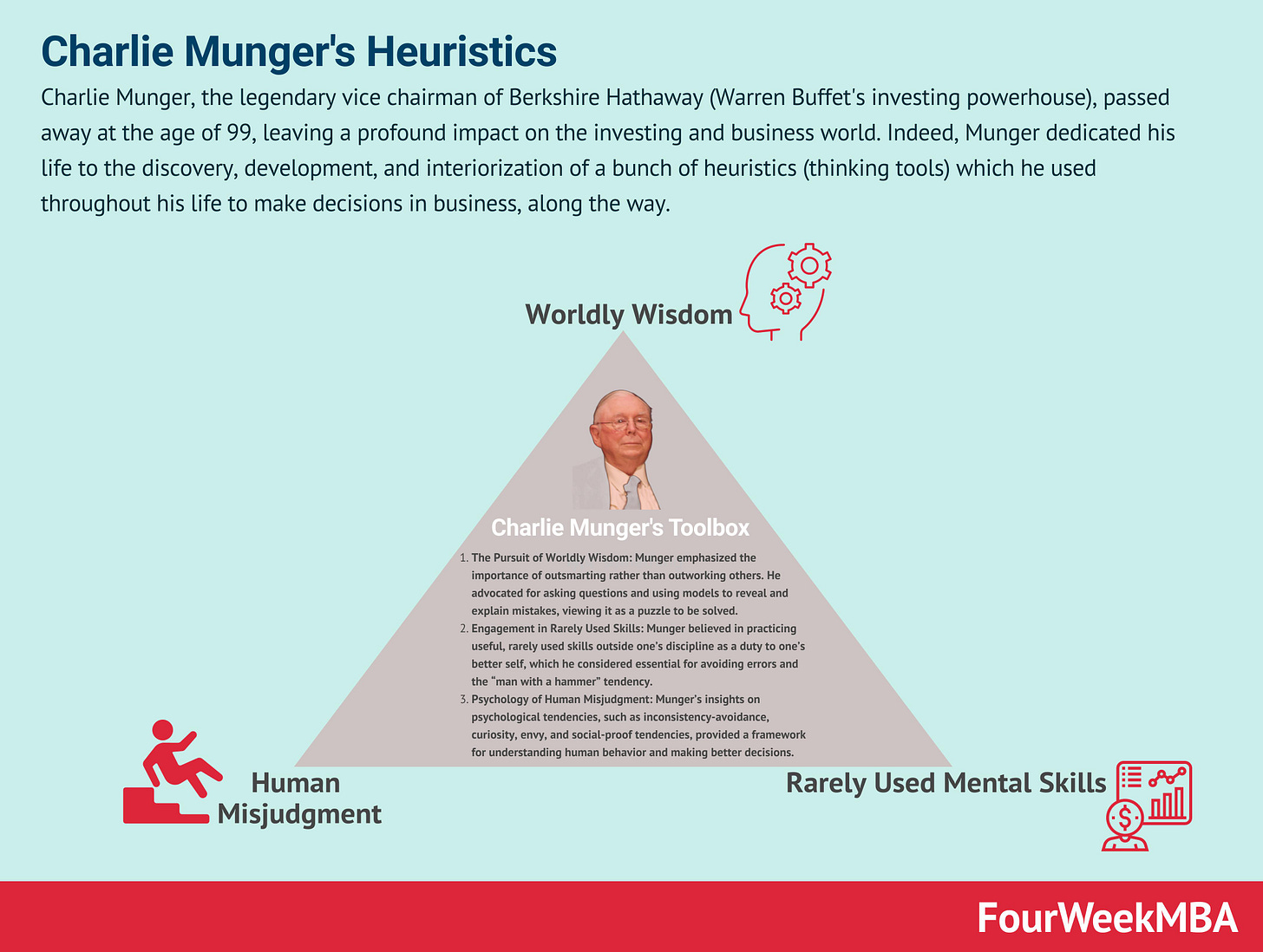

Back in November, Charlie Munger, the legendary vice chairman of Berkshire Hathaway (Warren Buffet's investing powerhouse), passed away at the age of 99, leaving a profound impact on the investing world, and not only that!

