This Week In AI Business #53

This is the first week of 2025, yet a quick reminder of the news that closed 2024, as Sundar Pichai, CEO of Google, asked his executive team (referring to ChatGPT’s consumer domination): “What’s our plan to combat this in the upcoming year? Or are we not focusing as much on consumer-facing LLM?”

Do you like the weekly format? Subscribe below.

You can see what key news and trends closed 2024:

I’ve also published The Web²: The AI Supercycle, which is all you got to know, to understand where we’re going in the coming decades, in terms of development of the AI industry.

The strength of Google has always been its bottom-up consumer traction. Without it, there would be no Google.

That’s why Google, as a consumer-first company, is aware that not having an AI product as strong as ChatGPT would disrupt its core search business model.

I’ve explained this quite in detail in these issues:

That’s why in an internal strategic meeting, in one comment read aloud by Pichai, he suggested that ChatGPT “is becoming synonymous to AI the same way Google is to search,” and with that, it sounded an alarm that resonated the whole 2025, as the most critical year for Google.

If Google doesn’t aggressively gain market shares by this year to ChatGPT, with an AI native product detached from search, Google might have lost the “AI Chatbots” train for good.

And that might cost Google hundreds of billions!

The Digital Advertising cake is too good to let go

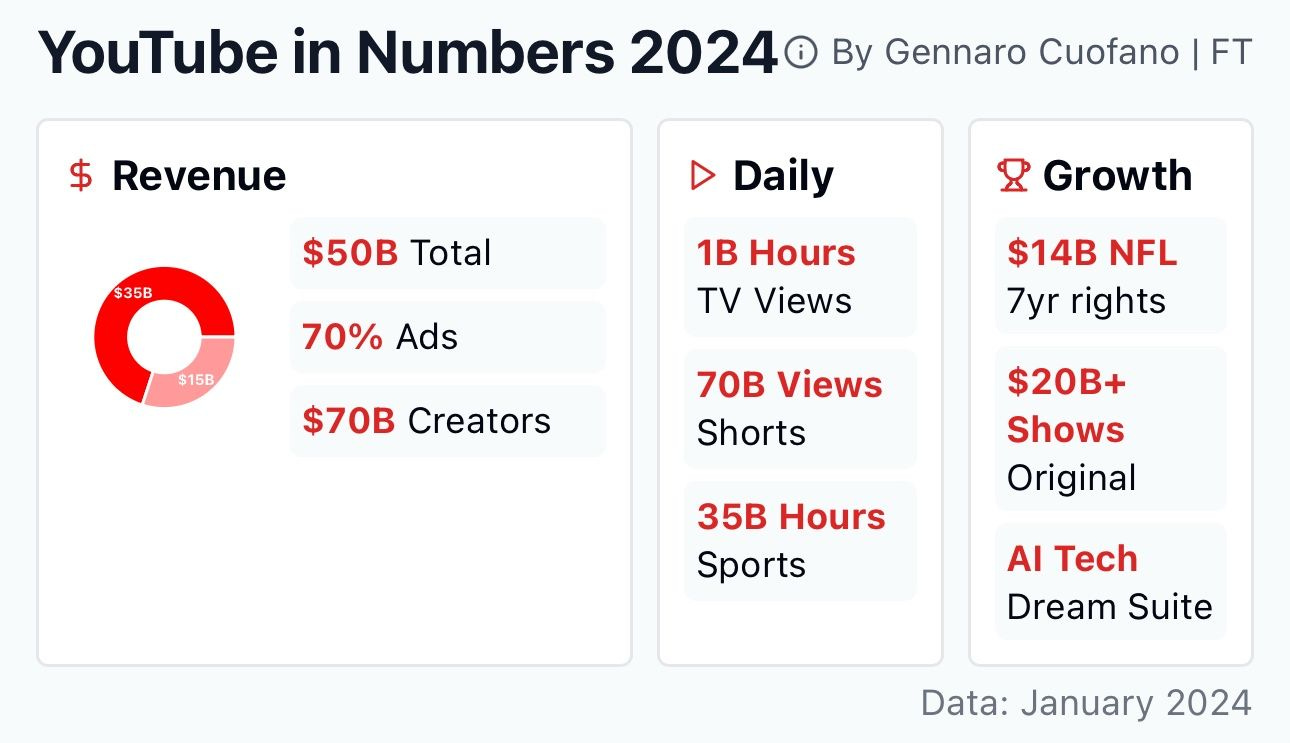

Digital advertising has become a larger market opportunity than TV.

And AI is set to transform advertising in 2025, with platforms like OpenAI and Microsoft leveraging precise targeting to capture a growing market.

Global ad spending surpassed $900 billion in 2023, with digital dominating 70% of budgets.

AI could claim 20% of the market by 2029.

The fact that the Internet has come full circle shows in how YouTube has become synonymous with TV, of course with a significant twist, which makes it a massive reach machine, a level of scale television has never experienced: