This Week In AI Business #52

It was another interesting week in AI Business, with some significant shifts as 2024 ends.

Interestingly, rather than waiting for the new year before making some bold, strategic moves, most AI players are taking action now to crystallize their vision before the new year comes. Following along and grasping this vision is critical, as that will define these “AI hyperscalers” strategy for the next 5-10 years.

That’s the fun part of this industry, whereas, in other sectors, you might have to wait for these major developments to come slowly and gradually.

In AI Business, they come wildly, and it is almost as if there is no logic to it when a lot of underlying structure is developing.

I look for the developing underlying structure that sits under the surface. Where others might see buzz, we want to take the news that matters the most as the key data point driving the development of this new structure and strategic landscape.

For 2025, it seems (based on the bold moves hyperscalers are making) that things are solidifying in three main directions:

Ecosystem Transformation, from competition to coopetition

Companies are restructuring their products, partnerships, and strategies to embed AI as a core component across ecosystems. From Microsoft rebranding to Google integrating AI across hardware and software, this trend signals a foundational shift where the competitive landscape is getting clearer. We started with a more fixed landscape, defined by a few major partnerships among big tech and AI research labs (e.g., Google-DeepMind, Microsoft-OpenAI, Amazon-Anthropic), and we moved to a much more fluid one, as we speak, where “everyone will do business with everyone.” This “competitive” landscape might be the rule for the next 3-5 years, after which we’ll see the emergence of a more defined competitive landscape again, as we’ll get some clear winner-take-all effects in a few enterprise and consumer spaces.AI bridging the gap between Hardware and Software for both Consumer and Enterprise Applications

Before integrating AI with augmented reality (AR), smart glasses, and robotics, we’ll see a transitional phase at scale (AI is eating the real world, but just not yet). The current AI paradigm, driven by world modeling, will finally make it possible to transform the unit of economic production in a way that could not have been foreseen just a few years back in the process of a “cognitive revolution.” In this short term (5-10 years), it might play out by riding existing physical forms (AI integrated into smartphones, AI integrated into existing specialized robots). But, in this decade, while AI will be integrated at scale in these existing form factors, it will also be tested in new, AI-native form factors (AR, brain interfaces, humanoids). This will completely redefine the dynamics of our economic system.Cost down for computing, up for reasoning

We’ll see more and more of the emergence of players capable of pre-training much “smarter” AI models with smaller budgets. This will lower the cost of computing on the pre-training side. With hyperscalers, pushed by much smaller players, to figure out innovative ways to keep scaling these models more cheaply. In addition, we’ll also see the emergence of much more capable yet much smaller models, which will work exceptionally well for specialized tasks. These smaller AI models might become critical as architectural integrations into Agentic AI systems. Yet, and that’s quite a counterintuitive take, if the cost of computing goes down dramatically, the cost of top-tier reasoning is going up dramatically instead. Hyperscalers determine how to make reasoning more accessible and advanced for as many people as possible. Things will get quite expensive in this transitional phase for much more advanced forms of reasoning. Thus, enterprise players can now leverage the top tier of reasoning.

Let’s see them in detail.

Goodbye, Microsoft 365. Hurrah, Microsoft Copilot!

Microsoft is rebranding Microsoft 365 as Microsoft 365 Copilot in January 2025, emphasizing AI integration across its core productivity products.

Key changes include a revamped interface, removing features like “My Day” and “Help Me Create,” and enhanced AI tools such as Copilot Chat for document creation.

The organization logo and “Back” button will be removed.

This signals a core integration of AI across all of Microsoft’s products. That is coming as Microsoft tries to redefine its partnership with OpenAI.

The end of the Honeymoon between OpenAI and Microsoft?

The Microsoft-OpenAI partnership is maturing into something else.

A reminder that Microsoft has placed over $13 billion in OpenAI’s partnership, which gave the tech giant some key advantages.

From privileged, early access to the tech produced by OpenAI to the exclusive commercial right to distribute that before anyone else.

