This Week In AI Business: AI-SF Is Back, London Up, Paris Down [Week #3-2025]

To understand how buzzy is the AI tech world right now, take this news that just came out:

How do you discern whether this is fiction, a scene from The Silicon Valley series, or reality?

That’s the thing, and the purpose of this weekly is to find the signal in the massive noise of this current AI market paradigm.

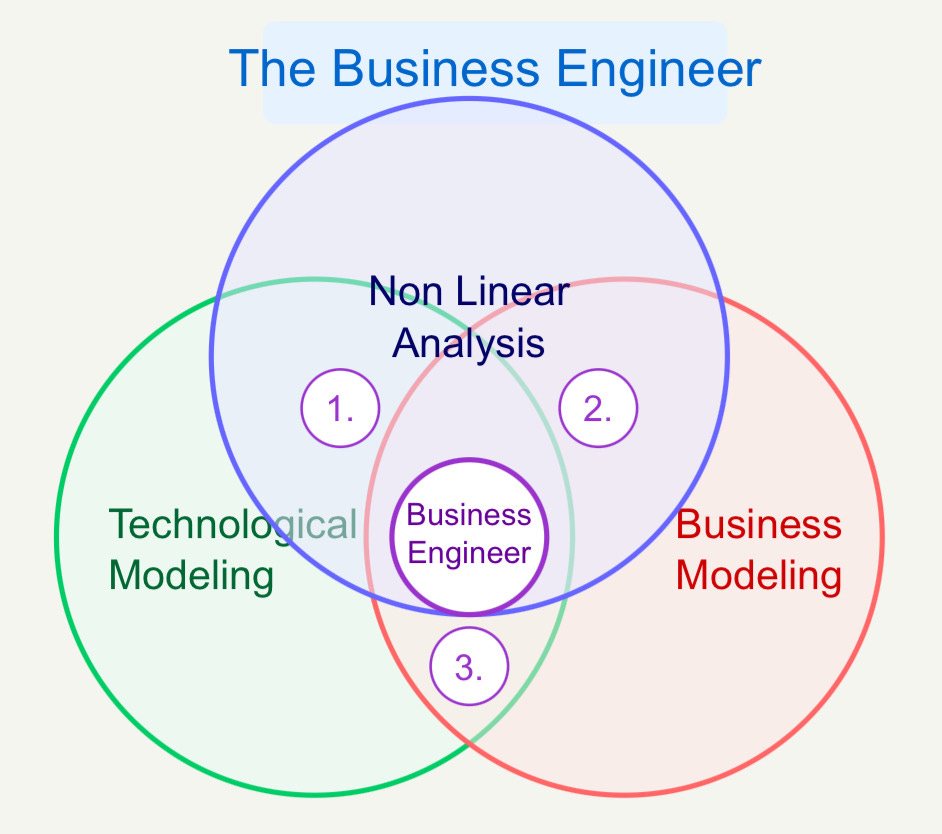

This is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while it sticks to its long-term vision via transitional business modeling market dynamics?

These are non-linear analyses whose goal is to isolate the short-term buzz and noise, find the signal, and make sure you can reconcile the short with the long term!

A reminder that you can find most of this data in our dashboard: ChiefFinancialOfficerAI:

If there is one chart to explain 2024, this is it:

AI captures 35.7% of the total deal value for global VC funding, and the US contributes to nearly half of it.

I’ll bust some of the myths developed in the last decade in this issue.

