AI VC Trends & Dashboard For 2025

2025 will be a pivotal year, as everyone in AI knows.

I’ve compiled a set of insights for 2024 and some key patterns I’ve seen developing for 2025.

I’ve also published the key data of this piece at ChiefFinancialOfficerAI, where you can query it with an AI Assistant.

Let’s get to it.

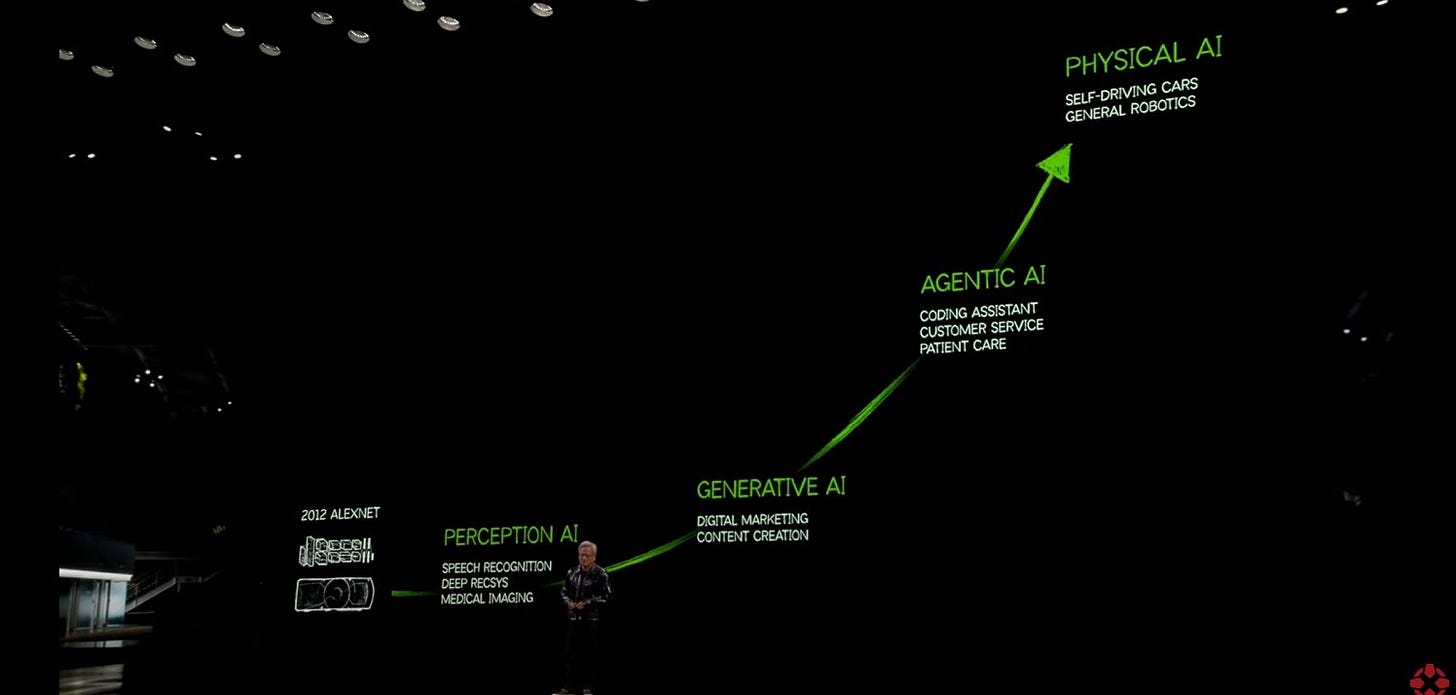

The talk by Nvidia’s iconic CEO, Jensen Huang, at CES, only confirmed what we’re going through in terms of the subsequent phases of development in AI.

And I’m not talking just about regular people who feel the exceptional bottom-up rise of AI tools as they become available to more and more consumers.

There is also massive pressure on top executives at big tech who are rushing to become hyperscalers.

