From SaaS Economics to AI-Native Monetization

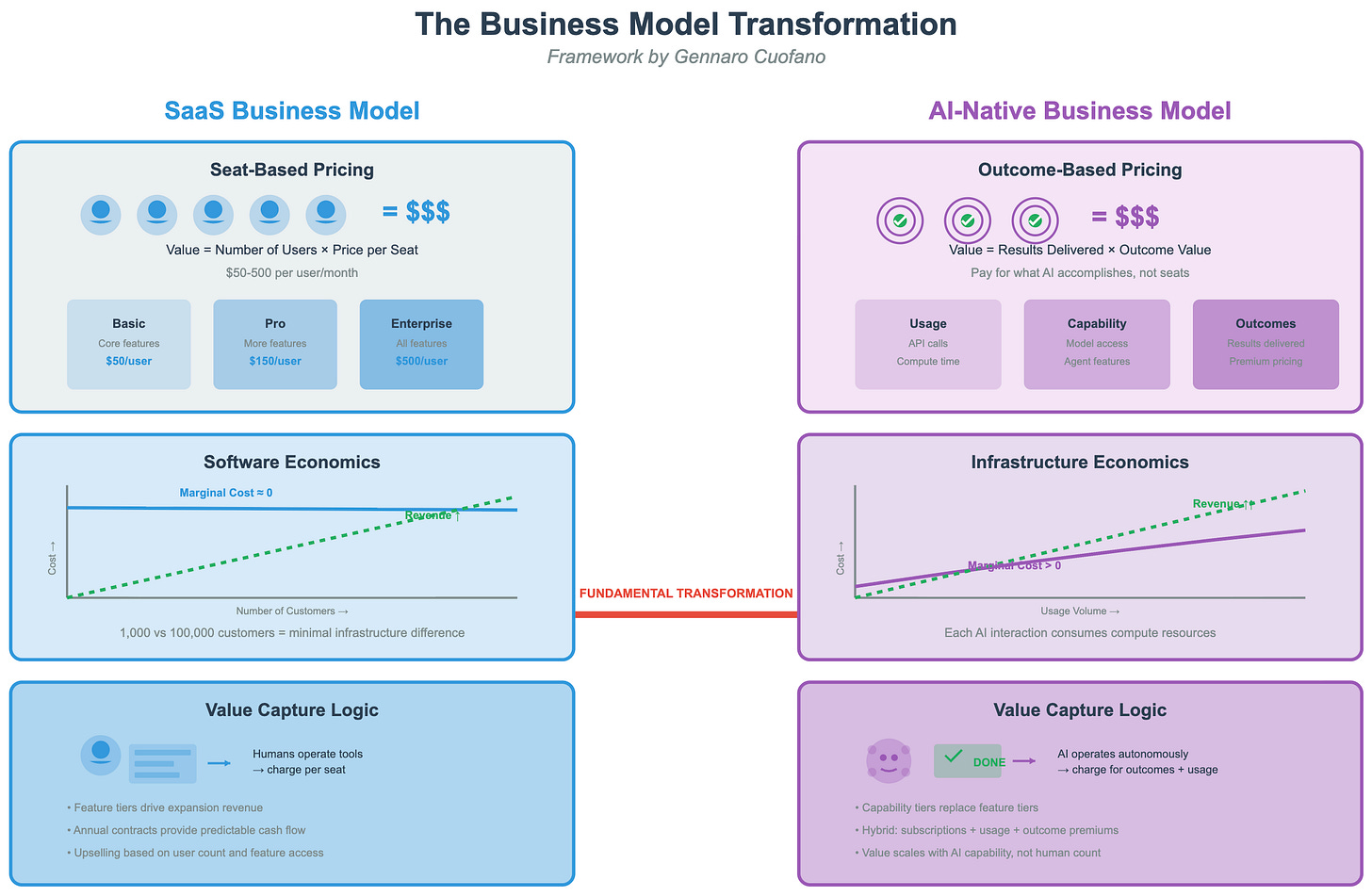

The architectural shift from SaaS (surfacing) to AI-native (embedding) doesn’t just change how software works—it fundamentally transforms how companies capture value. This isn’t an evolutionary adjustment to existing monetization models; it’s a categorical break that invalidates the core economic assumptions of the SaaS era.

The SaaS business model—seat-based pricing, subscription economics, software margins—was optimized for a specific technology paradigm: applications that surface functionality for human operation. When the underlying technology shifts from human-operated tools to autonomous AI agents, the economic logic breaks entirely.

This transformation creates both crisis and opportunity. Companies clinging to SaaS monetization models while deploying AI will find themselves in an economic vice: their costs scale like infrastructure (variable, compute-intensive) while their revenue models assume software economics (fixed costs, marginal scaling). The winners will be those who recognize that AI isn’t just different technology—it requires fundamentally different business models.

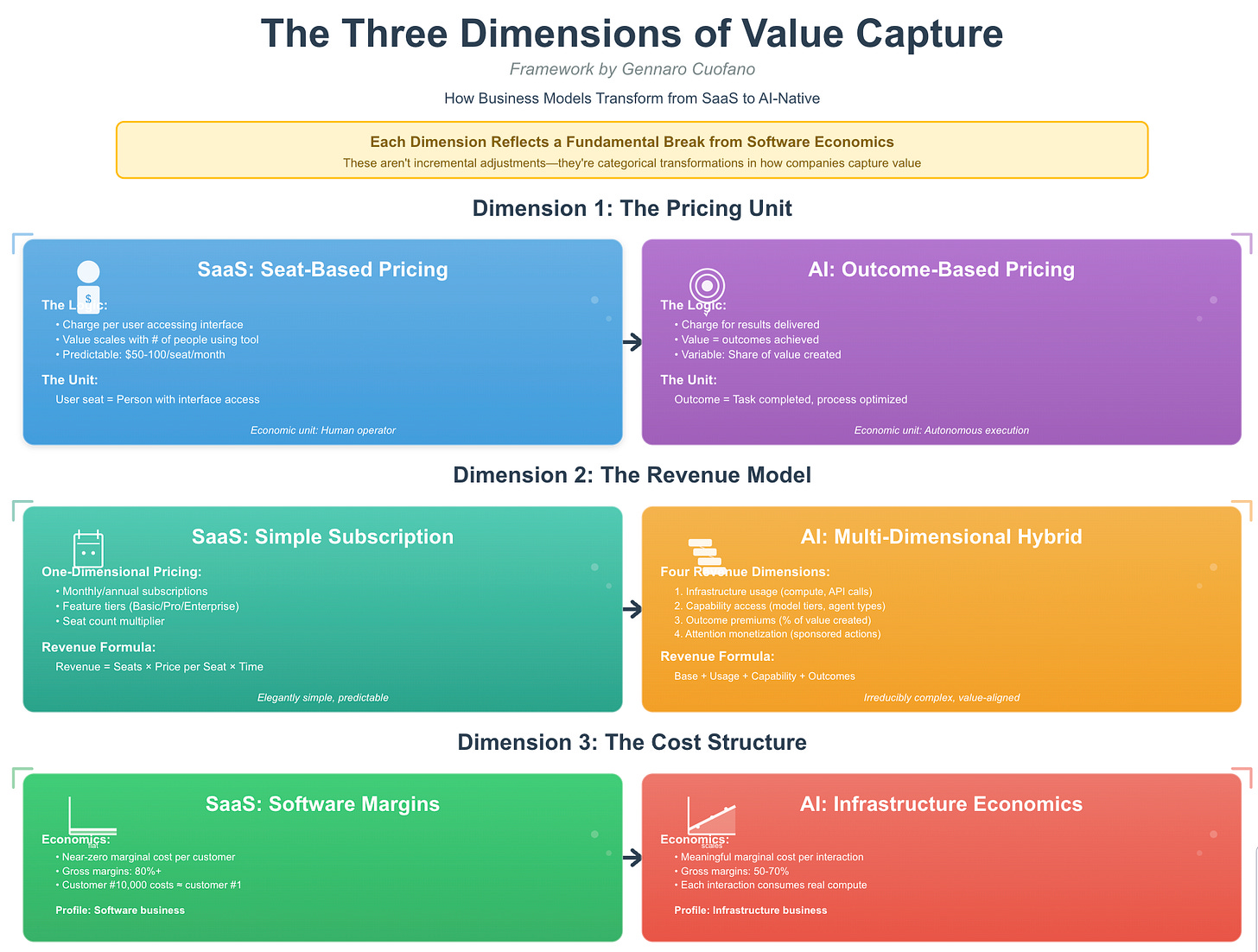

The Three Dimensions of Value Capture

1. From Seat-Based to Outcome-Based Pricing

The SaaS Logic

For two decades, SaaS companies operated on a simple premise: charge per user because value scales with the number of people using the interface.

The logic was elegant:

Each user occupies a “seat” in the software

Each seat represents interface access

More seats = more value delivered = higher revenue

Predictable monthly recurring revenue per seat

This model worked because SaaS was fundamentally about human operation. The software’s value came from enabling humans to execute workflows more efficiently. The interface was the product. The seat was the economic unit.

The model’s success created standardization: $50/seat/month for basic tiers, $100+/seat/month for premium features, enterprise custom pricing for large deployments. Revenue became predictable. Investors understood the metrics. Entire industries organized around this pricing paradigm.