As Reuters reported, 2024 might also be the end of the exclusive distribution of OpenAI into Microsoft. Microsoft is diversifying 365 Copilot’s AI models, reducing reliance on OpenAI due to cost and speed concerns.

The company integrates homegrown models like Phi-4 and customizes open-weight alternatives for efficiency.

While adoption accelerates, many enterprises remain in pilot stages, highlighting the challenges in creating a long-term commercial use case within the Fortune 500.

Why does it matter as of now?

Well, as OpenAI is figuring out a transition into a for-profit, that will also pose some challenges to the partnership, as they’ll need to figure out how to structure the for-profit partnership.

Transitioning a non-profit structure into a for-profit isn’t that simple to pull off, as there are fiscal and legal complications.

Outside, you must also ensure agreement from those who have poured money into the non-profit on what might define the for-profit partnership.

Considering that OpenAI’s mission has started as an AGI company, sharing its research openly.

How will this happen?

Let me quickly recap their partnership so you can understand what’s happening there.

Recap: the OpenAI-Microsoft Partnership

Back in June 2016, as OpenAI ramped up its research into generative models, it also explained the goal of what, at the time, was primarily a research lab with a clear mission:

OpenAI’s mission is to build safe AI, and ensure AI’s benefits are as widely and evenly distributed as possible. We’re trying to build AI as part of a larger community, and we want to share our plans and capabilities along the way. We’re also working to solidify our organization’s governance structure and will share our thoughts on that later this year.

Back in 2016, as OpenAI started to ramp up its research on generative models, it became clear those models required substantial computing power.

That is how the partnership with Microsoft came about. This was also the time when OpenAI moved away from a purely non-profit structure to what would be called a “capped-for-profit entity.”

As OpenAI explained, in March 2019, as the creation of the LP came about, "We’ve created OpenAI LP, a new “capped-profit” company that allows us to rapidly increase our investments in compute and talent while including checks and balances to actualize our mission."

That implied the creation of the LP was a way to bring in more capital to scale these models. Yet, while the LP acted as a capped organization (after a certain threshold, any additional revenue generated by OpenAI's generative models would go back to the non-profit organization), for the sake of maintaining the OpenAI LP on track to its mission, the for-profit, capped company is controlled by the OpenAI Nonprofit’s board.

The Non-profit board was initially comprised of LP employees, such as Greg Brockman (Chairman & President), Ilya Sutskever (Chief Scientist), and Sam Altman (CEO). And non-employees Adam D’Angelo (co-founder and CEO of Quora), Reid Hoffman (co-founder of LinkedIn, now owned by Microsoft), Will Hurd, Tasha McCauley, Helen Toner, and Shivon Zilis. Investors in the LP included Microsoft, Reid Hoffman’s charitable foundation, and Khosla Ventures.

Many events have happened in the last couple of years, which reshuffled the nonprofit board, but in short. Now, OpenAI is trying to unravel this messy structure and figure out a for-profit model that could work out in the long run.

OpenAI is turning into a for-profit

As reported by The Information, Sam Altman is working on transitioning OpenAI into a for-profit entity; the trickiest part will be negotiating with Microsoft on a few areas that were the pillars of the partnership.

From commercial exclusivity (OpenAI has to enable Microsoft to have access and release APIs into Azure first, as opposed to anyone else), equity stake, board control, Microsoft Azure cloud deal (for OpenAI pre-training and inference resources), and more.

A key point of contention will be the definition of AGI from an economic standpoint.

Why? Well, that is when OpenAI will be free from commercial obligations toward Microsoft, and indeed, it seems they might have put a $ sign on it.

How much is AGI worth?

As reported by The Information, since OpenAI and Microsoft are working on a deal to enable OpenAI to transition into a for-profit, they are also trying to put a $ on AGI.

In fact, as per their deal, if OpenAI achieves AGI, it will be free from the commercial agreement with Microsoft.

But when is it that achieved?

