Tech Business Models Book

Within the Business Engineering discipline, I put together a framework to understand the critical components of a tech company.

This framework has turned into a book, in which I analyzed what makes tech business models thick and how you can have the same model of the business world! To access it subscribe to the newsletter!

If you have already a premium plan, please ping me back and I’ll provide access!

VTDF Business Model Template

Keep reading if you want to understand how to use the framework.

Value model

It usually all starts with a value model which comprises:

An opportunity: the size of the opportunity will be determined by whether the market exists, whether it's still building up, and its growth potential. From the opportunity, it's possible to evaluate the potential market size (tech companies usually look at TAM).

A problem to be solved: a problem can be practical or go beyond that. Companies like Nike and Coca-Cola focus most of their efforts on demand generation. This also applies to tech business models. Before the iPhone, people didn't know they needed a smartphone in the first place.

A set of value propositions: a company will develop a core value proposition from the above. As it scales, it will be able to satisfy a set of value propositions, which are the glue that keeps together customers and the company.

Mission and vision: as the company develops its various models, it also develops its core beliefs, comprising its mission and vision.

Technological Model & R&D Management

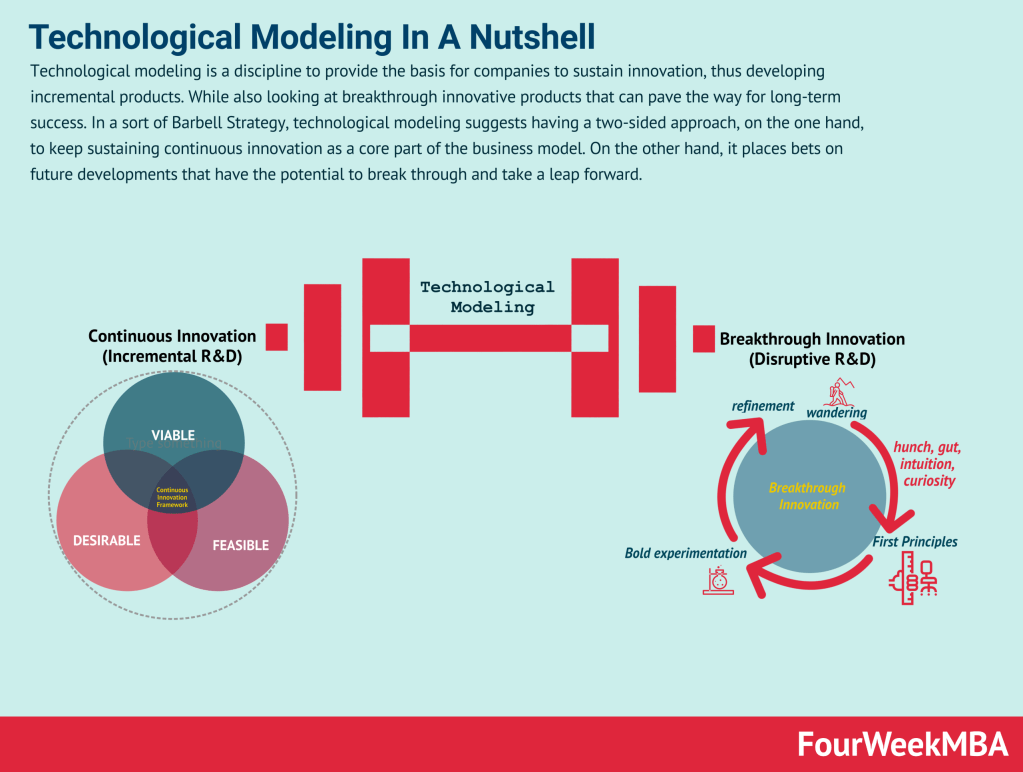

Technological modeling is a discipline that provides the basis for companies to sustain innovation, thus developing incremental products.

While looking at breakthrough innovative products that can pave the way for long-term success.

In a sort of Barbell strategy, technological modeling suggests having a two-sided approach, on the one hand, to sustain continuous innovation as a core part of the business model.

On the other hand, it places bets on future developments that have the potential to break through and take a leap forward.

Continuous Innovation: How do we handle engineering resources to sustain continuous innovation for business model expansion?

The technological model is the enhancer of the product, and it helps merge together the value proposition with the distribution model.

When engineering is done right, it helps bridge the gap between what customers still miss, the product, and the way the product is distributed.

The technological model will help satisfy the need of a larger and larger portion of the market, from early adopters to potential laggards. This will determine the ability of the company to scale up.

In his book Crossing the Chasm, Geoffrey A. Moore shows a model that dissects and represents the stages of adoption of high-tech products.

The model goes through five stages based on the psychographic features of customers at each stage: innovators, early adopters, early majority, late majority, and laggards.

In the technological model, the way R&D is managed to produce continuous innovation (to sustain the linear growth of the business) and breakthrough innovation (to enable the long-term success of the business) is critical.

On the other hand of the technological spectrum, you also ask:

Breakthrough Innovation: How do we handle engineering resources and look into very unusual (first-principle-based) solutions which might open up a whole new business model?

In other words, you handle continuous innovation in a path that leads toward the use of resources in a more linear manner.

You also need to balance this out with some aggressive bets on the future that move non-linearly and which might be the ones that make your business model obsolete in the foreseeable future.

Placing these bets is critical to ensure you might have a sense of when your business model is becoming obsolete.

You might say, "why do I want to do that?" Well, because if you don't do that, someone else on the market will do that.