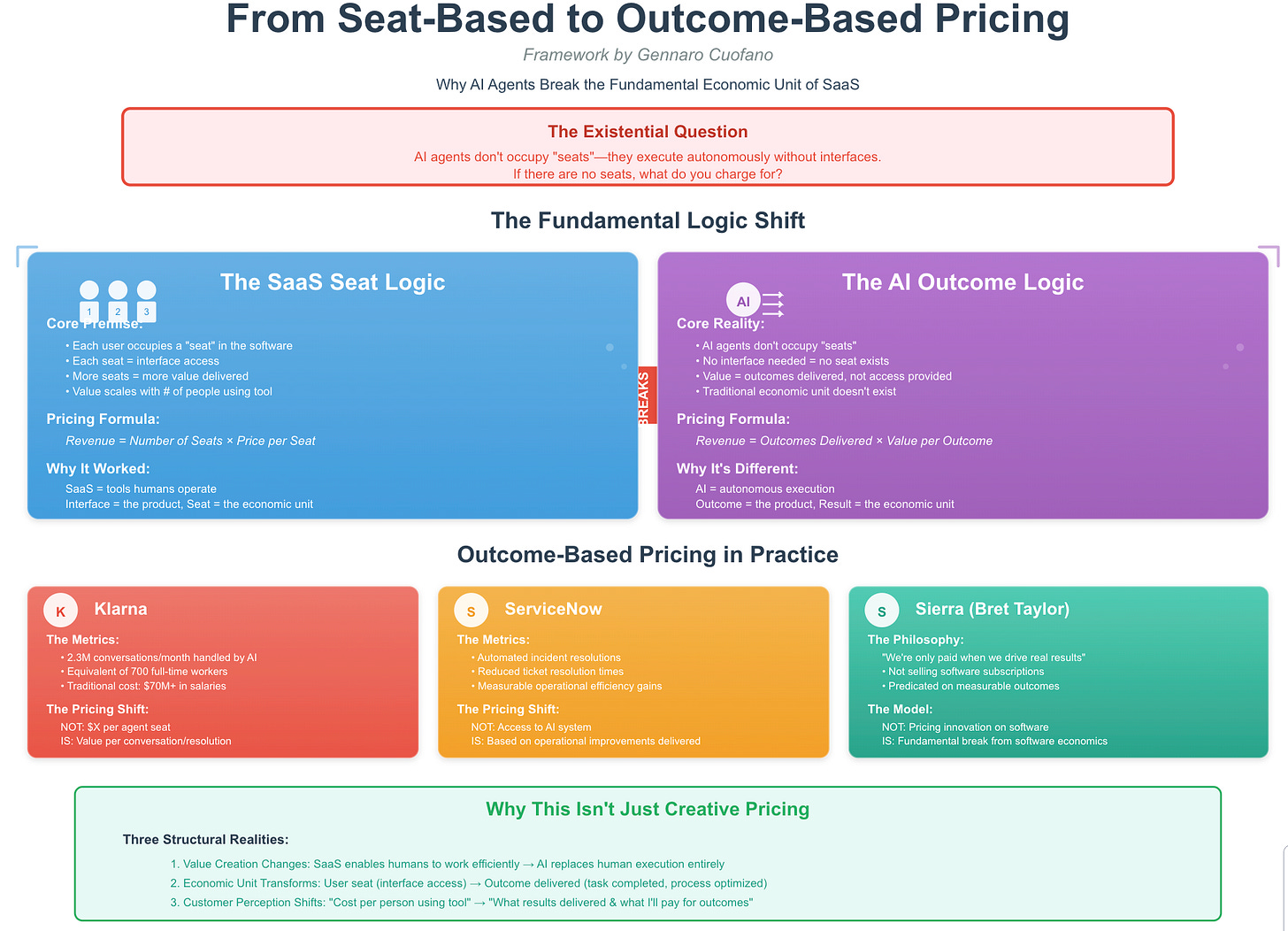

The AI Paradox

AI agents break this logic at its foundation.

An AI agent doesn’t occupy a “seat”—it doesn’t log into an interface, doesn’t need a dashboard, doesn’t click buttons. It executes workflows autonomously through direct infrastructure access. The traditional unit of monetization (the seat) doesn’t exist.

Consider the implications:

A sales agent that prospects, qualifies, schedules, and presents isn’t a user—it’s a capability

A support agent that resolves tickets end-to-end doesn’t need interface access—it orchestrates across systems

A finance agent that executes procurement doesn’t operate a dashboard—it transacts autonomously

The question becomes existential: if there are no seats, what do you charge for?

The Outcome-Based Revolution

Early AI-native companies are pioneering a fundamental answer: charge for results, not access.

Klarna’s Model: Klarna’s AI agent handles 2.3 million customer service conversations monthly—equivalent to 700 full-time workers. But Klarna doesn’t charge customers for “AI agent seats.” The value isn’t in accessing an interface; it’s in conversations handled, issues resolved, customer satisfaction maintained.

The pricing logic shifts: instead of “$X per agent seat,” it becomes “value delivered per transaction” or “cost savings achieved versus human baseline.” The AI’s value is measured in outcomes—resolved tickets, satisfied customers, operational efficiency—not in how many people log into a system.

ServiceNow’s Approach: ServiceNow’s AI-native offerings price based on automated incident resolutions and reduced ticket resolution times. The customer doesn’t pay for “access to the AI system”—they pay based on the operational improvement the AI delivers.

This reflects a deeper truth: the AI’s value isn’t in making humans more efficient at operating software; it’s in replacing entire categories of human-mediated workflows with autonomous execution.

Sierra’s Declaration: When Sierra CEO Bret Taylor states “We’re only paid when we drive real results,” he’s not describing a pricing innovation—he’s articulating a fundamental break from software economics. The company’s entire business model is predicated on delivering measurable outcomes, not selling software subscriptions.

Why This Isn’t Just Creative Pricing

The shift from seat-based to outcome-based pricing reflects three structural realities:

1. Value Creation Mechanism Changes

SaaS value: Enabling humans to work more efficiently

AI value: Replacing human execution entirely

2. The Economic Unit Transforms

SaaS unit: User seat (person with interface access)

AI unit: Outcome delivered (task completed, process optimized, decision executed)

3. Customer Value Perception Shifts

SaaS perception: “How much does it cost per person to use this tool?”

