diffusion of innovation

In a tech-driven business world, the most difficult part is not necessarily to build something but to build something that people want.

And also there, the question of who is the right target for that specific timeframe of product development is critical to make sure to have a proper balance between focus and innovation to move to the next phase of distribution.

Indeeed, in business it’s all about being able to build something valuable for a niche, and move to adjacent niches from there.

Easier said than done.

That’s why, one of the most important mental models in the technological world is the “diffusion of innovation” via the technology adoption curve!

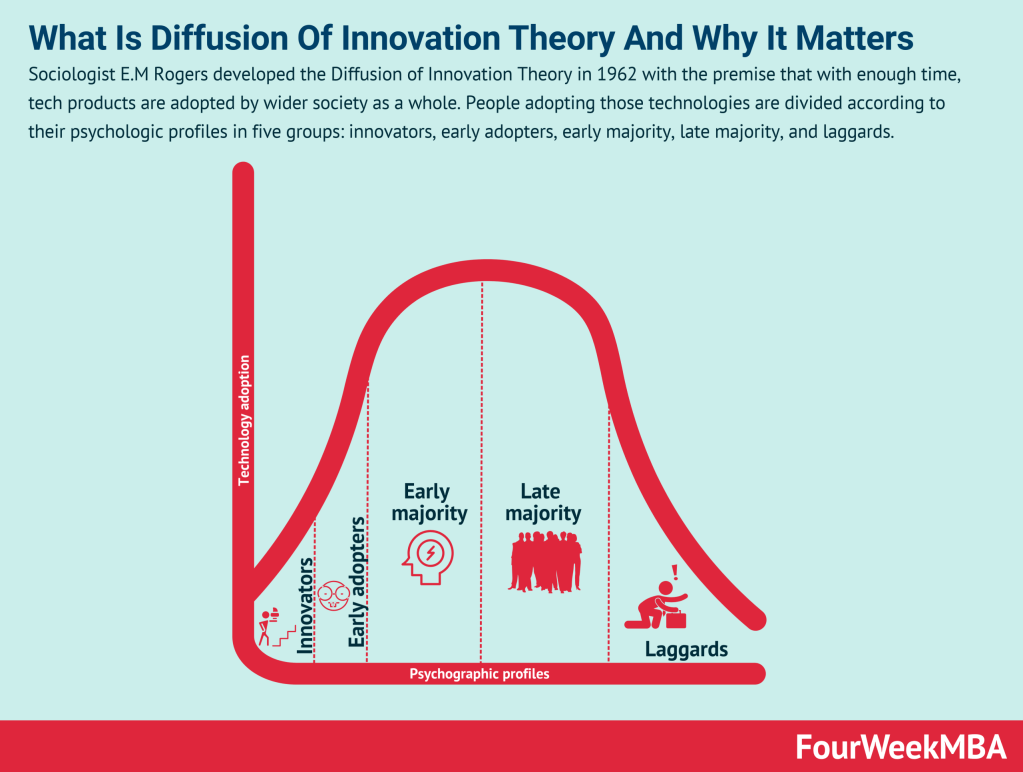

Sociologist E.M. Rogers developed the Diffusion of Innovation Theory in 1962, premised on the idea that with enough time, tech products are adopted by wider society as a whole.

People adopting those technologies are divided according to their psychologic profiles into five groups: innovators, early adopters, early majority, late majority, and laggards.

Before we get to that below a visual representation of all I’ll cover in this issue!

Understanding the Diffusion of Innovation Theory

The Diffusion of Innovation Theory was developed by sociologist E.M Rogers in 1962.

The basic premise of Rogers’ theory is that people spread or diffuse ideas and products through a population.

With enough time, they are adopted by wider society as a whole.

Indeed, adoption in this context means that a consumer does something they hadn’t done previously.

Businesses and marketing departments should be most interested in diffusion, which results in consumers purchasing a new product and influencing wider society to do the same.

For that process to play out in reality, the right type of consumer must be targeted. The next section will look at how this might be accomplished.

Categories of Consumers in the Diffusion of Innovation Theory

Individual consumers within a social system can be classified into five distinct groups according to their propensity for innovation.

1. Innovators

Innovators are consumers who are the first to buy a new product after it enters the market.

They come from higher socioeconomic classes and have the liquidity required for high-risk tolerance.

They are also very social and have many close contacts with other innovators.

2. Early adopters

Early adopters are similar to innovators in their degree of liquidity, education level, and social status.