So better to take the chances (in the future) to kill your own business model and yet open the way to new incredible opportunities, or someone else will simply do that for you!

For the sake of it, it's always crucial to leave some pockets of breakthrough innovation (10-20% of the company's resources toward this goal!).

Distribution Model

Distribution, Marketing & Sales: How do we reach, frame, communicate, fulfill and sell the product to the right audience?

The distribution model helps to bring the product into the hands of customers.

The company can leverage engineering, marketing, sales or all of them to make the product fit with the market via its distribution.

That is why, based on what problems the product solves and for whom, it will have an organizational structure more skewed toward engineering and marketing, engineering and sales, or perhaps a mix of the three.

Other things like partnerships and deal-making are also part of the distribution model.

Financial model

Financial Model: How does the company make, and spend money? Is it profitable? And how does it manage its cash for future growth?

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity).

For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.

The financial model is what enables the company to keep generating enough cash to sustain its operations, not only in the short-term but also toward R&D and innovation.

And it is made of several components:

Revenue model.

Cost structure.

Profitability.

And cash generation and management.

Revenue model

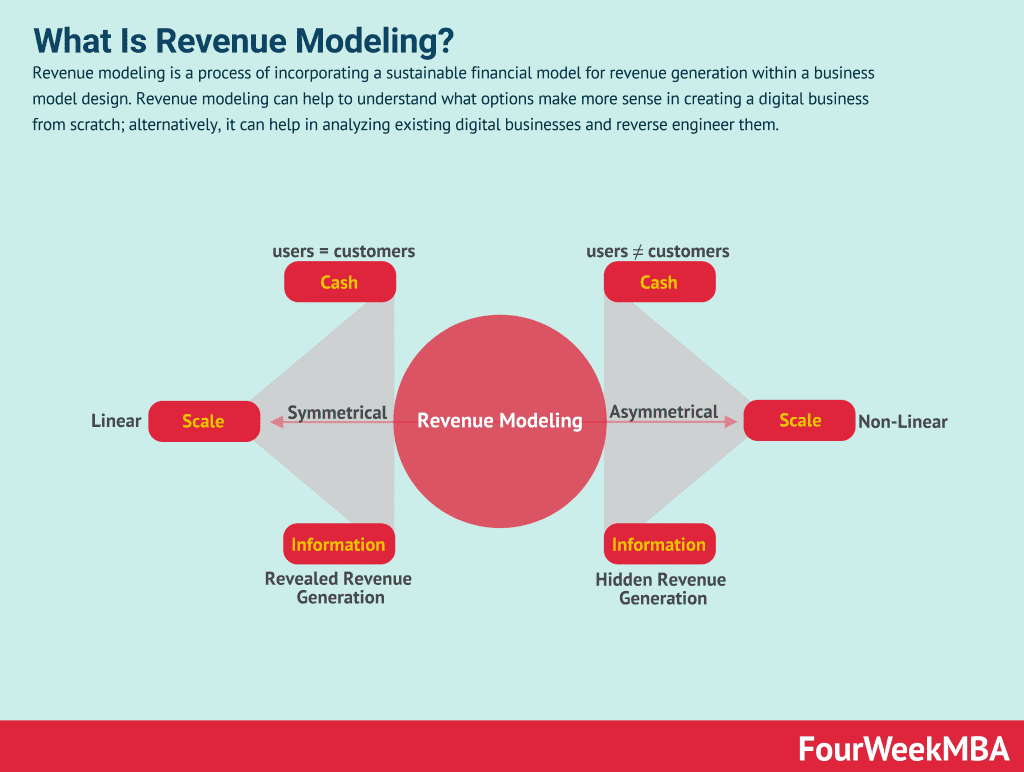

Revenue modeling is a process of incorporating a sustainable financial model for revenue generation within a business model design.

Revenue modeling can help to understand what options make more sense in creating a digital business from scratch; alternatively, it can help in analyzing existing digital businesses and reverse engineer them.

Cost structure

The cost structure is one of the building blocks of a business model. It represents how companies spend most of their resources to keep generating demand for their products and services.

The cost structure together with revenue streams, help assess the operational scalability of an organization.

Profitability

From how the company generates revenues and its cost structure, profitability will be determined.

When the revenue model isn't yet efficient enough to cover up or sustain the cost structure in the long-term, there is when we have a lack of profitability.

At the same time, it might happen that a company is profitable but it lacks cash, given its overall financial model.

Or it might happen that a company has no profits, or very tight margins and yet it generates a continuous stream of cash.

That is why it's critical to look at the next element.

Cash generation and management

The cash flow statement is the third main financial statement, together with the income statement and the balance sheet.

It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing, and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.

Profitability doesn't tell us the whole story.

We need to look at cash management. A company like Amazon have been running at very tight profit margins for years, and yet generating massive amounts of cash, invested back in its operations.

A company like Netflix has been generating good profit margins, but running with a cash negative model.

This isn't good or bad in absolute, but it gives us an understanding of the company's financial mode.

Perhaps, Netflix, with a negative cash flow model, it has been investing substantial cash in the development of original shows, which are both critical to generate revenue and also essential to its brand's strategy.

Thus, revenue generation, distribution, and marketing come together here.

Below is one of our master books: Tech Business Models.

To access the book, subscribe to the paid yearly plan!

If you have already a premium plan, please ping me back and I’ll provide access!

Ciao!

With ♥️ Gennaro, FourWeekMBA