AI perception: “What results does this deliver and what am I willing to pay for those outcomes?”

The outcome-based model isn’t a creative billing mechanism layered onto existing software—it’s the natural monetization model for systems that operate autonomously rather than tools humans operate.

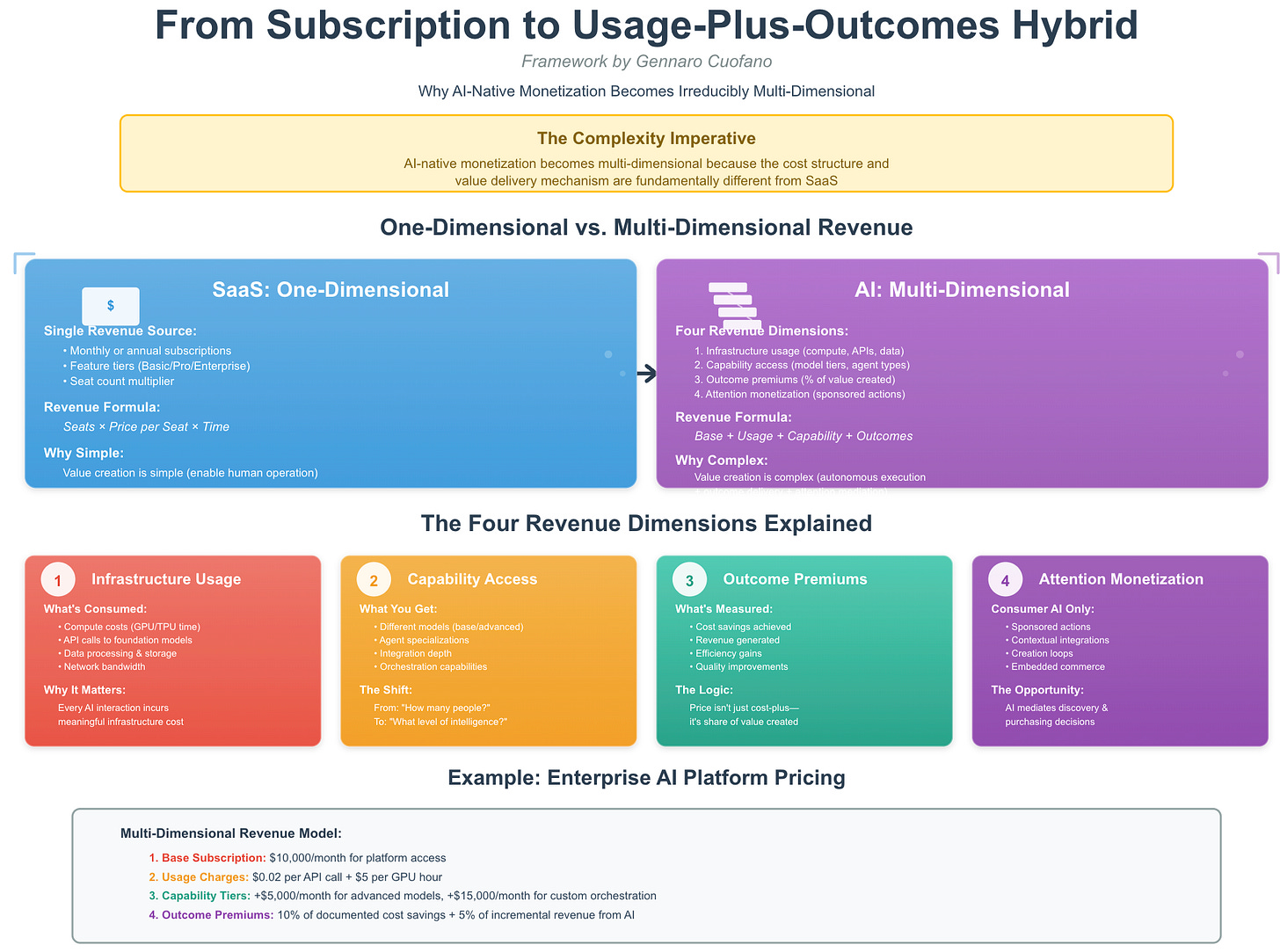

2. From Subscription to Usage-Plus-Outcomes Hybrid

The SaaS Monetization Simplicity

SaaS monetization achieved elegance through simplicity:

Monthly or annual subscriptions

Feature-based tiers (Basic, Professional, Enterprise)

Seat counts per tier

Predictable revenue per customer

A customer on the Professional plan with 50 seats paid the same amount every month. The customer’s actual usage—whether they logged in once per week or used every feature daily—didn’t materially impact the company’s costs or the customer’s bill.

This simplicity was a competitive advantage. Sales teams could quote prices instantly. Finance teams could project revenue with accuracy. Investors could model business growth with confidence.

The AI Complexity Imperative

AI-native monetization becomes irreducibly multidimensional because the cost structure and value-delivery mechanism are fundamentally different.