Indeed, Munger dedicated his life to the discovery, development, and interiorization of a variety of heuristics (thinking tools), which he used to make business decisions throughout his life.

Munger's impact on Buffett's investment approach was significant, and their collaboration played a crucial role in the success of Berkshire Hathaway.

Despite Munger's preference to stay in the background and let Buffett be the face of Berkshire, his wisdom and participation were instrumental in building the company into an investment powerhouse.

Today’s Sponsor: Airtable

It’s time to change the way we build digital products

Keeping busy is easy. Driving business impact is what matters. Consistently align your people to the most strategic priorities, discover product opportunities from deep customer insights, and gain total visibility on execution with Airtable ProductCentral.

The key insights from Charlie Munger are multiple, and they move along three lines of thoughts:

The Pursuit of Worldly Wisdom: Munger emphasized the importance of outsmarting rather than outworking others. He advocated for asking questions and using models to reveal and explain mistakes, viewing it as a puzzle to be solved.

Engagement in Rarely Used Skills: Munger believed in practicing useful, rarely used skills outside one’s discipline as a duty to one’s better self, which he considered essential for avoiding errors and the “man with a hammer” tendency.

Psychology of Human Misjudgment: Munger’s insights on psychological tendencies, such as inconsistency-avoidance, curiosity, envy, and social-proof tendencies, provided a framework for understanding human behavior and making better decisions.

His wisdom extended beyond investing, influencing countless individuals.

Munger's remarkable insights and teachings were a cornerstone of the annual Berkshire Hathaway meetings, attracting thousands of investors eager to learn from his wisdom.

Thus, Munger's legacy is not just about investing; it's about the enduring impact of his wisdom and wit, which will continue to inspire and guide investors for years to come.

Charlie Munger’s heuristics encompass a range of principles that guided his decision-making and contributed to his success. Some of these heuristics include:

Munger's study on Human Misjudgment

Early in his life, Munger figured out that human judgment was somehow influenced by a set of social cues, which he cataloged, studied, and learned from experience, in what he called Human Misjudgment, or a set of heuristics that drove his decision-making process, throughout his life!

These are:

Reward and Punishment Superresponse Tendency: Incentives and disincentives have a tremendous impact on human action. To persuade, appeal to interest, not to reason.

Liking/Loving Tendency: People tend to judge in favor of individuals and symbols they like. This tendency can lead to wrong decisions when individuals deliberately ignore or distort negative facts because they come from friends or admired sources.

Disliking/Hating Tendency: The opposite of the liking/loving tendency, this tendency leads individuals to ignore the positive qualities in a person or entity they dislike and hate all associated things. In investing, it's important not to let personal dislike influence decision-making.

Doubt-Avoidance Tendency: This is the inclination to make quick, poorly thought-out decisions under stress. The pressure to remove doubt can lead to ill-informed choices. To counter this, deliberate delays can be created when under pressure.

Inconsistency-Avoidance Tendency: Humans are creatures of habit, and their brains tend to conserve energy and space by avoiding inconsistency and being reluctant to change. In investing, it's important to keep an open mind to new facts to arrive at the best possible decision.

Curiosity Tendency: People have a natural inclination to seek more information, which can be beneficial for staying informed. However, overdoing it can complicate decision-making.

Kantian Fairness Tendency: This tendency relates to the desire for fairness and reciprocity in human interactions.

Envy/Jealousy Tendency: This tendency can lead to negative emotions and behaviors, affecting decision-making and relationships.

Reciprocation Tendency: People tend to reciprocate behaviors, both positive and negative. In investing, it's important to be cautious of potential ulterior motives behind certain behaviors.

Influence-from-Mere-Association Tendency: People often perceive things based on who or what they are associated with. Careful consideration is needed to avoid being misled by accidental, non-causative factors.

Simple, Pain-Avoiding Psychological Denial: This tendency involves avoiding facing painful truths, which can lead to poor decision-making.

Excessive Self-Regard Tendency: Overestimating one's abilities and knowledge can lead to arrogance and poor decision-making.

Overoptimism Tendency: Being overly optimistic can lead to underestimating risks and making poor decisions.

Deprival-Superreaction Tendency: People tend to react strongly to the feeling of deprivation, which can lead to irrational decision-making.

