This Week In AI Business: The Great AI Talent Wars [Week #27-2025]

This is a story in 12 chapters about the greatest talent wars we've ever seen in the history of technology.

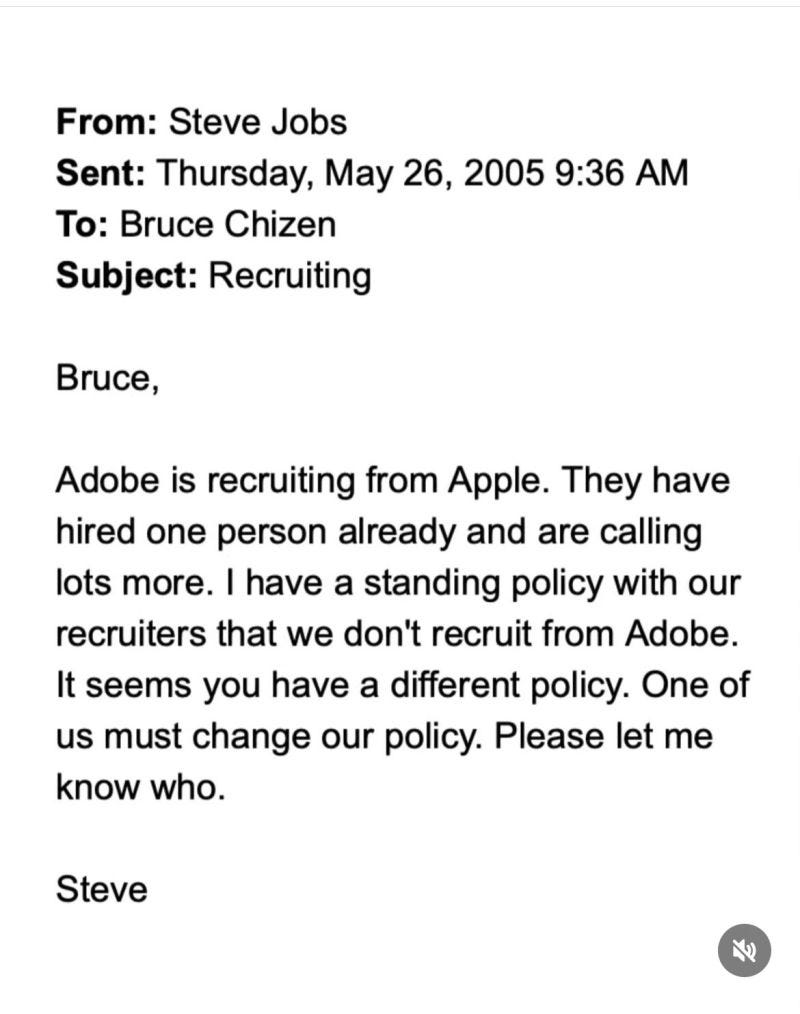

While echoing historical precedents, such as Steve Jobs' aggressive recruitment tactics in the early 2000s, what we're witnessing in Silicon Valley's AI race represents an entirely new level of competitive intensity.

While Sam Altman has characterized Meta's systematic talent poaching as distasteful, the reality is that everyone has been recruiting from one another, and the situation intensifies as AI development accelerates.

The annals of Silicon Valley history will remember 2025 as the year when the AI talent wars reached their zenith. What began as isolated departures from OpenAI cascaded into an industry-wide exodus that fundamentally reshaped the artificial intelligence landscape.

Former executives who once collaborated in the same offices now command competing billion-dollar enterprises, while companies deploy increasingly desperate measures to secure the finite pool of researchers capable of advancing AI's frontier.

The numbers tell a staggering story: over $170 billion flooded into AI companies in just the first half of 2025, with talent—not technology—driving valuations.

Ilya Sutskever's Safe Superintelligence, where he now serves as CEO, reached a $32 billion valuation with just 20 employees and no product. Mira Murati's Thinking Machines Lab secured the largest seed round in history at $2 billion.

Meta invested $14.3 billion for a stake in Scale AI primarily to acquire its CEO. These aren't just investments in companies; they're bets on the individuals who might unlock artificial general intelligence.

This is the story of how OpenAI's brain drain triggered a talent gold rush that transformed Silicon Valley, rewrote the rules of startup valuations, and forced even the most powerful tech companies to confront an uncomfortable truth: in the race for AI supremacy, talent has become the ultimate currency.

Caveat: We've compiled retention-related statistics using publicly available industry data. While these figures offer reasonable approximations, they are estimates rather than precise values and should be viewed as directional indicators to help understand each player's talent dynamics.

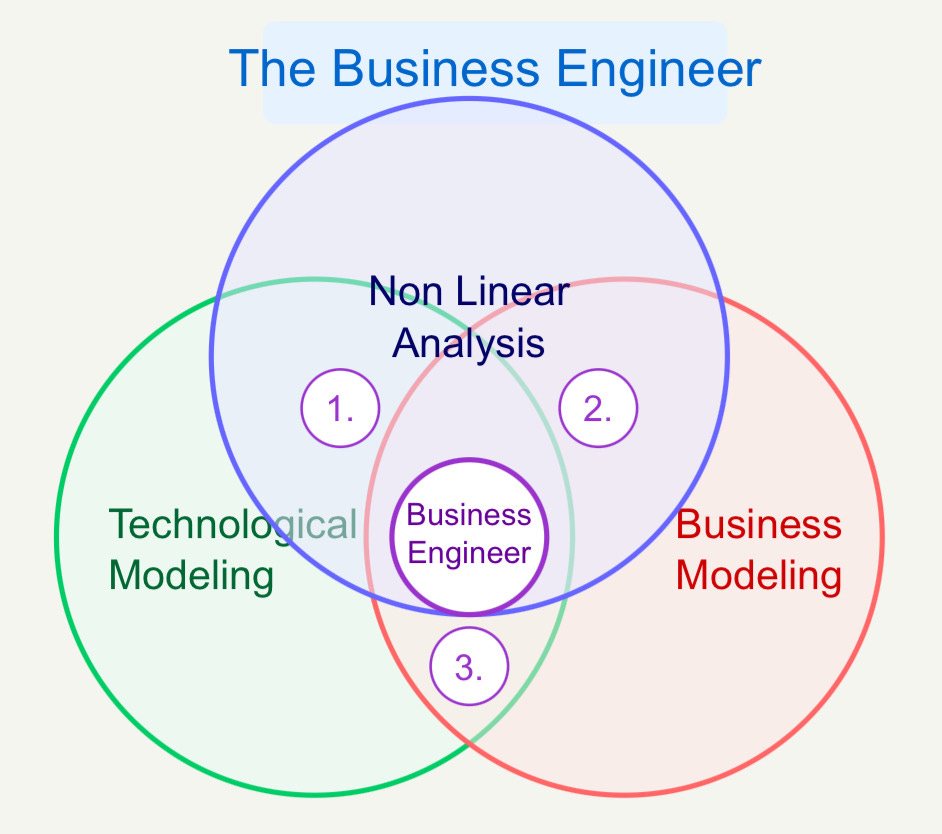

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.