OpenAI and Microsoft seem to have come to a shared economic definition of AGI: “the point when OpenAI develops AI systems that can generate at least $100 billion in profits.”

2024 is closing with another gripping drama playing out under the hood of OpenAI.

If that wasn't messy enough, OpenAI is also getting into humanoids.

OpenAI into humanoids

OpenAI seems to be getting more serious about directly developing a humanoid.

While the company has been actively investing in humanoid makers like Figure and Physical Intelligence, it seems that now OpenAI is considering building one itself.

While this will not be a core priority of the company, OpenAI is getting at it next.

For context, OpenAI previously shut down its robotics division in 2021 to focus on the core, and back then, it wasn’t getting interesting enough results.

But now, the time seems right for humanoids to become commercially viable.

This initiative is still in its early stages, with limited details available about specific timelines or use cases.

However, OpenAI's involvement in this field reflects its ambition to expand AI applications into physical environments.

Top-tier AI Reasoning is quite expensive (for now)

The most interesting aspect of the coming wave of “Reasoning AI” is that while we might have figured out a new scaling paradigm, for now, it is also coming at impressive computational costs.

Indeed, as reported by TechCrunch, OpenAI’s o3 model, while it demonstrates major advancements in AI scaling with a record 88% on the ARC-AGI test (designed to test more human-like intelligence), also came at extremely high compute costs (the high-scoring o3 comes at $10,000 per computation), making it impractical for everyday use, as of now.

However, advancements in cost-efficient AI inference chips (e.g., Groq, MatX) could help make test-time scaling more economical, improving accessibility for institutions and high-value applications before this would get ready for mainstream adoption.

Search is dying, and Google knows it

The “slow, then sudden” disruption of search is underway, as AI-powered search tools like ChatGPT and Perplexity are disrupting Google’s search dominance, with chatbot referrals growing rapidly in sectors like events and e-commerce.

While AI-driven traffic remains under 1%, it’s projected to hit 20% within a year, posing challenges to Google’s ad model amid regulatory pressures and antitrust scrutiny.

Here are some of the key highlights from an interesting piece from INC:

AI-Powered Search Disrupts Traditional Methods

AI systems like ChatGPT, Perplexity, and Microsoft’s Copilot are emerging as alternatives to traditional search engines.Google's Search Dominance Plateauing

Google's growth in search is stagnating as AI-powered platforms attract more users.Chatbot Referral Traffic Surges in Key Sectors

Sectors like events, e-commerce, and finance saw exponential growth in website traffic driven by AI chatbots.Low Current Impact, High Future Potential

Chatbots account for less than 1% of current website traffic but could reach 20% within a year.Disruption to Online Advertising Models

Declining reliance on traditional search could force a shift in search ad strategies and SEO practices.Google Faces Antitrust Pressure

Google proposes remedies to address DoJ concerns, including opening its platforms to multiple default search providers.Rising Competition in AI Search

AI-driven search platforms like Perplexity are gaining traction, challenging Google's ecosystem.Potential Reshaping of Marketing Strategies

Businesses may need to adapt to AI-driven ecosystems as chatbot use grows.Google's Cautious Integration of AI

Google tempers its AI search rollout to avoid alienating marketers while addressing competitive threats.Changing Dynamics in Online Information Retrieval

The shift to AI-powered search reflects broader changes in how users access and interact with digital information.

Google knows the above extremely well, as CEO Sundar Pichai reportedly told Google employees that 2025 will be a “critical” year for the company:

I think 2025 will be critical,

Pichai said:

I think it’s really important we internalize the urgency of this moment, and need to move faster as a company. The stakes are high.

Pichai also emphasized:

we have some work to do in 2025 to close the gap and establish a leadership position there as well.

And he closed up with:

Scaling Gemini on the consumer side will be our biggest focus next year.

That connects to another point: a key mistake Google is making. Gemini is based on a new paradigm: universally accessible intelligence rather than universally accessible information.

And yet, in the pressure to keep up, Google is making the mistake of trying to integrate the new paradigm into the core of its search product.

