Macroeconomics in The Age of AI

Beware, since this week is a key week that will signal the Federal Reserve’s perspective on interest rates until the end of the year.

I’m conducting this special analysis because I bet (happy to take any counter bets on it) that we might see a few more “AI bubble popping” narratives follow in the tech industry.

As if technology fundamentals drive short-term market dynamics, when they don't, it’s the opposite: market dynamics influence the development of the tech landscape, at least in the short term.

Technology follows a long arch of decades, and as I’ve said over and over, given we’re into an AI supercycle, this will probably be at least a 30-50 year cycle.

This is part of what I’ve explained in the Reality Gap Analysis:

And what I’ve explained in the AI Technology Analysis Framework:

Why is this week critical?

This week, the Federal Reserve is expected to cut rates by 25 basis points, its first reduction of 2025. Markets will focus on whether this marks the start of an easing cycle or a one-off move.

Powell’s commentary on inflation, growth, and labor market conditions will be critical. The Fed faces internal dissent, political scrutiny, and pressure to balance cooling inflation with signs of economic slowdown.

The decision matters because it sets borrowing costs, shapes business and consumer confidence, and signals future policy direction. Any deviation from expectations could trigger volatility in stocks, bonds, and currency markets.

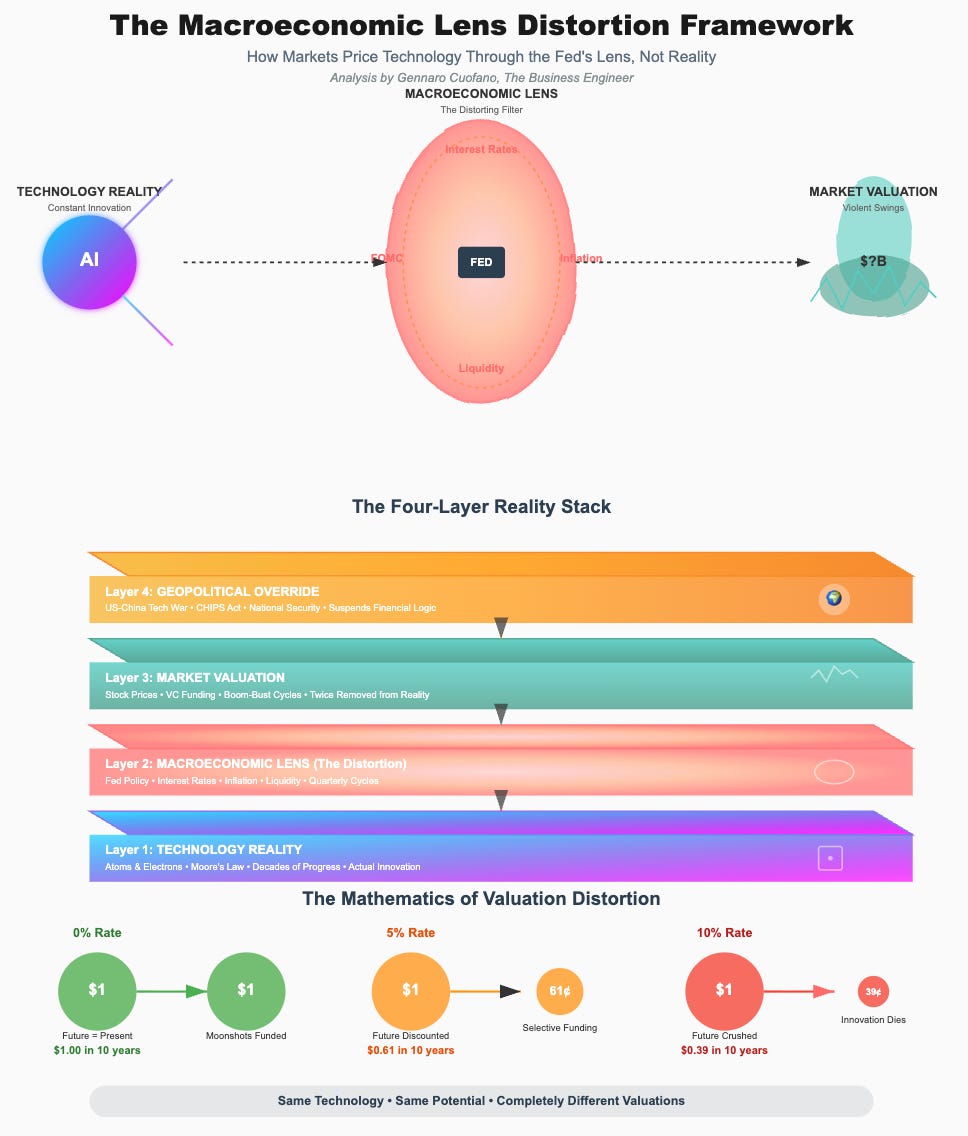

Picture a revolutionary technology, such as artificial intelligence, quantum computing, or bioengineering. Its capabilities remain constant: the same computational power, the same transformative potential, the same trajectory toward reshaping civilization.

Yet, depending on whether the Federal Reserve raises or lowers rates, this identical technology might be valued at a trillion dollars or deemed nearly worthless. This isn't a bug in the financial system; it's the system's core feature.

The financial market doesn't evaluate the future potential of a technology but only its potential based on the current macroeconomic environment, inflation expectations, job markets, interest rates, and available liquidity.

This creates a systematic distortion where markets price the lens through which they view technology, not the technology itself.

![This Week In AI Business: AI Technology Bubble Analysis [Week #35-2025]](https://substackcdn.com/image/fetch/$s_!pkd2!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc6d426bc-a100-44fb-b159-47c64a21662f_1290x1332.png)