Transitioning from Big Tech to hyperscaling means a shift from major distribution control of consumer demand via the existing pipelines to, and that’s the key point, the control over the “AI computing pipelines,” which will become a key strategic asset to have in the coming decades.

And the same type of pressure to keep up to implement AI within their enterprise businesses by top executives in all the verticals who are getting potentially redefined by AI.

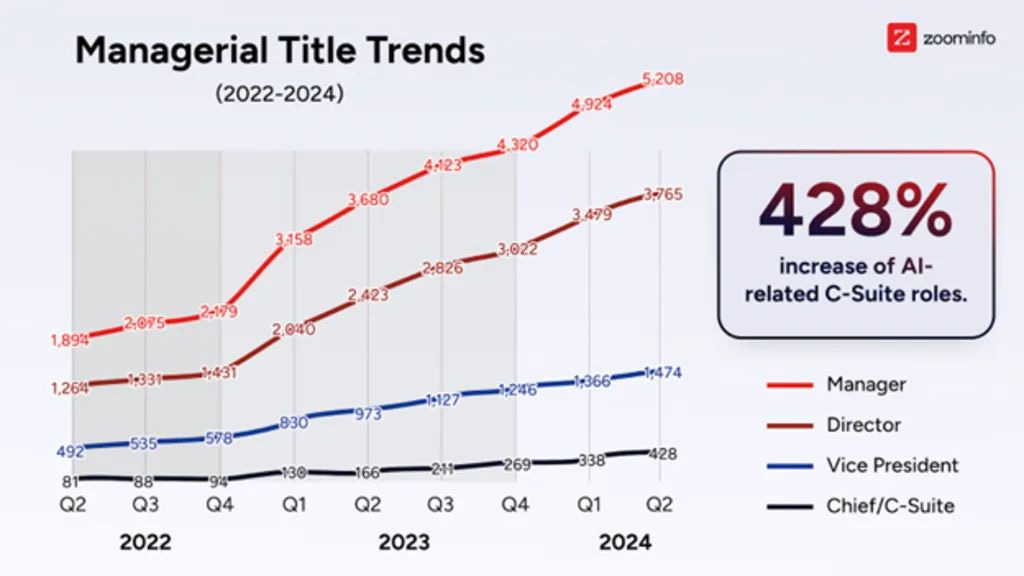

So much so that, as I’ve explained in the last weekly issue, we saw already the massive rise of an AI Managerial class at an enterprise level:

Just a few days back, Google’s CEO Sundar Pichai, addressing his top executives, said:

I think 2025 will be critical,

Pichai said:

I think it’s really important we internalize the urgency of this moment, and need to move faster as a company. The stakes are high.

Pichai also emphasized:

we have some work to do in 2025 to close the gap and establish a leadership position there as well.

And he closed up with:

Scaling Gemini on the consumer side will be our biggest focus next year.

At the same time, on the stage at CES, Jensen Huang has made clear we’re in the middle of a massive shift, which, rather than being over, is transitioning us from generative AI to agentic AI, to bringing us to a phase of “Physical AI.”

I’ll emphasize these points in the upcoming issues.

On the other hand, I can confirm that I get more and more questions from top executives at large enterprise companies who are trying to figure things out on the fly.

That’s the paradox of 2025. It will be a pivotal year for further consumer adoption. At the same time, the enterprise will also push on the accelerator to try to figure things out.

In the end, we’ll see three pivotal moves:

Hyperscalers are getting way more competitive, ramping up consumer and enterprise adoption.

Consumer adoption is reaching a critical mass, where an AI consumer application might be in the hands of over a billion people.

Enterprise businesses will be experimenting way more wildly within their organizations as the pressure to experiment with AI comes from the top. Thus, for the first time since the “ChatGPT moment,” operational teams will have the bandwidth to test and experiment while dealing with massive pressure from the top.

Based on the above, let’s see some key trends developing regarding key people and capital movements, shaping consumer and enterprise products in 2025.