As I’ll show you below, that won’t work, if at all; it might be a patch at best or even speed up the decline of Google's core search business at worst.

A Google AI Mode?

Google plans to implement AI more aggressively in search via an AI Mode Option, which would turn Google Search into a Gemini AI-like Assistant.

The move might come as competition intensifies, and Google’s AI overviews might not be enough to prevent consumer disruption.

AI chat interfaces like Perplexity AI and ChatGPT Web Search.

If it confirms that might be the riskiest and boldest move from Google, in 30 years, on its core product.

This might make publishers even more unhappy, with Google, thus we might expect many of those, jumping boat, with other players, like OpenAI.

Integrating Generative AI into Google-like search is a patch that might make Google’s search decline even faster, as integrating AI advanced features into Google search will imply that Google will kill its own ecosystem.

That’s the quandary there! And there is no way out…

We moved from a paradigm where you had Google working on making information universally accessible. To a new paradigm, where it’s not information, but intelligence, which is made universally accessible.

OpenAI winning publishers

A key element of Google’s business model - what made it thick over the years - was its strong publishing ecosystem, which was the foundation to feed both Google’s indexing machine and generate revenue on the AdSense network.

That worked quite well for over twenty years.

Yet, AI Chatbots haven’t just eroded Google’s organic capabilities - as a growing chunk of the informational and real-time queries are going through these AI chatbots - but it has also forced Google to implement further more aggressive AI features in search (like AI overviews) which have further eroded the publishing ecosystem trust.

Thus, it’s not surprising to me, at this stage, that publishers are going all in on content licensing with OpenAI.

If OpenAI managed to strike right into the leg of Google’s business model, which made it thick for 30 years, that might be the beginning of the end.

However, as it happens, Google won’t just sit there looking at it, as in a post-Google world, the parent company, Alphabet, will need to redefine itself.

Google's breathtaking roadmap

The impressive timeline of Google releases in 2024 points toward some key directions for 2025, which gives us a glimpse into Google’s AI strategy as we go into next year. I’ve summarized some of these directions below:

Iterative Innovation: Regular upgrades to core products (e.g., Gemini 1.5 to Gemini 2.0) focus on continuous improvement and refinement.

Holistic Ecosystem Integration: AI features embedded across devices and platforms (Pixel, Android, Chrome, Workspace) for a seamless experience.

Generative AI Expansion: Strong emphasis on creative AI tools (ImageFX, MusicFX), productivity enhancements, and health applications.

Multimodal AI Development: AI models like Gemini integrate text, images, audio, and video for diverse and flexible applications.

User-Centric AI: Focus on tools like Circle to Search and AI shopping assistants that enhance accessibility and everyday usability.

Developer Enablement: APIs, toolkits, and resources designed to empower developers to build with AI more efficiently.

Consumer-First AI Products: AI-powered Search, Shopping, and Workspace features prioritize personalization and interactivity.

AI-Powered Hardware Integration: AI is deeply embedded in hardware products like Pixel phones, smart home devices, and XR headsets.

Agentic AI Focus: Gemini 2.0’s transition to agentic AI reflects a shift toward autonomous, context-aware systems.

Within these moves, hitting the jackpot of a potential AR device might be the key element of the whole strategy.

What might be the next Google consumer breakthrough?

Google ready to launch an AR Device

The fact that Google might be getting ready with a smart glasses release in 2025 also seems clear from the hiring ramp-up the company has been pushing this year, as it hired more than 100 staffers at AR firm Magic Leap.

The arrangement with Magic Leap will help Google work in parallel on underlying AI assistant, operating system, and hardware device for the next AR race, especially vs. Meta, which is trying to establish itself as the top player there.

Of course, Apple will be a giant if it successfully transitions from the iPhone to a successful AR device.

And if it’s unclear, Project Astra, on that device, will be the underlying AI assistant powering up future models of Google’s smart glasses.

In short, it all seems ready for a launch in 2025.

That might also explain the closing gap between Google and Microsoft regarding valuation.