Dimension 1: Infrastructure Usage

AI systems consume real resources with every interaction:

Compute costs (GPU/TPU time)

API calls to foundation models

Data processing and storage

Network bandwidth for agent coordination

Unlike SaaS, where adding another user had near-zero marginal cost, every AI interaction incurs meaningful infrastructure expense. The cost base scales with utilization, not just with customer count.

This creates the first pricing dimension: usage-based charging for resource consumption. Similar to AWS charging for compute hours or API calls, AI-native companies must recover variable infrastructure costs.

Dimension 2: Capability Access

Not all AI capabilities are equal. Different models, different agent specializations, different integration depths require different investments and deliver different value.

This creates the second pricing dimension: capability tiers analogous to SaaS feature tiers, but fundamentally different in structure.

Instead of:

Basic: 5 users, core features

Professional: 25 users, advanced features

Enterprise: Unlimited users, premium features

AI-native tiers become:

Foundation: Access to base models, standard agents, public API integrations

Advanced: Specialized models, custom agents, enterprise system integration

Enterprise: Proprietary fine-tuning, multi-agent orchestration, dedicated infrastructure

The economic unit shifts from “how many people get access” to “what level of intelligence and capability do you need.”

Dimension 3: Outcome Delivery

The third dimension—outcome-based premiums—captures value in a way SaaS never could.

A company using an AI procurement agent that saves $2M annually isn’t just consuming compute resources and accessing capabilities—it’s receiving measurable business outcomes. The fair price isn’t just “cost-plus margin on infrastructure” or “subscription fee for capability access”—it’s “share of value created.”

This creates outcome-based premiums: additional charges for achieved results. Cost savings, revenue generation, efficiency gains, quality improvements—these become monetizable outcomes beyond infrastructure and capability costs.

Dimension 4: Attention Monetization (Consumer AI)

For consumer-facing AI, a fourth dimension emerges: attention-based monetization.

When AI becomes the interface through which people discover, evaluate, and purchase—when AI agents recommend products, broker services, create content—new monetization mechanisms become possible:

Sponsored actions (brands paying for AI agent recommendations)

Contextual integrations (embedded commerce within AI interactions)

Creation loops (monetizing AI-generated content)

OpenAI’s projected $77B in non-subscription revenue by 2030 reflects this dimension. The value isn’t in subscription fees for ChatGPT access—it’s in monetizing the attention and decision-making the AI mediates.

The Hybrid Model Necessity

AI-native companies can’t choose one dimension—they must orchestrate all relevant dimensions simultaneously:

Example: Enterprise AI Platform

Base subscription: $10K/month for platform access

Usage charges: $0.02 per API call, $5 per GPU hour

Capability tiers: +$5K/month for advanced models, +$15K/month for custom agent orchestration

Outcome premiums: 10% of documented cost savings, 5% of incremental revenue attributed to AI recommendations

This complexity isn’t a bug—it’s an accurate representation of a multi-dimensional value-creation mechanism. SaaS monetization was simple because SaaS value creation was simple (enabling human operation). AI monetization is complex because AI value creation is complex (autonomous execution, outcome delivery, and attention mediation).

3. From Software Margins to Infrastructure Economics

The SaaS Economic Dream

SaaS achieved the holy grail of software economics: near-zero marginal cost per customer.

After initial development investment, a SaaS company could scale from 1,000 to 100,000 customers with minimal incremental infrastructure cost. The software ran on shared infrastructure. Adding another customer meant adding another database entry, not provisioning significant new resources.

The unit economics were extraordinary:

Develop once, sell infinitely

Fixed costs (development, hosting) spread across growing customer base

Gross margins exceeding 80%

Operating leverage that improved with scale

This is why SaaS became the dominant software model. The economics were unmatched. Revenue scaled faster than costs. Profitability was a mathematical inevitability at scale.

The AI Economic Reality

AI returns software to infrastructure economics—and the implications cascade through every aspect of business model design.

Marginal Cost Becomes Meaningful Again

Each AI interaction consumes real resources:

A complex agent orchestration might cost $0.50-$2.00 in compute

A sophisticated reasoning chain could require 10-50 API calls to foundation models

Real-time learning and adaptation requires continuous model updates and data processing

Unlike SaaS, where customer #10,000 costs almost nothing more than customer #9,999, customer #10,000 in AI-native systems incurs meaningful variable costs. The cost structure looks more like AWS (infrastructure provider) than Salesforce (software vendor).

Why This Changes Everything

Infrastructure economics force different strategic choices:

1. Pricing Must Recover Variable Costs SaaS could profitably charge $50/user/month because marginal costs were negligible. AI-native companies must price to recover meaningful compute costs per interaction, fundamentally changing the economics of low-priced offerings.

2. Scale Doesn’t Automatically Equal Profitability In SaaS, scale almost always improved unit economics—more customers spreading fixed costs. In AI-native businesses, scale can worsen unit economics if usage grows faster than efficiency improvements.

3. Gross Margins Compress SaaS gross margins of 80%+ are replaced by AI-native margins of 50-70% (similar to cloud infrastructure providers). The economic profile changes from software to infrastructure.