Social-Proof Tendency: People tend to follow the actions of others, even if it's not the best course of action.

Contrast-Misreaction Tendency: This tendency involves reacting strongly to contrasts, which can lead to distorted perceptions and decisions.

Stress-Influence Tendency: Under stress, individuals may make quick, poorly thought-out decisions, leading to ill-informed choices.

Availability-Misweighing Tendency: This tendency involves giving undue weight to information that is readily available, leading to biased decision-making.

Use-It-or-Lose-It Tendency: People tend to use skills and knowledge they have, or they lose them. This can lead to a reluctance to learn new things.

Drug-Misinfluence Tendency: The influence of drugs can lead to impaired judgment and decision-making.

Senescence-Misinfluence Tendency: As people age, their judgment and decision-making abilities may decline.

Authority-Misinfluence Tendency: People tend to be influenced by authority figures, even when it's not in their best interest.

Twaddle Tendency: This tendency involves using jargon and complex language to obscure the truth.

Reason-Respecting Tendency: People tend to be influenced by reasoning, even when it's flawed.

Lollapalooza Tendency: This is the combination of multiple tendencies acting in the same direction, leading to extreme outcomes.

Let's get into each of them and their real-world applications!

Reward and Punishment Superresponse Tendency:

The "Reward and Punishment Superresponse Tendency" underscores the significant influence of incentives and disincentives on human behavior. It suggests that individuals are highly responsive to the prospect of gain or the fear of loss, sometimes to the detriment of logical reasoning. In practical terms, this means that people may be more motivated by financial rewards or penalties than by objective evidence or reasoned arguments.

Real-world Application: This tendency has critical implications for various fields, from business and finance to public policy. For instance, businesses often use financial incentives to motivate employees to meet performance targets. In investing, understanding how this tendency operates can help investors avoid making impulsive decisions based solely on the allure of potential profits or the fear of losing money.

Liking/Loving Tendency:

The "Liking/Loving Tendency" is rooted in the human inclination to judge in favor of individuals and symbols they have positive feelings toward. This bias can lead individuals to ignore or downplay negative information about people or things they like, potentially resulting in flawed decision-making.

Real-world Application: This tendency is frequently observed in everyday life. People may trust the advice or recommendations of friends or admired figures, even when those suggestions are not based on sound reasoning or evidence. In business and marketing, it underscores the value of building positive brand associations and customer loyalty.

Disliking/Hating Tendency:

Conversely, the "Disliking/Hating Tendency" leads individuals to ignore positive qualities in a person or entity they dislike or hate. This can result in a distorted and one-sided perception, potentially leading to irrational decision-making.

Real-world Application: In investing, it is crucial not to let personal biases and animosities influence financial decisions. For instance, disliking the management of a company should not cloud one's judgment when evaluating the company's investment potential objectively.

Doubt-Avoidance Tendency:

The "Doubt-Avoidance Tendency" refers to the tendency to make hasty, ill-informed decisions under stress or pressure. The desire to eliminate doubt can lead to impulsive choices, sometimes to the detriment of one's long-term interests.

Real-world Application: In high-stress situations, such as financial crises or emergency decision-making, this bias can lead to snap judgments that are not well-considered. Creating deliberate delays or utilizing structured decision-making processes can help counteract this tendency and lead to better outcomes.

Inconsistency-Avoidance Tendency:

Humans have a natural aversion to inconsistency and change. The "Inconsistency-Avoidance Tendency" explains our reluctance to alter established habits or beliefs, even when presented with new information that contradicts them.

Real-world Application: In the context of investing, this tendency can hinder adaptability and open-mindedness. To make sound investment decisions, it is essential to remain receptive to new facts and be willing to adjust one's strategies when warranted.

Curiosity Tendency:

The "Curiosity Tendency" highlights the innate human inclination to seek more information and knowledge. While curiosity can be a valuable trait, overindulging in the pursuit of information can complicate decision-making.

Real-world Application: In the digital age, information overload is a common challenge. People often spend excessive time gathering data but may struggle to distill it into actionable insights. Effective decision-makers strike a balance between satisfying their curiosity and making timely choices.

