The State of AI Venture Capital

Premium Analysis

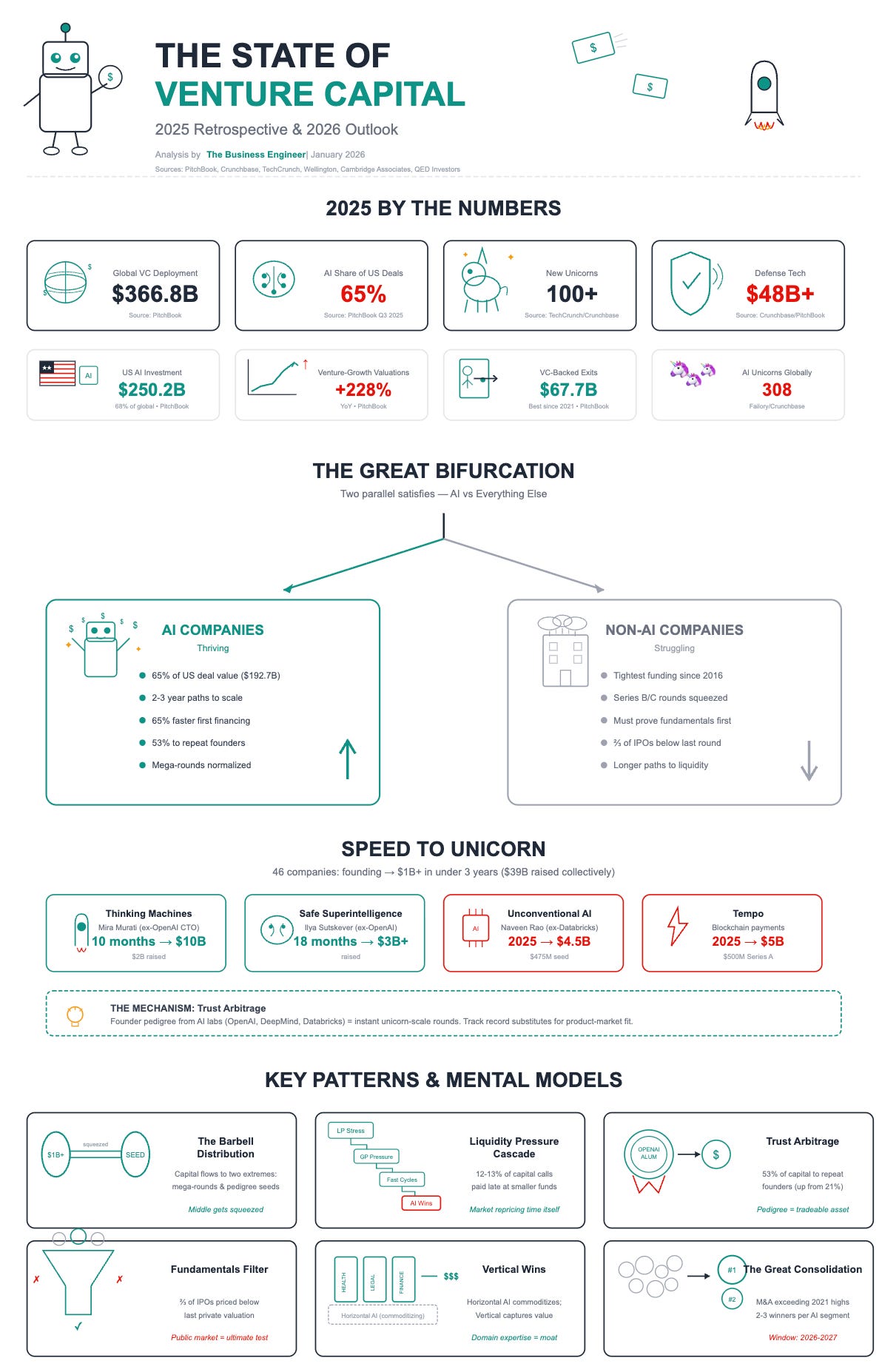

2025 marked a structural transformation in venture capital: AI captured 65% of US deal value (up from 35% in 2023), defense tech emerged as VC’s second mega-category with $48B+ deployed, and the market bifurcated sharply between AI and non-AI companies.

More than 100 new unicorns were minted, with 46 companies going from founding to $1B+ valuation in under three years.

The mechanism: compressed time-to-scale in AI combined with LP pressure for liquidity created a structural preference for fast-cycle investments. 2026 brings continued AI dominance, the reopening of the IPO window (68 projected IPOs), and a “fundamentals-first” filter that will separate durable platforms from transient ones.