4. Capital Requirements Increase SaaS companies could scale with relatively modest capital—development teams and sales organizations. AI-native companies require continuous infrastructure investment: compute clusters, model training, data pipelines. The capital intensity resembles infrastructure businesses more than software businesses.

The Hybrid Model Emergence

The winners in AI aren’t pure-play startups trying to achieve software margins with infrastructure costs—they’re established platforms that can leverage existing customer bases and infrastructure investments.

Microsoft’s Hybrid Strategy: Microsoft embeds AI across Office 365 (300+ million users), prices Copilot separately ($30/user/month) but requires E3/E5 subscriptions ($20-$57/user/month base). The economics work because:

Existing subscription revenue covers baseline infrastructure

Copilot pricing recovers incremental AI compute costs

Enterprise customers already committed to platform

Infrastructure costs amortized across massive user base

Google’s Infrastructure Advantage: Google integrates AI capabilities into Workspace while leveraging the world’s largest AI infrastructure investment. The company can afford AI economics because it controls the infrastructure layer and amortizes costs across search, cloud, ads, and workspace products.

Anthropic’s Composite Model: Anthropic combines enterprise subscriptions (predictable base revenue), API usage pricing (variable cost recovery), and compute-sharing models (efficiency through resource pooling). The business model reflects the reality that AI requires diverse revenue streams to sustain infrastructure costs.

The Pattern: Companies winning in AI aren’t pure SaaS players adding AI features—they’re infrastructure platforms embedding intelligence. They have the capital, the customer base, and the infrastructure leverage to make AI economics work.

The Strategic Implications

For Incumbents: Adapt or Die

Existing SaaS companies face a brutal choice: transform their business models or become progressively irrelevant.

The Three Paths:

Path 1: Full Transformation (High Risk, High Reward) Completely rebuild from SaaS to AI-native architecture. Abandon seat-based pricing, embrace outcome-based models, invest in infrastructure. Few companies can execute this successfully—it requires cannibalizing existing revenue while building new capabilities.

Path 2: Hybrid Evolution (Moderate Risk, Moderate Reward) Maintain core SaaS business while building AI-native offerings alongside. Charge differently for AI capabilities, experiment with outcome-based pricing in new product lines, gradually shift customer expectations. This is Microsoft’s path—maximize existing Office 365 revenue while building Copilot as new revenue stream.

Path 3: Niche Defense (Low Risk, Declining Reward) Double down on workflows where human operation remains superior, defend against AI encroachment in current markets, accept declining relevance in broader market. This is viable for specialized tools in regulated industries or contexts where human judgment is legally required, but addressable market shrinks over time.

The Trap to Avoid: The failure mode is adding “AI features” to existing SaaS products while maintaining seat-based pricing and subscription models. This creates the worst of both worlds: AI costs (variable, infrastructure-intensive) without AI monetization (outcome-based, value-aligned). Unit economics deteriorate. Customers don’t pay more because they don’t perceive qualitatively different value.

For Startups: Build for AI-Native Economics from Day One

New companies have a massive advantage: no legacy business model to protect.

The Design Principles:

1. Infrastructure-First Architecture Build on the assumption that every interaction incurs meaningful compute cost. Design systems that can scale compute usage gracefully, implement caching and optimization aggressively, price from the beginning to recover infrastructure costs.

2. Multi-Dimensional Monetization Don’t pick one model (subscription vs. usage vs. outcome). Build the billing and product analytics infrastructure to support all three simultaneously. Instrument systems to measure outcomes, not just usage. Create pricing frameworks that evolve with customer value delivery.

3. Outcome Measurement as Core Product If you’re pricing on outcomes, outcome measurement can’t be an afterthought—it must be a core product capability. Build dashboards that show cost savings, efficiency gains, revenue attribution. Make outcome delivery visible and measurable from day one.

4. Capital Efficiency in Infrastructure Unlike SaaS, where infrastructure costs scaled slowly, AI infrastructure costs can grow faster than revenue in early stages. Design for infrastructure efficiency: model compression, intelligent caching, compute sharing, tiered processing (fast models for simple queries, expensive models only when needed).

For Investors: Understand Different Unit Economics

AI-native companies require different evaluation frameworks than SaaS.

The Metrics That Matter:

Traditional SaaS Metrics (Less Relevant):

ARR per employee (infrastructure-intensive businesses require more people)

Logo retention (less meaningful when pricing is outcome-based)

Seat expansion (seats aren’t the economic unit)

AI-Native Metrics (Critical):

Gross margin profile (should be 50-70%, not 80%+)

Compute efficiency trajectory (costs per outcome should decline over time)

Outcome delivery consistency (can the company reliably deliver measurable value?)

Infrastructure leverage ratio (revenue per dollar of infrastructure investment)

Pricing power in outcome-based models (can the company capture fair share of value created?)

The Capital Question: AI-native companies require more capital than equivalent SaaS businesses because infrastructure costs are meaningful. But they shouldn’t require as much capital as pure infrastructure businesses because intelligence creates leverage. The sweet spot is companies that combine infrastructure investment with continuous efficiency improvement through model optimization and architectural innovation.