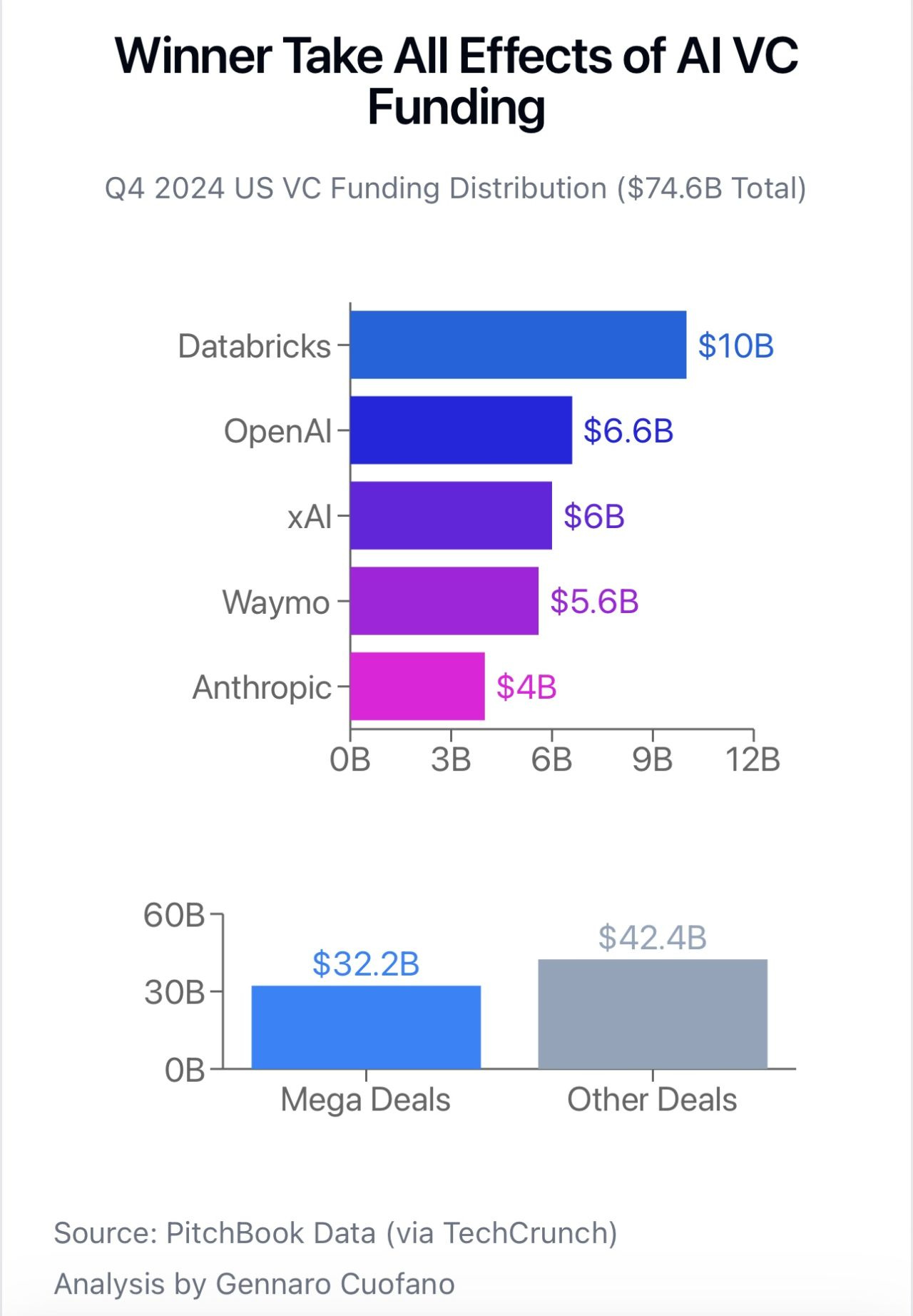

As I’ll also show you in this issue, a clear signal from how AI is evolving is even more extreme than that of the Web, with capital skewing toward a few places, players, and ecosystems across each layer stack.

Capital Concentration And Winner-Take-All

I’ve explained this in detail:

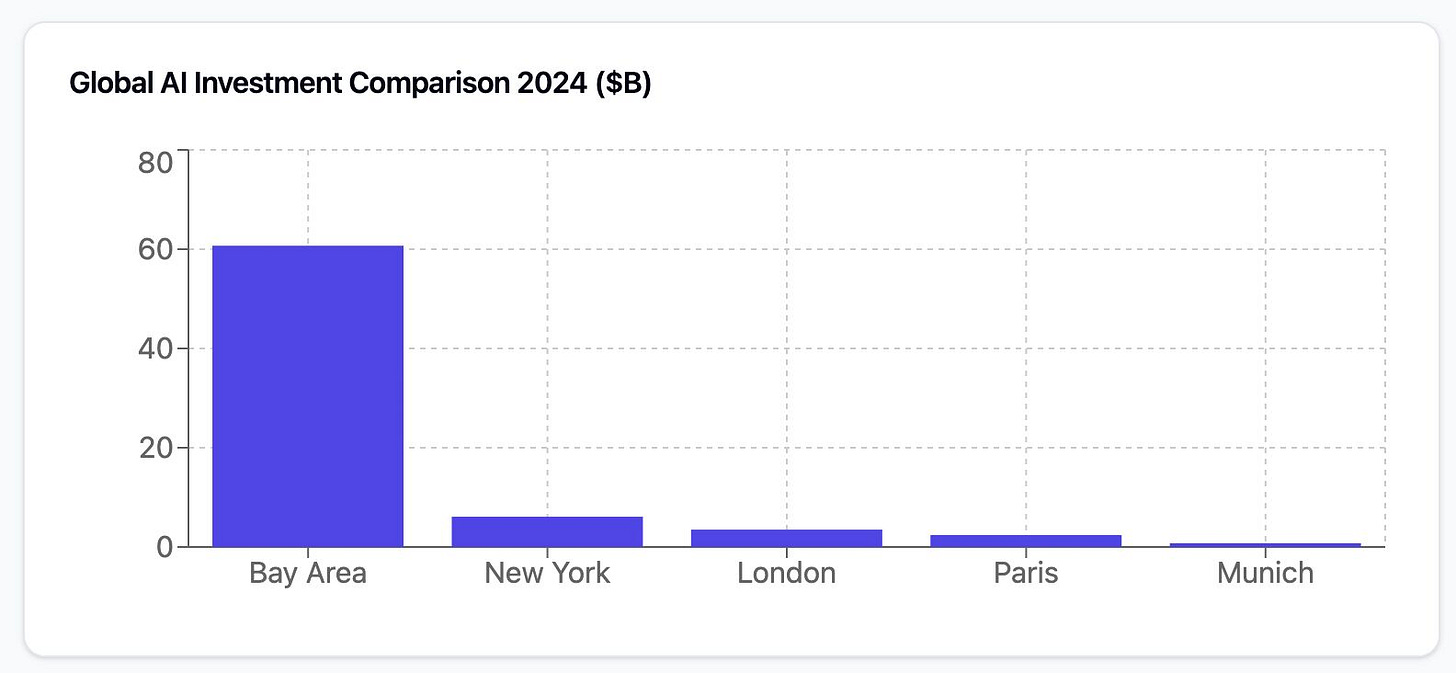

That implies that location matters like never before, as you want to be closer to the capital sources and the customer base and integrated into a system that can translate that capital across each stack of the AI ecosystem layer!

Yet, the interesting take here is while capital will become skewed across a few winners, across almost all the layers stack, the vertical layer of enterprise AI, with very specialized, industry-specific AI models and solutions, might be the most spread out.

To recap:

Hardware, foundational, and consumer application layers will be winner-take-all, with very few players winning most market shares.

The vertical and application layers of enterprise AI will be more spread out, with a very complex market map of many AI-based providers in many niches that are not dissimilar to the SaaS market map you see today.