They are generally more opinionated about their life choices and enjoy a degree of leadership in this area.

However, their risk tolerance is lower, and as a result, they are more discerning about the type of products they adopt.

3. Early majority

The early majority represents consumers who adopt a new product or technology after a sufficient amount of time has passed.

They are not as vocal about their life choices as the early adopters, but their opinions still carry weight in wider society.

4. Late majority

The late majority of consumers approach a new product with skepticism because of their low liquidity and social status.

They will generally not adopt a new product until the majority of the population of consumers has done so.

5. Laggards

Laggards are the last consumers to adopt a new product.

They tend to be found in older demographics who have traditional values opposed to change.

They also have small social circles and have little interest in voicing their opinions.

Using the Diffusion of Innovation Theory in marketing

For marketing departm’ efforts are best served by focusing on the early adopters and early majority.

While the temptation may be to market to innovators, businesses should not confuse an innovator’s high tolerance for risk with the popularity of their products.

Efforts are best served by focusing on the early adopters and early majority.

Consumers in these segments represent a sweet spot for marketers, with their high disposable income, sociability, and product discernment.

For these reasons, these consumers create momentum that helps drive a product to its tipping point - or the point at which it becomes widely adopted.

Tesla Case Study

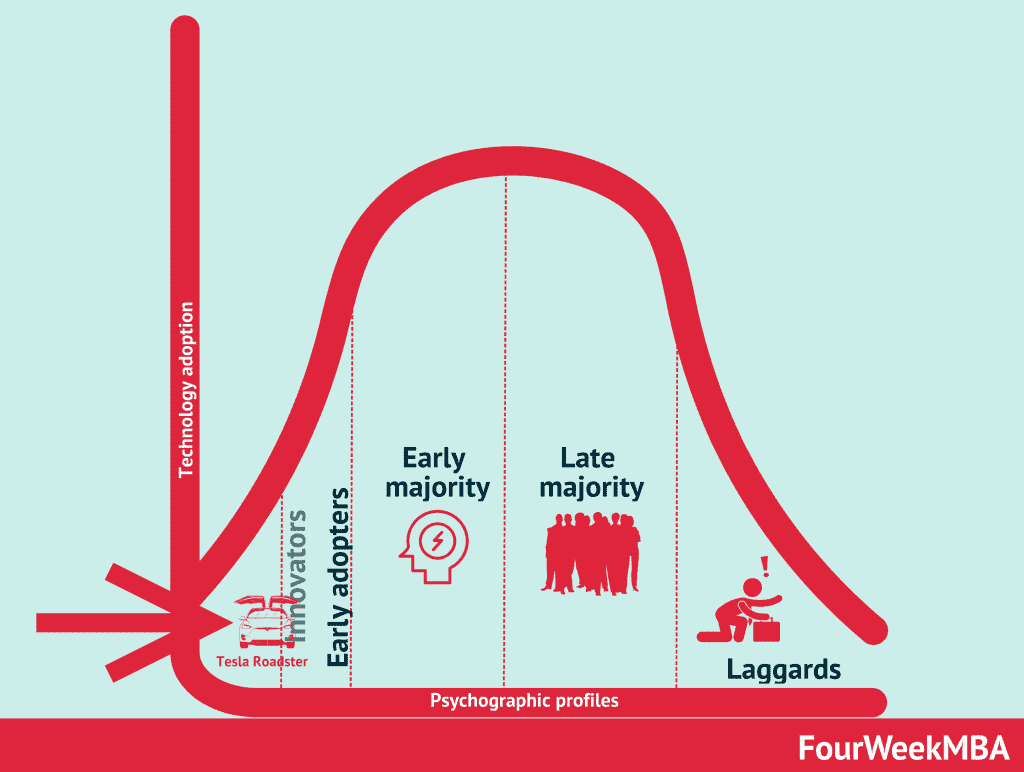

A great way to understand the diffusion of innovation is the evolution of the Tesla business model.

In short, when Tesla entered the market, it didn't do it by trying to build an EV that could be distributed to the masses.

Indeed, Tesla was not the first to try to build a successful EV vehicle.

In the mid-late 1990s, General Motors built a car called EV1.

The car was supposed to target right on a more significant segment of the market.

This made sense for General Motors because, as an established automaker, it made sense to look into the development of an electric vehicle, only if this would go after a large market.

Yet, this turned out to be a complete failure.

That's the core difference between a startup and an incumbent.

When launching new products, an incumbent like General Motors tries to go after large market segments immediately (targeting the late majority).