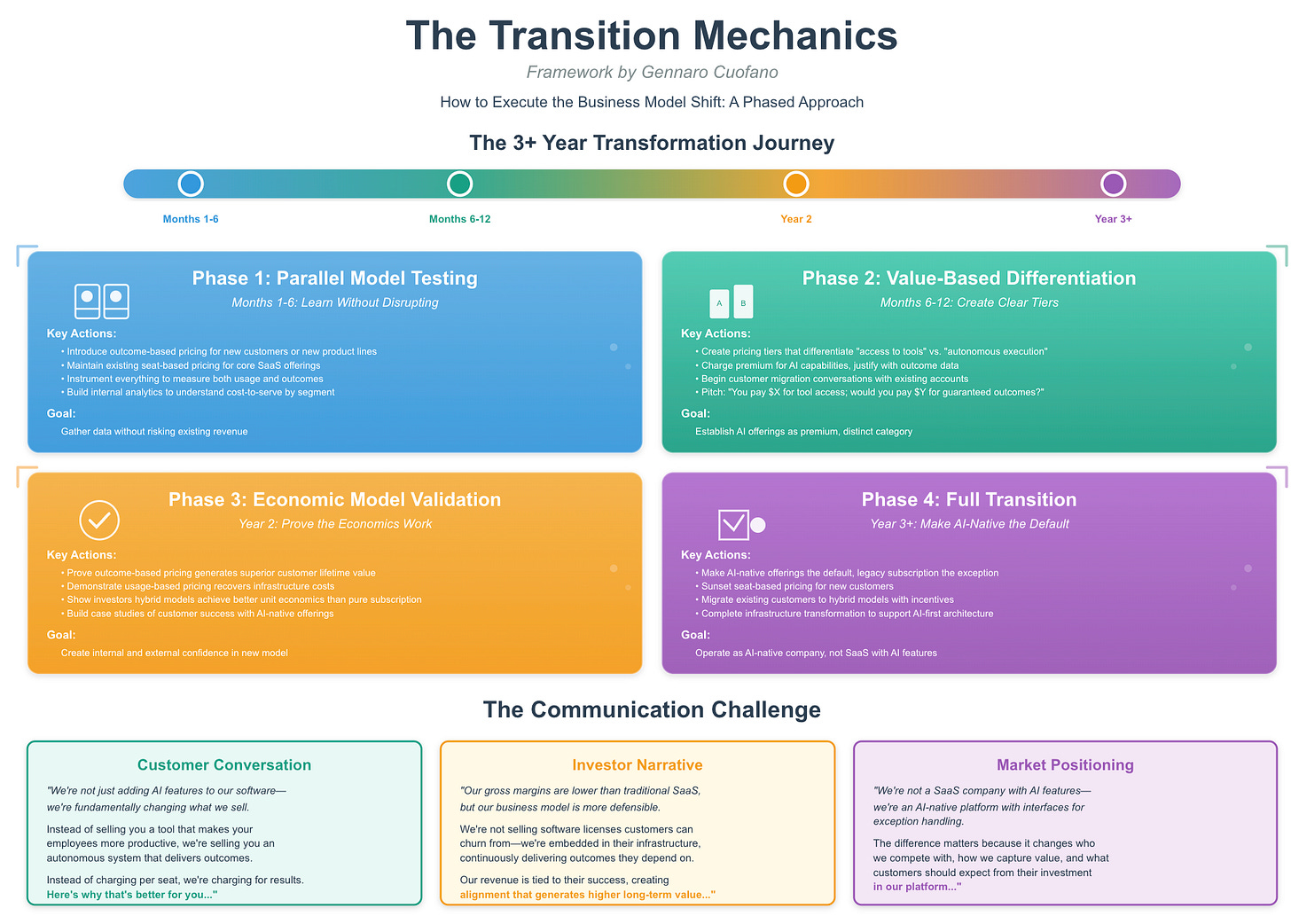

The Transition Mechanics

How to Execute the Business Model Shift

Transformation isn’t abstract strategy—it requires specific execution steps.

Phase 1: Parallel Model Testing (Months 1-6)

Introduce outcome-based pricing for new customers or new product lines

Maintain existing seat-based pricing for core SaaS offerings

Instrument everything to measure both usage and outcomes

Build internal analytics to understand cost-to-serve for different customer segments

Phase 2: Value-Based Differentiation (Months 6-12)

Create pricing tiers that explicitly differentiate between “access to tools” (SaaS legacy) and “autonomous execution” (AI-native)

Charge more for AI capabilities, justify with outcome data

Begin customer migration conversations: “You’re paying $X for tool access; would you pay $Y for guaranteed outcomes?”

Phase 3: Economic Model Validation (Year 2)

Prove that outcome-based pricing generates superior customer lifetime value

Demonstrate that usage-based pricing recovers infrastructure costs

Show investors that hybrid models achieve better unit economics than pure subscription

Build case studies of customer success with AI-native offerings

Phase 4: Full Transition (Year 3+)

Make AI-native offerings the default, legacy subscription the exception

Sunset seat-based pricing for new customers

Migrate existing customers to hybrid models with incentives

Complete infrastructure transformation to support AI-first architecture

The Communication Challenge

Business model transformation requires customer education and market repositioning.