The Google-Microsoft “AI Divide” is over

The “AI Divide” between Microsoft and Google (Alphabet) stocks just closed up, with Alphabet getting the upper hand.

As a reminder, almost two years back, in January 2023, as OpenAI had launched ChatGPT just a couple of months before, the Microsoft-OpenAI partnership propelled Microsoft into a stock run, which created a gap with Google’s stock, which moved in the opposite direction.

That “AI Divide” has closed up after nearly two years, as Google has massively ramped up its AI release pacing with numerous impressive upgrades, signaling an interesting 2025 (see above).

Yet, another giant won’t be sitting there, looking at what’s happening; quite the opposite…

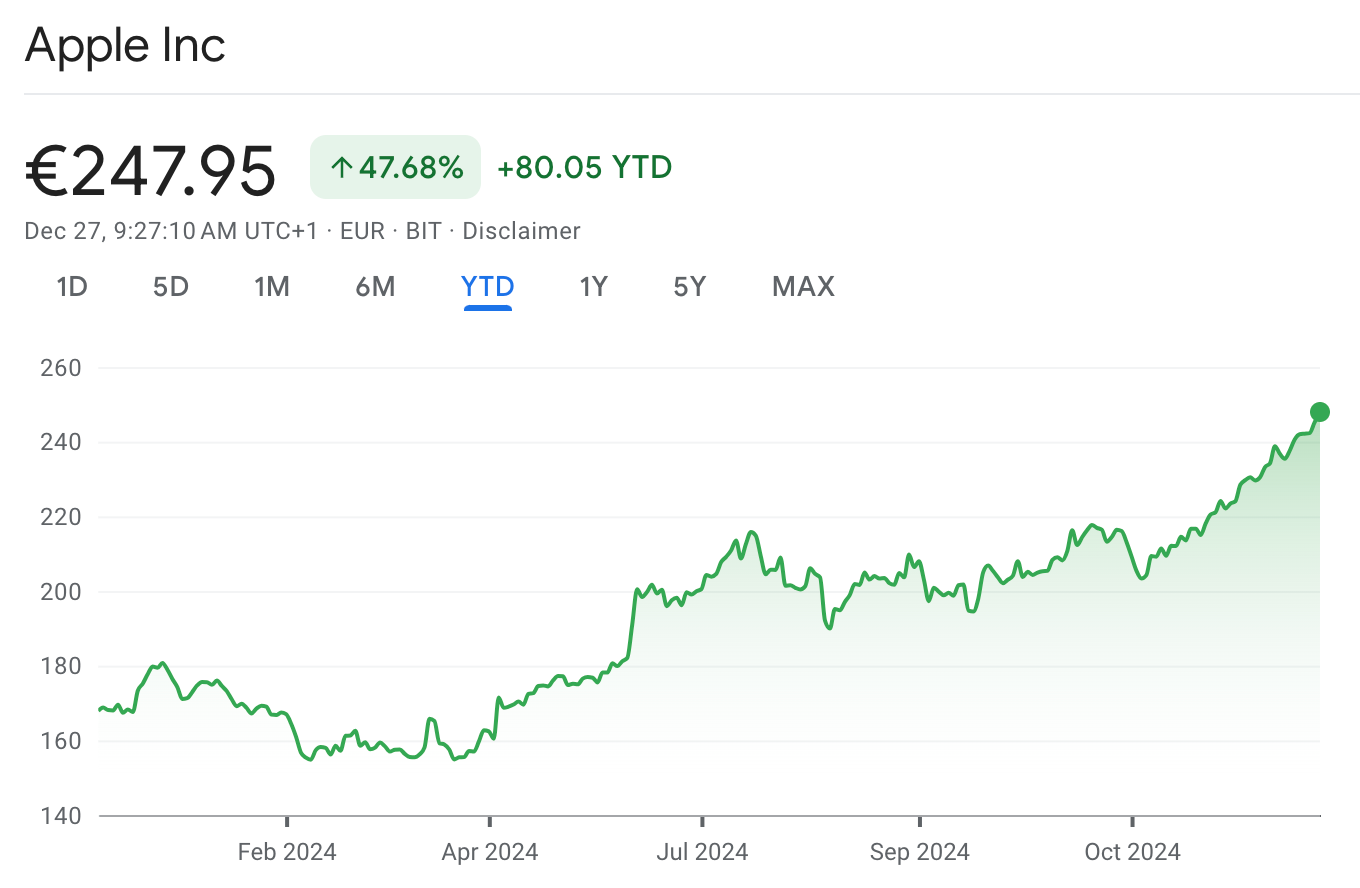

Apple’s AI Momentum

AI momentum might be turning Apple into a $4 trillion juggernaut!

The sole integration of ChatGPT and AI into its iPhone is sparring a stock rush as these expanded features might turn into rebounding sales for 2025.

Apple's AR Glasses: Project Atlas

As reported by Bloomberg just a few weeks back, Apple reportedly works on lightweight AR glasses under the code "Project Atlas."

These glasses aim to provide a seamless integration of AR into everyday life, potentially offering features like:

Notifications and navigation overlays

Fitness tracking and entertainment options

Gesture and voice-based controls for intuitive operation

Unlike the Apple Vision Pro, a high-end mixed-reality headset, these glasses are expected to be more affordable, compact, and focused on everyday usability.

Apple has been conducting internal studies and focus groups to refine the design and functionality of these glasses, ensuring they meet user needs while maintaining Apple's premium standards.

Is 2025 when Apple will launch its lightweight AR device?

Also, which other player has bet everything on an AR future?

Meta’s AI/AR Bet

As reported by The Financial Times, Meta plans to add displays to its Ray-Ban smart glasses by 2025, accelerating its AR strategy.

The updated glasses will show notifications and AI responses, complementing Meta’s Orion AR prototype.

Despite challenges like costs and scalability, Meta aligns its AI and AR efforts to dominate next-gen computing platforms.

What will Meta AR strategy be in 2025?

It will move along a few pillars:

Ray-Ban Smart Glasses Upgrade: Meta plans to add displays to its Ray-Ban smart glasses by late 2025, enabling notifications and AI responses, marking a step toward augmented reality (AR).

AR Prototype Orion: Meta accelerates the development of Orion glasses, featuring a lightweight design, 3D overlays, and neural interfaces, though commercialization faces hurdles.

Reality Labs Focus: 2025 is deemed critical for Reality Labs, despite $13 billion in losses in 2024. The Ray-Ban glasses gained popularity, doubling previous sales within months.

Silicon Carbide Innovation: Orion’s advanced lenses enhance image brightness but pose scalability and cost challenges.

AI Integration: Meta integrates AI into mixed reality devices, converging its AI and AR strategies to dominate next-gen operating systems potentially.

Market Growth: Smart glasses shipments grew by 73% in 2024, with Meta and competitors like Apple and Google driving the adoption of wearable tech.

Meta’s Long-Term Goal: Zuckerberg envisions AR glasses as the next computing platform, aiming to replace smartphones and lead in AI-driven hardware innovation.

xAI, now valued at $50 billion, wants to dominate AI

xAI raised $6 billion - bringing the company's valuation to $50 billion.

xAI, Elon Musk’s AI company, raised $6 billion, doubling its valuation to $50 billion. Its Grok AI model powers X features and integrates across Musk’s ventures like Tesla and SpaceX.

With 100,000 GPUs in its Memphis data center, xAI plans further scaling, aiming to rival OpenAI and Anthropic in generative AI.

What is its AI strategy for 2025? Is it to buy more GPUs?

Indeed, xAI will probably use most of that money to ramp up the acquisition of GPUs further to improve the capabilities of its foundational model.