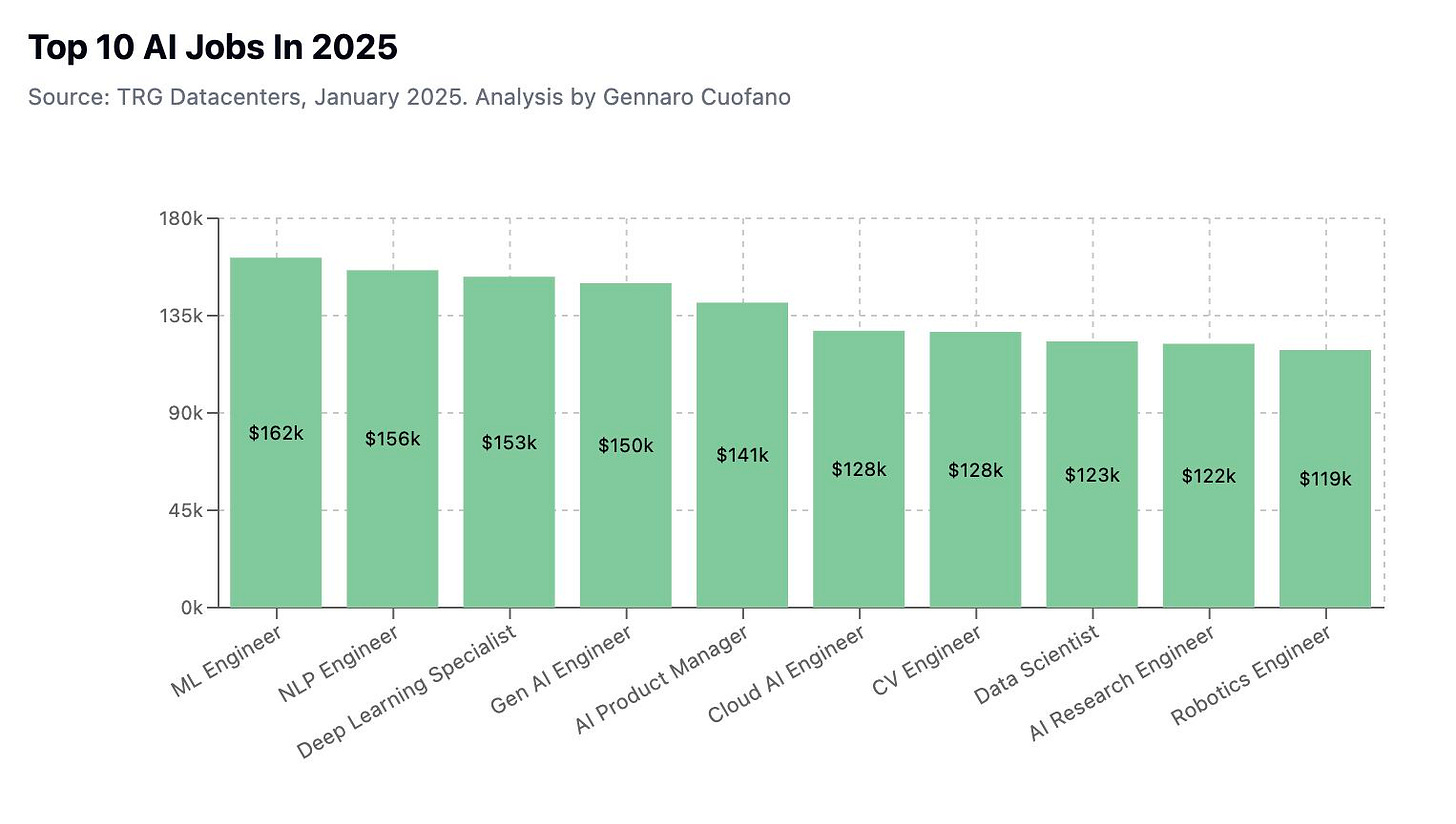

With the above in mind, I also stressed last week that in 2025, as the AI industry keeps developing, technical roles will be in high demand.

Junior Roles Down, Senior Roles Up, But There Is A Catch!

Systems engineers, cloud architects, and data engineers especially enable scalable AI deployments.

Developers and senior software engineers create AI applications while analysts and administrators maintain the efficiency of these systems.

As AI matures, the demand for technical expertise and adaptability is skyrocketing to stain the AI infrastructure being developed.

For now, it’s buzzy to say that AI will replace developers, yet the truth is that AI is replacing only bad or very junior developers while it’s compensating quite well the senior ones.

At the career level, there is bad news and good news. If you’re a junior technical person, it might be harder to find a job.

Yet, suppose you learn fast by using all the AI tools available to coders. In that case, you’ll be able to bootstrap your education to quickly become as competent as a senior technical person, thus becoming valuable in the market.

Thus, the sooner you get into a senior role, the faster you’ll be hired and the higher you’ll earn.