The Customer Conversation: “We’re not just adding AI features to our software—we’re fundamentally changing what we sell. Instead of selling you a tool that makes your employees more productive, we’re selling you an autonomous system that delivers outcomes. Instead of charging per seat, we’re charging for results. Here’s why that’s better for you...”

The Investor Narrative: “Our gross margins are lower than traditional SaaS, but our business model is defensible in a way SaaS never was. We’re not selling software licenses that customers can churn from—we’re embedded in their infrastructure, continuously delivering outcomes they depend on. Our revenue is tied to their success, creating alignment that generates higher long-term value...”

The Market Positioning: “We’re not a SaaS company with AI features—we’re an AI-native platform that happens to have a web interface for exception handling. The difference matters because it changes who we compete with, how we capture value, and what customers should expect from their investment in our platform...”

The Business Model Transformation is the Transformation

The shift from SaaS to AI-native isn’t primarily a technology transformation—it’s a business model transformation that happens to require new technology.

Companies that treat AI as “better features” while maintaining SaaS economics will fail. The unit economics don’t work. The value proposition doesn’t align. The customer expectations diverge from what the product delivers.

Companies that embrace AI-native business models—outcome-based pricing, usage-plus-outcomes hybrid monetization, infrastructure economics—position themselves to capture the full value of autonomous intelligence.

The winners won’t be the companies with the best AI models (models become commodities). They won’t be the companies with the most features (features become irrelevant when AI executes autonomously). They’ll be the companies that figure out how to align their business model with AI’s actual value creation mechanism: autonomous execution of outcomes at scale.

The business model shift isn’t a consequence of the technology shift—it’s the same shift, viewed from a different angle. Embedding AI in infrastructure rather than surfacing it in applications requires charging for outcomes rather than seats, adopting usage-based pricing rather than flat subscriptions, accepting infrastructure margins rather than software margins.

This transformation is already underway. The question isn’t whether it will happen—it’s whether your company will lead it, follow it, or be destroyed by it.

Recap: In This Issue!

AI Breaks the Core Economic Assumption of SaaS

SaaS monetization is built on humans operating interfaces.

AI agents don’t use interfaces, don’t occupy seats, and don’t require dashboards.

This removes the unit that SaaS monetizes: the seat.

When AI executes work autonomously, the SaaS pricing model collapses.

Value Capture Shifts From “Access to Tools” to “Outcomes Delivered”

AI-native value is measured in tickets resolved, revenue generated, costs reduced, not user logins.

Klarna, Sierra, ServiceNow already price based on outcomes, not seats.

AI creates value like a workforce, not like software.

The monetization unit becomes task, transaction, or business result.

AI-Native Pricing Requires a Multi-Dimensional Hybrid Model

AI forces monetization across three layers simultaneously:

Usage-based (compute, tokens, GPU hours).

Capability-based (model class, agent sophistication, orchestration depth).

Outcome-based (value capture: cost savings, revenue lift, efficiency gains).

SaaS’s single-variable pricing cannot support AI’s variable cost base.

Margins Shift From Software Economics to Infrastructure Economics

SaaS: 80–90 percent gross margins; near-zero marginal cost.

AI-native: 50–70 percent margins; every action consumes compute.

Scale increases usage, not efficiency.

Companies adding AI into SaaS models face margin compression and deteriorating unit economics.

The Strategic Crisis for SaaS Companies

Adding “AI features” while keeping seat pricing creates a structural mismatch:

AI costs scale; SaaS revenue doesn’t.Companies that fail to realign pricing will absorb compute costs without capturing AI value.

The legacy model becomes a trap.

The New Growth Blueprint: Embed → Wrap → Migrate → Replace

A four-phase transition pattern is emerging:

Embed AI in infrastructure.

Wrap existing SaaS with agents via APIs.

Migrate business logic from applications into AI.

Replace SaaS with thin orchestration layers.

This is a multi-year architectural and economic transition.

Partnership Models Shift From Integration to Agent Composition

SaaS integrations: “Connect app A to app B.”

AI-native ecosystems: “Agents coordinate across systems to deliver business outcomes.”

Value moves from data sharing to capability orchestration.

Startups Have the Advantage — Incumbents Face Cannibalization

Startups:

No legacy pricing model to protect.

Can design outcome-based and usage-based monetization from day one.

Build architecture around compute efficiency and outcome measurement.

Incumbents:

Must transform the revenue model while protecting existing cash flows.

Must educate customers on outcome-based value.

Must rebuild infrastructure and reprice capabilities without eroding margins.

AI-Native Metrics Replace SaaS Metrics

Relevant KPIs shift from SaaS norms to infrastructure economics:

Gross margin on AI workloads

Compute cost per outcome

Efficiency gains over time

Infrastructure leverage ratio

Outcome consistency and attribution

ARR, seat expansion, logo churn become less predictive of durability.

The Strategic Endgame

AI-native winners are those who:

Embed intelligence at the infrastructure layer

Capture value through outcomes, not access

Build economic models aligned with compute reality

Design multi-dimensional monetization frameworks

Deliver measurable business impact rather than interface-driven usage

The core insight:

AI-native business models are not an adaptation of SaaS. They replace SaaS.

The companies that understand the economic shift—not just the technical one—will define the next enterprise era.

With massive ♥️ Gennaro Cuofano, The Business Engineer