non-linear competition!

how to look at the business landscape with a lateral thinking approach!

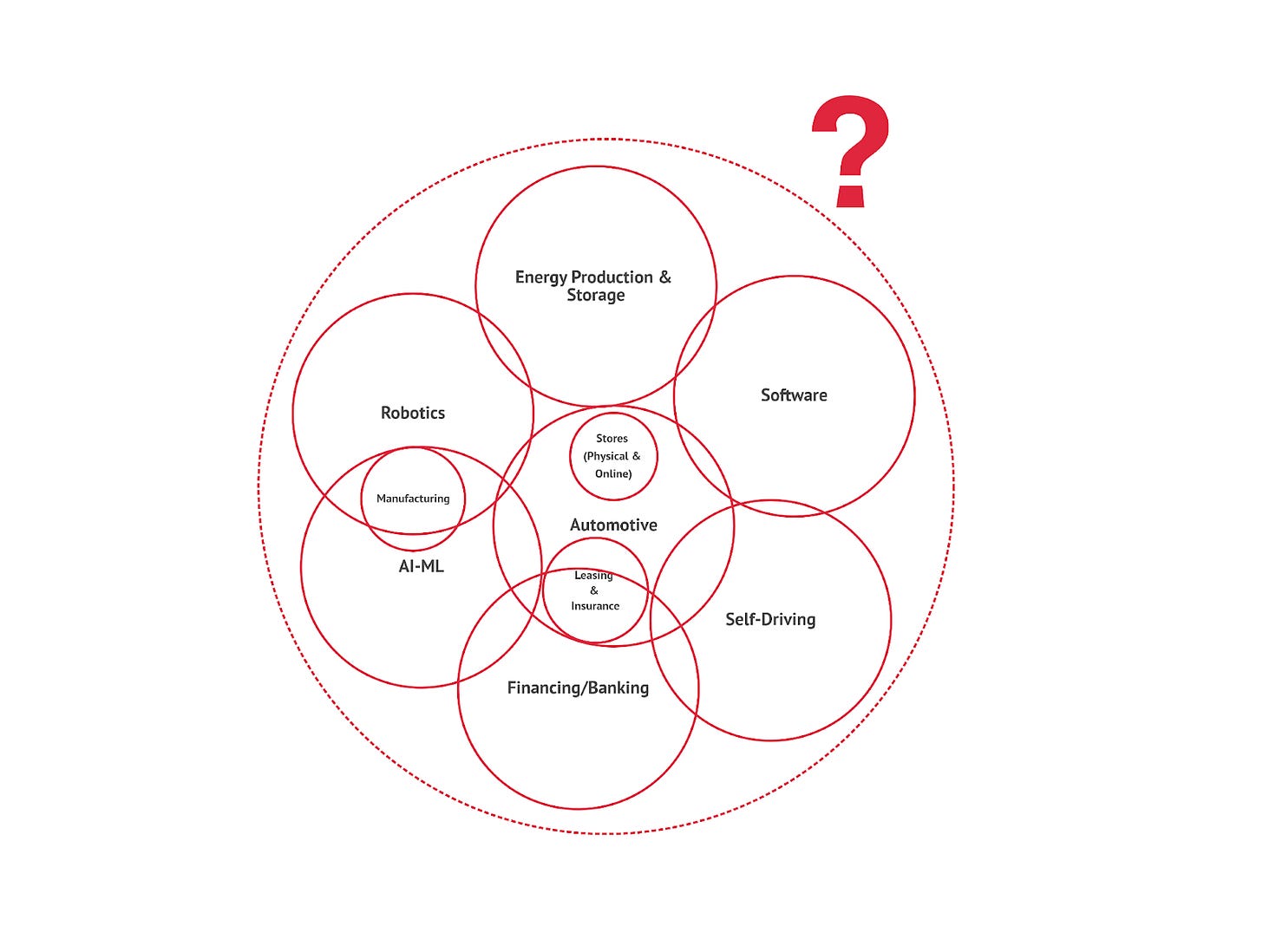

Is Tesla just a car company?

Well, it depends on which angle you take. From a linear standpoint, it is.

However, if you only look from that angle, you're missing many valuable insights about the development of a set of industries around EVs, which will also play a critical role in the future!

Here, we want to leverage lateral thinking instead.

Welcome to the fluid world!

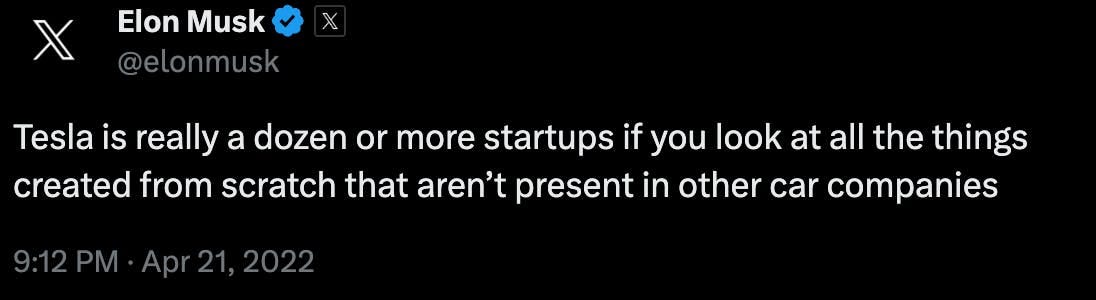

And yet, by April 2022, with Tesla consolidating its manufacturing at scale, Musk emphasized how the company has the potential to become multiple companies at once via its portfolio of bets:

Competition in the tech industry is linear in the short but pretty much non-linear in the long.