Kantian Fairness Tendency:

The "Kantian Fairness Tendency" is rooted in the human desire for fairness and reciprocity in social interactions. People tend to value equitable treatment and fairness in their dealings with others.

Real-world Application: This tendency underpins the concept of fairness in legal and ethical systems. In business and leadership, it highlights the importance of transparent and equitable practices to maintain trust and cooperation.

Envy/Jealousy Tendency:

Envy and jealousy can trigger strong negative emotions, affecting decision-making and relationships. The "Envy/Jealousy Tendency" can lead to biased judgments and actions driven by rivalry and resentment.

Real-world Application: Understanding this tendency is crucial in personal and professional relationships. It is also relevant in marketing and advertising, where companies may leverage consumers' desire to outdo others or acquire what their peers possess.

Reciprocation Tendency:

The "Reciprocation Tendency" suggests that people tend to reciprocate both positive and negative behaviors. In the context of investing, it is essential to be cautious of potential ulterior motives behind certain actions, as favors or gifts may come with expectations of reciprocity.

Real-world Application: This tendency is prevalent in social interactions, where individuals often feel obligated to return favors. It can be leveraged in marketing through strategies like offering free trials, knowing that customers may reciprocate by making a purchase.

Influence-from-Mere-Association Tendency:

The "Influence-from-Mere-Association Tendency" explains how people often perceive things based on their associations. Careful consideration is necessary to avoid being misled by accidental, non-causative factors.

Real-world Application: This tendency can manifest in various ways, from the influence of product packaging on consumer perception to the impact of endorsements by celebrities on public opinion.

Simple, Pain-Avoiding Psychological Denial:

The "Simple, Pain-Avoiding Psychological Denial" tendency involves avoiding facing painful truths, which can lead to poor decision-making. People often engage in denial as a coping mechanism to shield themselves from discomfort.

Real-world Application: This bias can have significant consequences in personal health decisions, where individuals may ignore symptoms or medical advice to avoid acknowledging a serious health issue.

Excessive Self-Regard Tendency:

The "Excessive Self-Regard Tendency" refers to the propensity to overestimate one's abilities and knowledge. This can lead to overconfidence and poor decision-making.

Real-world Application: Overconfidence can impact professional judgment and decision-making in various fields, from finance and entrepreneurship to healthcare and education.

Overoptimism Tendency:

The "Overoptimism Tendency" involves an exaggerated optimism that can lead to underestimating risks and making poor decisions. Individuals may underestimate the likelihood of negative outcomes.

Real-world Application: In financial markets, overoptimism can lead to speculative bubbles and investment decisions based on unrealistic expectations.

Deprival-Superreaction Tendency:

The "Deprival-Superreaction Tendency" suggests that people react strongly to the feeling of deprivation, which can lead to irrational decision-making. Loss aversion, a related concept, is part of this tendency.

Real-world Application: In marketing, creating a sense of urgency or scarcity can trigger consumers' fear of missing out, influencing their purchasing decisions.

Social-Proof Tendency:

The "Social-Proof Tendency" reflects the human inclination to follow the actions of others, even if it may not be the best course of action. This can result in herd behavior and conformity.

Real-world Application: Social proof is a powerful marketing tool, with companies often showcasing testimonials, user reviews, or social media engagement to influence consumer behavior.

Contrast-Misreaction Tendency:

The "Contrast-Misreaction Tendency" involves reacting strongly to contrasts, which can lead to distorted perceptions and decisions. People may overemphasize differences when comparing two or more items or situations.

Real-world Application: Understanding this tendency can be valuable in contexts such as negotiation and pricing strategies, where the framing of comparisons can influence decisions.

Stress-Influence Tendency:

Under stress, individuals may make quick, poorly thought-out decisions, leading to ill-informed choices. Stress can impair cognitive functioning and rational thinking.

Real-world Application: Stress-influence tendency is relevant in various high-pressure situations, such as emergency response, crisis management, and decision-making during turbulent market conditions.

Availability-Misweighing Tendency:

The "Availability-Misweighing Tendency" involves giving undue weight to information that is readily available, leading to biased decision-making. Information that is easily accessible may be overemphasized, while less accessible information is overlooked.