A startup with constrained resources must do the opposite.

A company like Tesla, with limited funding, had to figure out how to niche down the market as much as possible to showcase the technology without going bankrupt.

To Tesla in the early days, it didn't matter how small it was the niche it was going to tackle.

What mattered was the ability to showcase the technology at first.

This is a core difference, as whereas new entrants develop markets by starting from tiny niches, incumbents try to launch markets by starting from the masses!

The former approach creates options to scale, where failure is cheap and bearable.

The latter creates a scenario where failure gets so expensive that if the product doesn't reach the masses, it will be withdrawn, and progress will be stopped for years!

Therefore, Tesla used the Roadster as a gateway to the car industry, targeting a tiny market segment made of innovators who supported Tesla's mission.

Over time, Tesla produced other EVs in parallel to address increasingly large market segments.

It took Tesla fifteen years to start working toward mass manufacturing the Model 3.

And this strategy is still ongoing.

The essence of scale

Thus, a few critical lessons work remembering here:

Market Size

Whereas incumbents try to tackle mass markets right off the bat.

New entrants, with limited funding and constrained resources, niche down to the point of tackling what seems to be an interesting microniche.

Over time, that microniche can turn into a giant industry!

Cost of failing

The incumbent comes up with a strategy where failure gets extremely expensive and failed launch turns into an unsuccessful product for years.

A new entrant instead niches down as much as possible to make failing fast and cheap.

In the case of General Motors, the failure of the EV1 was such that still, in the 2020s, the company had to recover and compete in full in the EV industry.

Options to scale

A key thing to understand is that you don't need to go after an extensive market when launching new products.

Tackling a large market requires economies of scale.

Achieving economies of scale requires a foundational product that has been iterated many times over at various production scales.

This process takes years to build up.

Thus, it would be best to look for small opportunities that create options when launching a whole new product to scale.

You can always decide to try to make the product work at a larger scale once it works at a small scale.

The opposite is not true.

When you try to make a product work on a large scale, failure is almost guaranteed.

There is one exception to the rule, and that is Apple's iPhone. The rest is mainly guaranteed failure.

Strategy vs. product launches

When building a new market, you must shift your mindset from product vs. strategy.

The product launch mindset is that you want to see the product succeed at scale.

Instead, a strategy mindset requires understanding that for a product to be successful at scale, it needs to be rolled out through various stages of iterations, at various scales, for years. In some cases, it might take decades.

In other words, today's microniches are tomorrow's mass markets!

To succeed, you want to limit your options today to create options to scale tomorrow!

Key Highlights

Diffusion of Innovation Theory: Developed by sociologist E.M Rogers in 1962, this theory explores how ideas and products spread through a population over time. The ultimate goal is for these ideas or products to be adopted by society as a whole.

Consumer Adoption: Adoption in this context refers to consumers taking up a new behavior or purchasing a new product. This process is crucial for businesses and marketers, as they want to influence consumers to adopt new products and contribute to their widespread acceptance.

Categories of Consumers: The theory categorizes consumers into five groups based on their willingness to adopt new ideas or products:

Innovators: First to adopt, often with high risk tolerance and strong social networks.

Early Adopters: Similar to innovators but more discerning and influential.

Early Majority: Adopt after a new idea or product gains some traction.

Late Majority: Skeptical and adopt only when most have already done so.

Laggards: Last to adopt, often due to traditional values and limited social circles.

Marketing Implications: Marketing efforts are best directed towards early adopters and early majority, as they have high disposable income, sociability, and influence. These segments can create momentum leading to a product's widespread adoption.

Tesla Case Study: Tesla's approach to the market exemplifies the diffusion of innovation theory. Tesla started by targeting a small niche (innovators) with their Roadster to showcase their technology. Over time, they expanded to larger market segments.

Startup vs. Incumbent Strategy: Startups, with limited resources, should initially target small niches to showcase their technology and iterate gradually. Incumbents may try to target large markets from the beginning, making failure expensive.

Options to Scale: New products should be tested in smaller niches before attempting mass-market adoption. Scaling requires iterative development and takes time, while trying to scale prematurely often leads to failure.

Mindset Shift: To succeed in building new markets, a strategy mindset is crucial. Understanding that products need iterations and scaling over time is essential for long-term success.