New industries that might seem unrelated might swallow old industries in the long.

Another example I like is when innovative players (those who see the market as a whole without clear boundaries) enter new spaces.

Take the case of Tesla entering into the insurance business.

Would you even put Tesla on the competitor's map if you were Geico?

Chances are, you won't, and probably you won't do that because competition seems linear in the short term.

Thus, your competition might look like the following graph:

When you look at Tesla's insurance business, you know that, for now, it's part of the service business, but you're not sure how much it generates for the company.

Indeed, in 2023, Tesla's service business generated over $8 billion in revenues, and we can assume that the insurance arm drove a good chunk of its growth!

Tesla has now become a legitimate and significant player in car premium insurance in the US!

Thus, it might be too late to finally have accurate data about the Tesla insurance business revenues and, most importantly, margins.

When we do, Tesla's real-time insurance might already be among the top players in the US!

That's why data might be relatively important in non-linear competition, as you might have to counteract without it.

Often, true disruptors are hidden from view until it's too late!

Take another case, that of Amazon, which left everyone amazed when it showed its AWS numbers in 2016:

When Amazon opened its AWS numbers (as they were obliged to comply with the SEC's requirements back then), AWS was the fastest-growing segment, growing at a double-digit rate per year.

For instance, when Amazon finally shared the data for AWS, it had already become a giant in the cloud space, and companies like Google and Microsoft had to rush and ramp up their cloud operations to keep up!

Indeed, what we call Web2 or 2.0 today, or the plethora of companies that were built or scaled throughout the 2010s, were built on top of AWS (those comprised Netflix and Slack).

It was also becoming more profitable than Amazon's core business!

Remember that executives in the industry, well-positioned to see this coming, didn't see it!

Interviewed by Charlie Rose in October 2014 (when AWS was already generating over $4 billion in revenues), asked about what he thought of Amazon AWS, former Microsoft CEO Steve Ballmer said:

"They make no money, Charlie! In my world, you're not a real business until you make some money!"

It's, of course, too easy to pick on Steve Ballmer, but you get the point.

He completely missed that AWS was making money and making it at wide margins, actually, higher margins than the core Amazon business!

Today, AWS is a major powerhouse, and it's playing an even more critical role for Amazon as it enables it to compete in the generative AI era! (AWS is where Amazon is building its AI Supercomputers to train and inference LLMs).

Therefore, good businesses are often hidden and hard to predict, and when you realize it might be too late, the time window to catch up might be very tight! To sum things up:

Keep these principles in mind when it comes to non-linear competition!

1. Competition seems linear only in the short term:

Indeed, while you might be able, as a dominant player, to stiffen competition in the short term, your future competitor might come from an unexpected place. Take the case of Tesla entering the insurance business. If you were a traditional insurance player, like Geico, operating since 1936, would you even place Tesla on your competitors' map? When looking at the business world, you want to keep an open eye on what niches are developing, which might, non-linearly, develop as take-all industries!

Building moats in technology is quite challenging because if the market has not been monopolized through regulation capture, it will be prone to be disrupted every 10-20 years.

In that case, disruption starts from very far away and in the corner of a market, which is extremely hard to identify as a threat, if not until it's too late!

2. A central point is about looking at built-in disincentives in large, existing industries and what other sectors these incentives are making emerge

In short, dominating industries have hidden costs, which create disincentives for other industries to emerge. In a way, that is their moat.

If you can identify new players who are changing (in a hidden way) the underlying incentive structure of a system, you are on the right path to identifying an industry's disruption.

One example is how OpenAI, with ChatGPT, is shifting the web industry's incentives from advertising to an API economy and cloud.

And if you start from there, you can grasp all the second-order effects and consequences of this change.

3. The last and critical point. In the short term, what seemed an utterly unrelated industry might become the new paradigm, thus eating you up!

This connects to the first point. In a (mainly) free market, the mechanism of knowledge dispersion (the discovery of new business niches) happens every day.

This mechanism is tricky because most of these niches will remain small and localized to narrow industries.

Yet, a few of these niches might reach a massive scale slowly, then quite suddenly!

Like in a snowball effect, the compounding power gains so much momentum it becomes impossible to contrast.

That is why you get a tsunami effect when a new technology (like Generative AI) creates a whole new industry, bottom-up (driven by first improvements in consumer alternatives, then by a whole new type of consumer demand!).

Thus, you have to embrace that quickly.

For that sake, you must keep an open eye on the few data points that matter.

