This Week In AI Business: Even if Google Search will Die, Alphabet will Thrive [Week #17-2025]

Google search remains, at the same time, one of the most interesting businesses ever created, and yet also one of the most challenged ones at the moment.

This, indeed, is the most paradoxical moment for Alphabet, with its core business, advertising, which continues to grow, creating further incentives for its management to maintain a focus on that for the next few years.

And yet, I argue that outside quarter-by-quarter decision-making, the classic blue links search interface won’t survive another decade.

Google, therefore, finds itself in the middle of the Innovator’s Dilemma.

In this position, to survive as the dominant player in the search industry, Google must kill its golden goose, the most valuable asset that continues to generate record-breaking revenue for the company, albeit, I argue, temporarily.

If you look at the data above from a quarter perspective, things look amazing, and they are:

Overall Revenue: Grew 12.0% year-over-year to $90.2B, maintaining the same growth rate as Q4 2024.

Google Search: Revenue increased 9.8% to $50.7B, showing slower growth compared to 12.5% in Q4. Despite this, Search remains the dominant revenue source, accounting for 56.2% of total revenue.

Google Cloud: The fastest-growing segment with 28.1% YoY growth to $12.3B. Cloud operating income grew over 140%, indicating improved profitability.

Subscriptions: Strong 18.8% growth to $10.4B, supported by YouTube Music & Premium reaching 125M+ subscribers.

Network Advertising: The only declining segment, dropping 2.1% to $7.3B.

Capital Expenditures: Increased 43% to $17B in Q1, with plans to spend $75B in 2025, primarily on AI infrastructure.

AI Investments: Gemini 2.5 Pro release and significant AI integration across Google's product suite, including AI Overviews, now reaching 1.5B monthly users.

So, how do you make sense of this moment?

Let’s see.

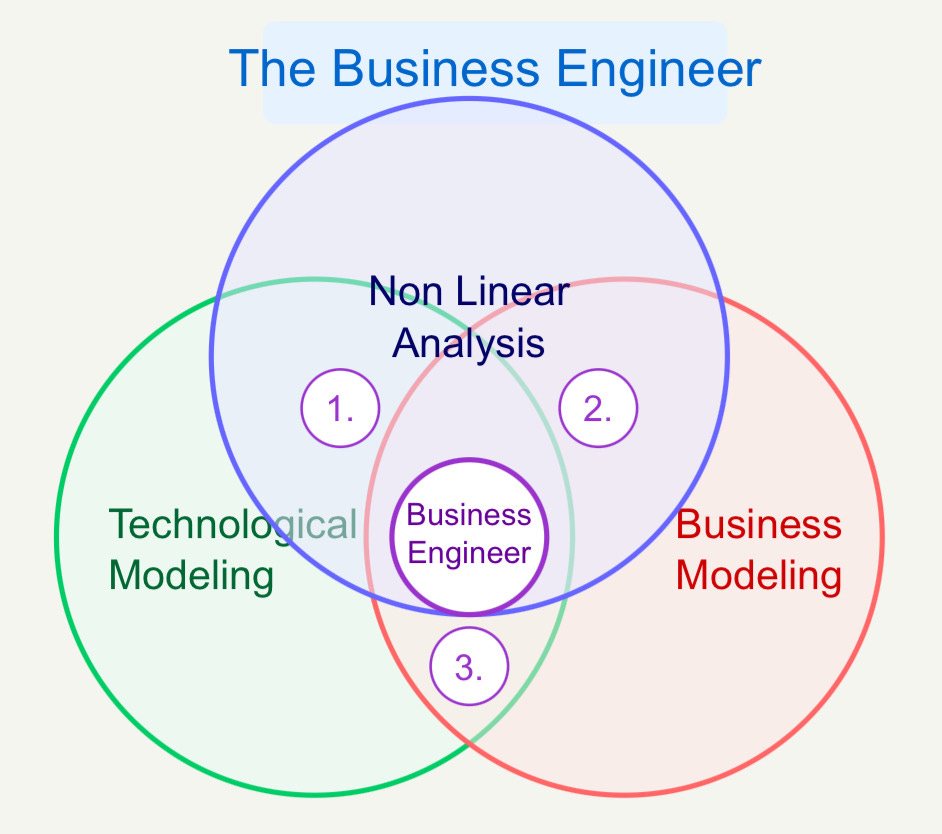

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that you can reconcile the short-term with the long-term.