Real-World Case Studies

Tesla

Segment Targeted: Innovators

Product: Tesla Roadster

Key Elements: High-performance, limited production, luxury sports car

Outcome: Established brand credibility and showcased technology

Segment Targeted: Early Adopters

Product: Model S

Key Elements: High-end electric sedan, long range, advanced features

Outcome: Built brand recognition, attracted premium customers

Segment Targeted: Early Majority

Product: Model 3

Key Elements: Affordable electric sedan, mass production, improved technology

Outcome: Mass-market adoption, significant sales growth

Apple

Segment Targeted: Innovators

Product: Macintosh

Key Elements: Revolutionary GUI, premium pricing, unique design

Outcome: Established Apple as an innovator in personal computing

Segment Targeted: Early Adopters

Product: iPod

Key Elements: Portable music player, sleek design, iTunes integration

Outcome: Dominated the portable music player market

Segment Targeted: Early Majority

Product: iPhone

Key Elements: Smartphone with touch interface, App Store ecosystem

Outcome: Revolutionized mobile industry, high market penetration

Google

Segment Targeted: Innovators

Product: Google Search

Key Elements: Superior search algorithm, ad-free initially

Outcome: Rapid adoption among tech-savvy users

Segment Targeted: Early Adopters

Product: Google Ads

Key Elements: Pay-per-click advertising model, targeted ads

Outcome: Became primary revenue source, widespread adoption among businesses

Segment Targeted: Early Majority

Product: Google Workspace

Key Elements: Cloud-based productivity tools, seamless integration

Outcome: Significant penetration in enterprise productivity market

Netflix

Segment Targeted: Innovators

Product: DVD Rental by Mail

Key Elements: Subscription model, convenience, no late fees

Outcome: Established initial customer base, disrupted video rental industry

Segment Targeted: Early Adopters

Product: Streaming Service

Key Elements: Online streaming, vast content library

Outcome: Rapid growth, shifted focus to digital streaming

Segment Targeted: Early Majority

Product: Original Content

Key Elements: High-quality original shows and movies

Outcome: Became a major player in content production, subscriber growth

Amazon

Segment Targeted: Innovators

Product: Online Bookstore

Key Elements: Vast selection, convenience, competitive pricing

Outcome: Established as a leading online retailer

Segment Targeted: Early Adopters

Product: Amazon Prime

Key Elements: Subscription service, free shipping, exclusive content

Outcome: High customer retention, expanded to broader product offerings

Segment Targeted: Early Majority

Product: Amazon Web Services (AWS)

Key Elements: Cloud computing services, scalable infrastructure

Outcome: Dominated cloud services market, high revenue growth

Facebook

Segment Targeted: Innovators

Product: Facebook (TheFacebook)