And again, the good news is, with the current AI paradigm, you might be able to do it fairly quickly, as you can jumpstart your career with these tools.

Also, last week, I pointed out how, with the "ChatGPT moment" in late 2022 and the ongoing redefinition of the industry through AI, enterprise businesses are still trying to figure out how to integrate AI into their core operations effectively.

This uncertainty has contributed to a 428% surge in AI-related C-suite roles, highlighting the growing demand for leadership to navigate this evolving and ambiguous landscape.

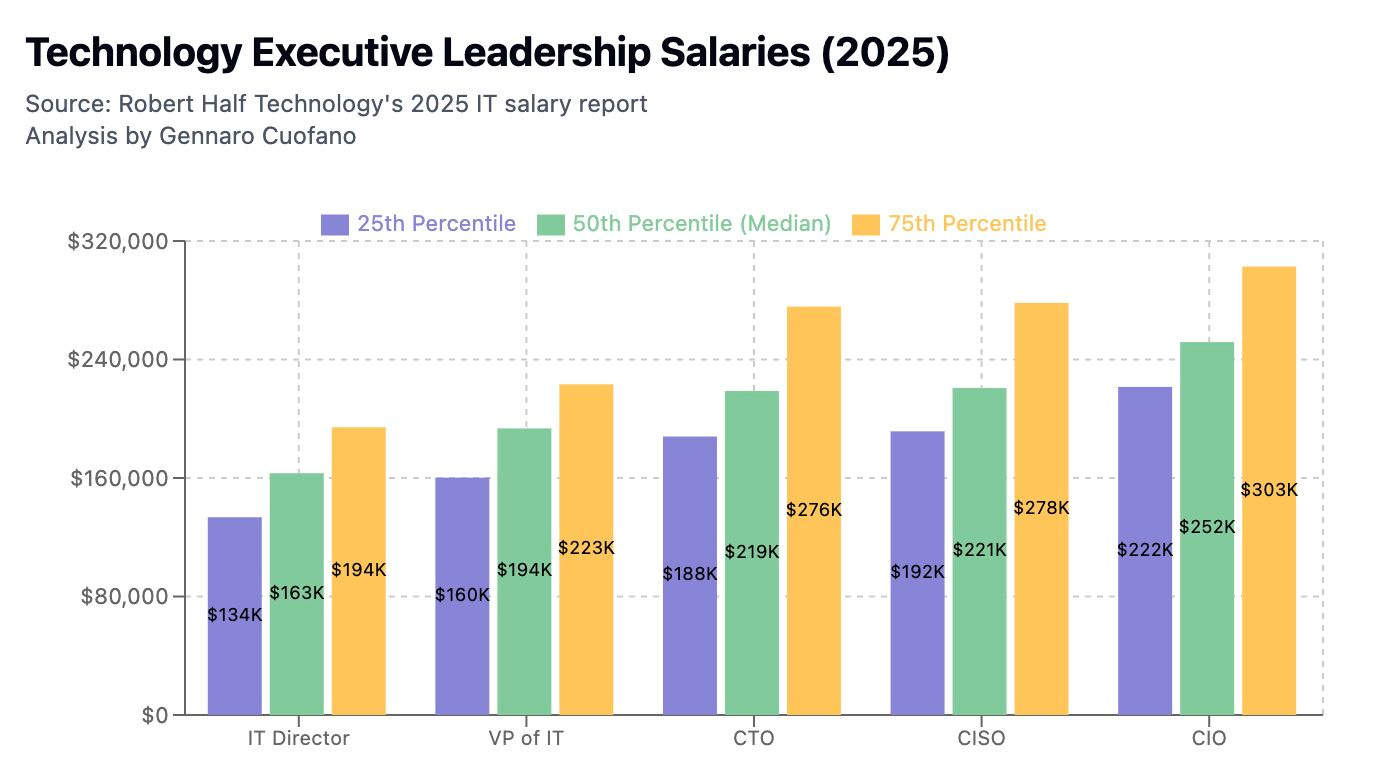

That’s also why, in 2025, there has been a spike in salaries for critical roles of IT executives, which signals the growing reliance on technology and AI for enterprise re-organizations.