Real-world Application: This tendency can impact journalism, where the media may focus on readily available, sensational stories, potentially distorting public perception of important issues.

Use-It-or-Lose-It Tendency:

The "Use-It-or-Lose-It Tendency" suggests that people tend to use their skills and knowledge actively, or they risk losing them. This can lead to a reluctance to learn new things or adapt to changing circumstances.

Real-world Application: In education and professional development, this tendency underscores the importance of continuous learning and skill maintenance to remain competitive and adaptable.

Drug-Misinfluence Tendency:

The "Drug-Misinfluence Tendency" highlights how the influence of drugs can impair judgment and decision-making. Substance use can lead to irrational behaviors and choices.

Real-world Application: Substance abuse can have devastating consequences on an individual's decision-making, affecting personal and professional life.

Senescence-Misinfluence Tendency:

As people age, their judgment and decision-making abilities may decline. The "Senescence-Misinfluence Tendency" acknowledges the impact of aging on cognitive function.

Real-world Application: This tendency is relevant in areas such as healthcare and elder care, where understanding the cognitive changes associated with aging is essential for providing appropriate support and care.

Authority-Misinfluence Tendency:

The "Authority-Misinfluence Tendency" suggests that people tend to be influenced by authority figures, even when it may not be in their best interest. Individuals may defer to experts or leaders without critically evaluating the merits of their arguments.

Real-world Application: This tendency can have significant implications in contexts where authority figures hold sway, such as political decision-making, organizational leadership, and consumer endorsements.

Twaddle Tendency:

The "Twaddle Tendency" involves using jargon and complex language to obscure the truth. People may employ convoluted language to sound knowledgeable or authoritative.

Real-world Application: Clear and effective communication is crucial in various fields, from academia and law to business and healthcare. Recognizing and avoiding twaddle can promote transparency and understanding.

Reason-Respecting Tendency:

The "Reason-Respecting Tendency" suggests that people tend to be influenced by reasoning, even when it's flawed. Individuals may be swayed by the presentation of arguments, regardless of their quality.

Real-world Application: This tendency underscores the importance of critical thinking and evaluating the strength of reasoning in debates, decision-making, and argumentation.

Lollapalooza Tendency:

The "Lollapalooza Tendency" is a unique concept that represents the combined impact of multiple cognitive biases and psychological tendencies acting in the same direction. It can result in extreme and often unexpected outcomes.

Real-world Application: The lollapalooza effect can be observed in various situations, such as financial market bubbles or sudden shifts in public opinion driven by a convergence of different biases and factors.

Real World Case Studies

Reward and Punishment Superresponse Tendency: Berkshire Hathaway's compensation structure for its managers is designed to align their interests with those of the company and its shareholders. By tying rewards to long-term performance, they create incentives that encourage managers to make decisions that benefit the company in the long run.

Liking/Loving Tendency: Munger and Buffett have been known to invest in companies with strong management teams that they admire and trust. For example, their investment in GEICO was partly driven by their admiration for GEICO's management and their belief in the company's long-term potential.

Disliking/Hating Tendency: Munger and Buffett have avoided investing in businesses they dislike or do not understand, such as technology companies during the dot-com bubble. This approach has helped them avoid making poor investment decisions based on personal biases.

Doubt-Avoidance Tendency: Munger and Buffett have been known to take their time when making investment decisions, carefully analyzing the available information and avoiding impulsive decisions. This approach has helped them avoid making ill-informed choices under pressure.

Inconsistency-Avoidance Tendency: Berkshire Hathaway's long-term investment approach reflects Munger's belief in the importance of consistency. By sticking to their core investment principles, they have been able to achieve consistent success over time.

Curiosity Tendency: Munger and Buffett's continuous learning and reading habits exemplify their curiosity and desire to seek more information. This tendency has helped them stay informed and make well-informed investment decisions.

Kantian Fairness Tendency: Berkshire Hathaway's reputation for treating its acquired companies fairly and allowing them to maintain their autonomy reflects Munger's emphasis on fairness and reciprocity in human interactions.

Reciprocation Tendency: Munger and Buffett have built strong relationships with their business partners and managers by treating them fairly and with respect, fostering a culture of trust and reciprocity within Berkshire Hathaway.