Key Elements: College network, exclusive membership

Outcome: Rapid growth among college students

Segment Targeted: Early Adopters

Product: Expanded Membership

Key Elements: Opening to high schools, eventually public

Outcome: Explosive user base growth

Segment Targeted: Early Majority

Product: Mobile App

Key Elements: Mobile-first experience, real-time updates

Outcome: Dominated mobile social networking

Microsoft

Segment Targeted: Innovators

Product: Windows OS

Key Elements: Graphical user interface, improved usability

Outcome: Became dominant operating system

Segment Targeted: Early Adopters

Product: Office Suite

Key Elements: Integrated productivity tools, business focus

Outcome: Became standard software for business productivity

Segment Targeted: Early Majority

Product: Azure

Key Elements: Cloud computing platform, enterprise solutions

Outcome: Significant share in cloud services market

Uber

Segment Targeted: Innovators

Product: UberBLACK

Key Elements: Luxury ride service, app-based booking

Outcome: Established brand, showcased convenience

Segment Targeted: Early Adopters

Product: UberX

Key Elements: Affordable ride-sharing, expanded driver base

Outcome: Rapid market expansion, high user adoption

Segment Targeted: Early Majority

Product: UberEATS

Key Elements: Food delivery service, app integration

Outcome: Expanded service offerings, increased revenue

Airbnb

Segment Targeted: Innovators

Product: Airbed & Breakfast

Key Elements: Short-term rentals in private homes, unique experiences

Outcome: Created initial user base, validated concept

Segment Targeted: Early Adopters

Product: Expanded Listings

Key Elements: More property types, increased inventory

Outcome: Significant growth, market penetration

Segment Targeted: Early Majority

Product: Airbnb Experiences

Key Elements: Curated local activities, integrated platform

Outcome: Enhanced user engagement, diversified revenue streams

Spotify

Segment Targeted: Innovators

Product: Free Streaming

Key Elements: Ad-supported, large music library

Outcome: Built initial user base, validated streaming model

Segment Targeted: Early Adopters

Product: Premium Subscription

Key Elements: Ad-free, offline access, higher audio quality

Outcome: High conversion to paid subscribers, increased revenue

Segment Targeted: Early Majority

Product: Personalized Playlists

Key Elements: Curated playlists, Discover Weekly

Outcome: Enhanced user experience, retention, and engagement

Slack

Segment Targeted: Innovators

Product: Free Messaging Service

Key Elements: Team collaboration, integrations with other tools

Outcome: Built user base among tech-savvy teams

Segment Targeted: Early Adopters

Product: Premium Features

Key Elements: Enhanced security, more integrations, analytics

Outcome: High adoption in enterprises, increased revenue

Segment Targeted: Early Majority

Product: Enterprise Grid

Key Elements: Large-scale deployments, enterprise-level features

Outcome: Significant penetration in large organizations, high user retention

Dropbox

Segment Targeted: Innovators

Product: Free Cloud Storage

Key Elements: Easy file sharing, seamless sync

Outcome: Rapid user growth, validated cloud storage model

Segment Targeted: Early Adopters

Product: Paid Plans

Key Elements: Increased storage, advanced features

Outcome: High conversion to paid subscribers, increased revenue

Segment Targeted: Early Majority

Product: Dropbox Business

Key Elements: Team collaboration, advanced security features

Outcome: Significant market share in business cloud storage

Warby Parker

Segment Targeted: Innovators

Product: Online Glasses Retailer

Key Elements: Home try-on program, affordable pricing

Outcome: Disrupted traditional eyewear market, built strong brand

Segment Targeted: Early Adopters

Product: Retail Stores

Key Elements: Physical presence, enhanced customer experience

Outcome: Expanded customer base, improved brand loyalty

Segment Targeted: Early Majority

Product: Vision Care Services

Key Elements: Eye exams, prescription services

Outcome: Comprehensive eye care solutions, increased market penetration

TikTok

Segment Targeted: Innovators

Product: Short-Form Video Platform

Key Elements: Easy video creation, viral challenges

Outcome: Rapid user adoption, strong engagement

Segment Targeted: Early Adopters

Product: Influencer Collaborations

Key Elements: Partnerships with popular creators

Outcome: Increased content quality, expanded user base

Segment Targeted: Early Majority

Product: Monetization Features

Key Elements: Ads, in-app purchases, brand partnerships

Outcome: High revenue growth, significant market presence

Laggards

Nokia

Segment Targeted: Laggards

Product: Feature Phones

Key Elements: Simple, reliable, long battery life

Outcome: Continued sales among consumers resistant to smartphones

Kodak

Segment Targeted: Laggards

Product: Disposable Cameras

Key Elements: Inexpensive, easy-to-use, physical prints

Outcome: Maintained market presence among non-digital camera users

BlackBerry

Segment Targeted: Laggards

Product: Physical Keyboard Smartphones

Key Elements: Tactile typing experience, secure email

Outcome: Retained a niche market of users resistant to touchscreen phones

Microsoft

Segment Targeted: Laggards

Product: Windows XP

Key Elements: Continued support and updates for an outdated OS

Outcome: Extended life cycle of an older product for resistant users

Toyota

Segment Targeted: Laggards

Product: Hybrid Cars (Toyota Prius)

Key Elements: Familiar driving experience, incremental innovation

Outcome: Slowly increased hybrid adoption among traditional car buyers

Panasonic

Segment Targeted: Laggards

Product: VHS Tape Players

Key Elements: Support for existing media libraries, reliability

Outcome: Sustained sales among users reluctant to switch to DVDs

Samsung

Segment Targeted: Laggards

Product: Flip Phones

Key Elements: Simple functionality, durable design

Outcome: Continued market presence among users avoiding modern smartphones

IBM

Segment Targeted: Laggards

Product: Mainframe Computers

Key Elements: Stability, reliability, long-term support

Outcome: Maintained dominance in industries resistant to change

Amazon

Segment Targeted: Laggards

Product: Printed Books

Key Elements: Extensive selection, familiarity, ease of reading

Outcome: Continued strong sales among consumers preferring physical books

Canon

Segment Targeted: Laggards

Product: Film Cameras

Key Elements: High-quality images, traditional photography experience

Outcome: Sustained niche market of film photography enthusiasts

Ciao!

With ♥️ Gennaro, FourWeekMBA