However, the xAI strategy is well encapsulated in the image below:

xAI’s strategy builds on three pillars:

1. Colossus infrastructure for scalable computing and rapid experimentation.

2. Core models (Grok 2, Grok 3, Aurora) delivering state-of-the-art AI capabilities.

3. Platforms (xAI API, Grok on 𝕏) enabling developer ecosystems and real-time insights.

What’s the xAI strategy for 2025? This massive funding will serve three core purposes which align with the strategy highlighted above:

Scaling Infrastructure: xAI operates a data center in Memphis with 100,000 Nvidia GPUs, slated to double next year. It secured 150MW of additional power, promising to improve local infrastructure, though the plan faced community criticism.

Cross-Company Integration: xAI collaborates with Tesla and SpaceX, powering customer support for Starlink and exploring R&D deals with Tesla despite shareholder lawsuits over resource diversion.

AI Ecosystem Integration Vision: xAI aims to integrate AI across Musk’s companies, including Tesla’s autonomous driving technologies, solidifying its position as a key player in generative AI and industrial applications.

Is xAI helping shape Musk’s vision to turn his companies into a massive conglomerate, similar to the movie Iron Man, but instead of the “Sturk Industries,” these will turn into the “Musk Industries”?

DeepSeek AI model shows you can build large AI models much more cheaply (on the pre-training side)

A Chinese AI company, DeepSeek V3, is a game-changing open challenger in AI released by the AI firm DeepSeek.

Released under a permissive license, it supports various tasks like coding, translating, and content creation, rivaling leading closed-source models.

With 671 billion parameters—1.6 times the size of Meta’s Llama 3.1—DeepSeek V3 exhibits exceptional performance on benchmarks like Codeforces and Aider Polyglot, surpassing competitors such as GPT-4o and Qwen 2.5.

Despite its large size, it was cost-efficiently trained on 14.8 trillion tokens for just $5.5 million, using Nvidia H800 GPUs.

However, DeepSeek V3 faces challenges, including hardware demands and regulatory constraints in China, where it must align with government-approved narratives.

But for one thing, that showed hyperscalers, which have been investing billions and billions into GPUs, that you can build performing foundational models with a much more limited CapeX.

Yet, as I’ve explained in 10+ Predictions By The Business Engineer For 2025, while “system 1” intelligence is getting cheaper (via more effective pre-training), reasoning (or system 2) is actually getting way more expensive (for now).

Recap: In This Issue!

Microsoft 365 Becomes Microsoft Copilot

Microsoft rebrands its productivity suite to emphasize full AI integration and enhanced tools like Copilot Chat.Microsoft-OpenAI Partnership Evolution

Microsoft diversifies AI models, reducing reliance on OpenAI as their exclusive distribution agreement nears its end.OpenAI’s Shift to For-Profit Status

OpenAI transitions to a for-profit model, facing legal and fiscal challenges while redefining its partnership with Microsoft.AGI Valuation and Milestone

OpenAI and Microsoft tie AGI definition to generating $100 billion in profits, impacting future independence for OpenAI.OpenAI Explores Humanoid Robotics

OpenAI revives its robotics ambitions, focusing on humanoid development to expand AI applications in physical environments.High Costs of AI Reasoning Models

Advanced models like OpenAI’s o3 showcase exceptional reasoning but remain impractical due to high computational costs.AI Search Disrupting Google

AI-powered search tools like ChatGPT and Perplexity challenge Google’s dominance, reshaping user behavior and the ad market.Google’s AI Strategy for 2025

Google focuses on iterative innovation, multimodal AI, and AR hardware as key drivers for maintaining market leadership.AR and AI Integration Advancing

Companies like Google, Apple, and Meta are poised to launch AR hardware and AI assistants, aiming for consumer adoption in 2025.xAI’s Rapid Growth and Vision

Elon Musk’s xAI scales GPU infrastructure and integrates AI across his companies, positioning itself to rival OpenAI.DeepSeek’s Cost-Efficient AI Models

DeepSeek develops large-scale AI models at significantly lower costs at the pre-training stage for system one thinking, challenging traditional hyperscaler approaches.

With massive ♥️ Gennaro Cuofano, The Business Engineer