Influence-from-Mere-Association Tendency: Munger and Buffett have been cautious about the influence of mere association on their investment decisions. For example, they have avoided investing in companies with questionable accounting practices or unethical business practices, regardless of their association with well-known brands or individuals.

Simple, Pain-Avoiding Psychological Denial: Munger and Buffett have been open about their mistakes and have used them as learning opportunities. By acknowledging and learning from their errors, they have been able to improve their decision-making processes.

Excessive Self-Regard Tendency: Munger and Buffett have often spoken about the dangers of overconfidence in investing. They have emphasized the importance of humility and the willingness to admit when they are wrong, which has helped them avoid costly mistakes driven by excessive self-regard.

Overoptimism Tendency: Munger and Buffett have been known for their conservative approach to investing, which reflects their awareness of the overoptimism tendency. They have often preferred to err on the side of caution, which has helped them avoid overly optimistic projections that could lead to poor investment decisions.

Deprival-Superreaction Tendency: Berkshire Hathaway’s long-term investment approach reflects Munger’s understanding of the deprival-superreaction tendency. By focusing on long-term value rather than short-term gains, they have been able to avoid overreacting to temporary losses or missed opportunities.

Social-Proof Tendency: Munger and Buffett have often gone against the crowd in their investment decisions, reflecting their awareness of the social-proof tendency. For example, they avoided investing in technology companies during the dot-com bubble when many others were piling into these stocks.

Contrast-Misreaction Tendency: Munger and Buffett’s approach to evaluating investment opportunities reflects their understanding of the contrast-misreaction tendency. They have been known to evaluate each investment on its own merits, rather than comparing it to other opportunities.

Stress-Influence Tendency: Munger and Buffett’s calm and patient approach to investing reflects their awareness of the stress-influence tendency. By avoiding impulsive decisions under stress, they have been able to make more rational and informed investment decisions.

Availability-Misweighing Tendency: Munger and Buffett’s thorough due diligence process when evaluating potential investments reflects their understanding of the availability-misweighing tendency. They have been known to gather as much information as possible, rather than relying on readily available information.

Use-It-or-Lose-It Tendency: Munger and Buffett’s continuous learning and adaptation reflect their awareness of the use-it-or-lose-it tendency. They have been known to continuously update their knowledge and skills, which has helped them stay relevant in a rapidly changing business environment.

Drug-Misinfluence Tendency: While this tendency may not directly apply to their investment decisions, Munger and Buffett’s emphasis on ethical business practices reflects their understanding of the potential negative impacts of unethical behavior, such as drug misuse.

Senescence-Misinfluence Tendency: Despite their advanced age, Munger and Buffett have remained active and engaged in their work, reflecting their awareness of the senescence-misinfluence tendency. They have been able to maintain their mental sharpness and productivity, which has contributed to their continued success[2].

Authority-Misinfluence Tendency: Munger and Buffett have often emphasized the importance of independent thinking in investing, reflecting their understanding of the authority-misinfluence tendency. They have been known to question conventional wisdom and make their own judgments, rather than blindly following the advice of authorities.

Twaddle Tendency: Munger and Buffett’s clear and straightforward communication style reflects their awareness of the twaddle tendency. They have been known to avoid unnecessary jargon and complexity in their communications, which has helped them convey their ideas more effectively.

Reason-Respecting Tendency: Munger and Buffett’s rational approach to investing reflects their understanding of the reason-respecting tendency. They have been known to base their decisions on sound reasoning and evidence, rather than on emotions or biases.

Lollapalooza Tendency: Munger and Buffett’s success can be seen as a result of the combined effect of many of these tendencies. Their ability to understand and manage these tendencies has helped them make better decisions and achieve extraordinary success.

Envy/Jealousy Tendency: Munger and Buffett have often spoken about the dangers of envy and jealousy in investing. They have emphasized the importance of focusing on one’s own goals and performance, rather than comparing oneself to others, which has helped them avoid poor decisions driven by envy or jealousy.

Recap: In This Issue

Charlie Munger's Key Insights:

Pursuit of Worldly Wisdom: Outsmart rather than outwork.

Engagement in Rarely Used Skills: Diversify skills to avoid errors.

