This Week In AI Business: How AI Is Reshaping The Global Order [Week #20-2025]

Contrary to the last thirty years of the web, consumer and private companies that have become big tech players have taken the lead.

We’re at a different time in history, and at an analogy level, this is way more like the early microchip timeline than the web one.

Its implications are massive, as it completely redefines how we tackle the AI ecosystem's development as a hybrid model between public and private and between geopolitical needs and infrastructure (energy, minerals), which are essential to spur the whole ecosystem.

As I’ve highlighted, AI is eating the world; we’re only at the beginning of this cycle of development of the whole ecosystem.

That means the “deep capital stack” that will infuse what’s needed to kick off the overall AI ecosystem will see the public/private joint ventures at its foundation, investing hundreds of billions to make this happen in the coming decade.

The recent U.S.-Saudi Arabia Strategic Investment Agreement represents more than a traditional bilateral deal; it exemplifies a new model of geopolitical competition centered around artificial intelligence infrastructure.

This $600 billion agreement reveals a sophisticated three-layer framework that defines how nations build alliances, distribute capital, and organize business ecosystems in the global race for AI dominance.

Let me show you why in this weekly analysis!

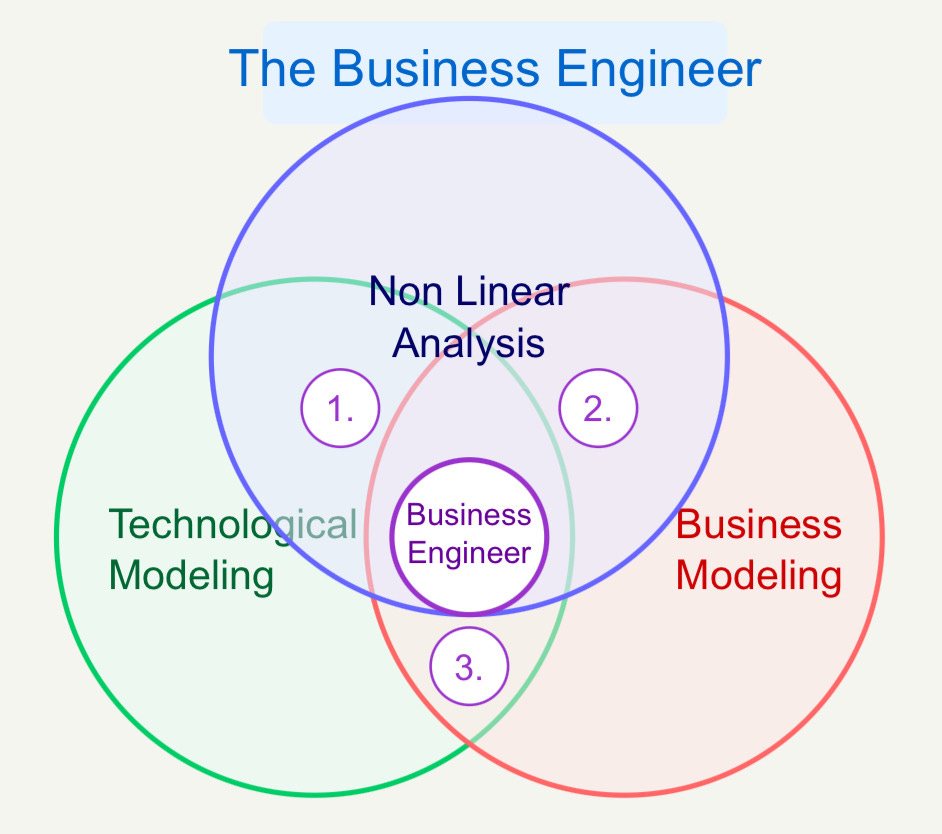

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.