If you were Steve Ballmer in 2014, instead of laughing at Amazon AWS, you would have sent around some of your key people to ask what startups were building their business on top of Amazon AWS.

You would have figured out that upstarts - at the time - like Netflix had been migrating their whole infrastructures on AWS.

So, where do we start?

Recap: In This Issue

The essence of non-linear competition: While Tesla is primarily known as a car company, it has broader implications for various industries. The development of electric vehicles (EVs) has the potential to create new markets and disrupt existing industries. Today we don't yet have a name for an industry at the intersection of energy storage/generation - EVs - self-driving - robotics - and real-time insurance. Yet, in the future, we might give that for granted...

Linear vs. non-linear: The competition in the technology industry is not always linear. In the short term, competition may seem straightforward, but new industries can emerge and overtake established ones in the long term.

Tesla's Real-Time Insurance example: Tesla's entry into the insurance business shows how innovative players can enter seemingly unrelated industries. Traditional insurance companies might not consider Tesla as a competitor due to the linear perspective of short-term competition, yet Tesla's Service Business, including its insurance arm, generated over $6 billion in revenues in 2022. However, the exact revenue and margins of the insurance business are unknown, thus highlighting the challenge of understanding the true impact of disruptors until it's too late.

AWS and Amazon's Disruption example: Amazon's AWS (Amazon Web Services) became a significant disruptor in the cloud computing industry. It grew rapidly and became more profitable than Amazon's core business. Traditional industry executives, like former Microsoft CEO Steve Ballmer, underestimated the potential of AWS.

Hidden and Hard-to-Predict Businesses: Disruptive businesses are often hidden and hard to predict. Recognizing new players and changes in underlying incentive structures can help identify industry disruptions. Building moats in technology is challenging, and markets are prone to disruption every few decades.

Long-Term Industry Shifts: Industries that may seem unrelated can grow and become significant competitors. The discovery of new business niches can have a snowball effect, compounding their momentum and disrupting established industries.

Embracing Change: To stay competitive, embracing new technologies and industry shifts is essential. Paying attention to critical data points and adopting a non-linear analysis approach can help identify emerging trends and opportunities.

Real World Case Studies

Apple

Current Market: Apple is a leader in consumer electronics, with products like the iPhone, iPad, and Mac.

Non-Linear Opportunity: Apple is venturing into healthcare with the Apple Watch, which includes health-monitoring features. The device has the potential to revolutionize personal health tracking and telemedicine.

Transition: Apple has continued to enhance the health-related capabilities of the Apple Watch and has partnered with healthcare providers to integrate health records and services into the device.

Walmart

Current Market: Walmart is a retail giant with a vast network of physical stores and e-commerce operations.

Non-Linear Opportunity: Walmart is exploring non-linear opportunities in healthcare by opening Walmart Health clinics. These clinics offer a range of healthcare services, including primary care and dental care.

Transition: Walmart is gradually expanding its Walmart Health clinics to more locations and offering telehealth services. This diversification aims to leverage their extensive physical presence for healthcare services.

Netflix

Current Market: Netflix is a streaming service known for its original content and vast library of movies and TV shows.

Non-Linear Opportunity: Netflix is exploring non-linear opportunities in gaming by offering a selection of video games through its platform. This diversification can enhance user engagement.

Transition: Netflix has started offering gaming content as part of its subscription service, allowing subscribers to play games on various devices alongside their regular streaming content.

Tesla (Tesla Energy)

Current Market: Tesla is primarily known for electric vehicles (EVs) and energy products.

Non-Linear Opportunity: Tesla Energy focuses on sustainable energy solutions, including solar panels and energy storage. These products have the potential to transform the renewable energy market.

Transition: Tesla continues to expand its energy product offerings, making solar and energy storage more accessible to homeowners and businesses. This transition aligns with their mission of sustainable energy.

General Motors (GM Cruise)

Current Market: General Motors is a major automaker with a history in traditional gasoline vehicles.

Non-Linear Opportunity: GM Cruise, a subsidiary of GM, is focused on autonomous vehicle technology. Autonomous vehicles have the potential to revolutionize transportation.

Transition: GM Cruise is actively testing autonomous vehicles in various cities and aims to launch commercial autonomous ride-sharing services. This represents a significant shift toward a future of autonomous mobility.

Facebook (Meta Horizon)

Current Market: Meta Platforms (formerly Facebook) is known for its social media platforms.

Non-Linear Opportunity: Meta Horizon is an initiative to create a metaverse, a virtual reality space with diverse applications, including social interaction, gaming, and commerce.

Transition: Meta Horizon involves significant investments in VR and AR technology, aiming to build a metaverse that connects people in new and immersive ways.

IBM (Quantum Computing)

Current Market: IBM is a leader in enterprise IT services, including cloud computing and AI.

Non-Linear Opportunity: IBM is actively developing quantum computing technology, which has the potential to solve complex problems far faster than classical computers.

Transition: IBM offers cloud-based access to quantum computers for research and experimentation, positioning itself at the forefront of quantum computing advancements.

Ciao!

With ♥️ Gennaro, FourWeekMBA