Psychology of Human Misjudgment: Understand human behavior for better decisions.

Charlie Munger's Heuristics:

Reward and Punishment Superresponse Tendency: Incentives and disincentives strongly influence behavior.

Liking/Loving Tendency: People favor individuals and symbols they like, potentially leading to biased decisions.

Disliking/Hating Tendency: People ignore positive qualities in those they dislike, distorting perception.

Doubt-Avoidance Tendency: Stress leads to hasty decisions; deliberate delays can counteract this.

Inconsistency-Avoidance Tendency: People avoid change and inconsistency, hindering adaptability.

Curiosity Tendency: People seek more information, but overindulgence can complicate decision-making.

Kantian Fairness Tendency: Desire for fairness and reciprocity in human interactions.

Envy/Jealousy Tendency: Negative emotions can affect decision-making and relationships.

Reciprocation Tendency: People reciprocate behaviors, both positive and negative.

Influence-from-Mere-Association Tendency: People perceive things based on associations, requiring careful consideration.

Simple, Pain-Avoiding Psychological Denial: Avoiding painful truths can lead to poor decisions.

Excessive Self-Regard Tendency: Overestimating abilities can lead to arrogance.

Overoptimism Tendency: Exaggerated optimism can lead to underestimating risks.

Deprival-Superreaction Tendency: Strong reactions to deprivation can result in irrational decisions.

Social-Proof Tendency: People tend to follow the actions of others, even if it's not the best course of action.

Contrast-Misreaction Tendency: Reacting strongly to contrasts can lead to distorted perceptions.

Stress-Influence Tendency: Stress can lead to quick, poorly thought-out decisions.

Availability-Misweighing Tendency: Giving undue weight to readily available information.

Use-It-or-Lose-It Tendency: People tend to use skills and knowledge actively, or they lose them.

Drug-Misinfluence Tendency: The influence of drugs can impair judgment.

Senescence-Misinfluence Tendency: Aging can impact judgment and decision-making.

Authority-Misinfluence Tendency: People tend to be influenced by authority figures.

Twaddle Tendency: Using complex language to obscure the truth.

Reason-Respecting Tendency: People tend to be influenced by reasoning.

Lollapalooza Tendency: The combination of multiple tendencies leading to extreme outcomes.

Real-World Case Studies:

Munger's principles have practical applications in fields such as investing, psychology, marketing, and ethics.

Berkshire Hathaway's success reflects Munger's insights in compensation structures and investment decisions.

Munger and Buffett's emphasis on critical thinking and humility contributes to their success.

Munger's awareness of cognitive biases and tendencies informs decision-making in various domains.

Charlie Munger's heuristics provide valuable guidance for individuals and organizations seeking rational decision-making.

Other Mental Models from The Business Engineer:

Antifragility - Embracing and benefiting from uncertainty and volatility.

Risk Mitigation and Tail Hedging - Implementing strategies to protect against extreme market events.

Day 1 Mentality - Maintaining agility, customer-centricity, and constant innovation.

First Principles Thinking - Breaking down problems to fundamental truths for innovative solutions.

The Growth Mindset - Embracing continuous learning, adaptation, and challenges.

Value Investing - Seeking undervalued assets and companies with solid fundamentals.

Move Fast and Break Things - Taking risks, iterating quickly, and learning from failures.

Moonshot Thinking - Aiming for audacious goals and groundbreaking innovations.

Design Thinking - Applying design principles to solve problems and create innovative solutions.

Zero to One - Focusing on creating unique and transformative innovations.

Disruptive Innovation - Revolutionizing industries through groundbreaking and disruptive innovations.

Customer-Centricity - Placing a strong emphasis on understanding and meeting customer needs and preferences.

Platform Thinking - Building and scaling platforms that enable various stakeholders to create value and innovate.

Blitzscaling - To understand when it makes sense to prioritize speed over accuracy to enable business survival.

Ciao!

With ♥️ Gennaro, FourWeekMBA

Today’s Sponsor: Airtable

It’s time to change the way we build digital products

Keeping busy is easy. Driving business impact is what matters. Consistently align your people to the most strategic priorities, discover product opportunities from deep customer insights, and gain total visibility on execution with Airtable ProductCentral.