The Disintermediated Middle-Management Organizational Layer (The End of The MBA?)

Yet, a key take from this current paradigm is that while leadership roles are critical for enterprise companies to figure out the next steps, that might not be the case for middle management, which is becoming a sort of “disintermediated organizational layer:”

The struggle of MBAs to quickly find top job opportunities has been the rule for the last few decades.

This might be both a signal of tech companies that are reducing the dependence of their organizations on the “middle-management” layer and a signal that many MBA candidates might not have realized yet that we live in a different world, thus refusing to take roles in smaller startups that will become the next incumbents.

Will this gap close again, or is it the end of the MBA?

Technological Leadership In High-Demand

In that context, instead, leadership roles, which are really able to drive the company’s strategy rather than check on other people’s productivity, are in high demand.

CIOs steer digital transformations, CISOs protect sensitive data, and CTOs spearhead innovation.

Their salaries reflect their strategic influence across enterprises.

As AI reshapes industries, these leadership roles are pivotal in guiding organizations through this technological change.

This might continue well into 2025-2026, so if you’re in one of these roles, kudos to you, as your job just got much harder but also much more valuable!

In addition, there is another interesting take here already, which is evident in the data: AI has already expanded the market for technical roles in all niches where, just a few years back, you could find really a few top researchers for each of these.

What’s the implication?

It’s a signal that AI is working in two directions to destroy jobs that don’t fit the new reality. At the same time, creating many jobs in many niches just a few years back was in the research domain.

In general, we might see a similar effect in the job market.

Among this roles, there is also the AI Product Manager, I might dedicate a whole issue to it…

Welcome to Aildorado

"Aildorado" represents the modern-day gold rush centered around AI, where the true wealth often lies not in mining for the "gold" (building the next breakthrough AI application) but in selling the "picks and shovels"—the essential tools and infrastructure needed for others to participate in the rush.

And that shows if you look at NVIDIA’s market shift in 2024:

The ecosystem of companies and entrepreneurs profiting by enabling the AI gold rush by selling "picks and shovels" are in these categories:

AI-based Cloud computing services (AWS, Azure, Google Cloud). Yet, these players will have to turn from Big Tech to Hyperscalers, which also means hundreds of billion dollars invested in AI infrastructure or specialized networking facilities optimized for AI training, inference, and reasoning!

Specialized hardware and architectures for AI (NVIDIA GPUs), AI architecture optimization companies, and anyone in the AI GPU supply chain.

Data Providers, like data labeling platforms, simulators, synthetic data providers, and anything in between.

AI development platforms that enable anyone to build AI tools.

AI models and APIs will be the foundational software layer of the whole ecosystem.

AI-SF Is Back Baby!

Global funding in 2024 reached $314 billion, a 3% increase from the previous year, with AI funding surging to $100 billion, up 80% year-over-year and accounting for nearly one-third of all funding.

The fourth quarter saw a significant boost, with funding hitting $93 billion, a 36% year-over-year increase, driven by billion-dollar rounds totaling $58.3 billion, led by AI companies like OpenAI and Databricks.

The U.S. dominated funding, with startups securing $178 billion, or 57% of the global total, and $90 billion concentrated in Silicon Valley.

The pandemic gave us the impression that location no longer mattered, yet the chart below speaks for itself.

AI has represented a renaissance for the Bay Area, with San Francisco, which could easily change its name to AI-SF.

Late-stage funding surged, increasing 70% quarter-over-quarter to reach $61 billion in Q4, while early-stage funding remained flat, focused on areas like AI, robotics, and biotech. However, seed funding declined to $7 billion, a 16% year-over-year drop.

Liquidity improved slightly, with M&A activity rising, but the IPO market remained slow, capped by ServiceTitan’s strong performance.

Looking ahead, a more positive IPO market in 2025 is expected to boost venture fund investments, creating new opportunities for growth and innovation.

Paris down

France’s generative AI startup ecosystem remains vibrant, with AI driving much of its venture funding stability in 2024; there are a few caveats.

Total venture funding reached €7.1 billion, slightly up from €6.8 billion in 2023 but significantly below the €11.8 billion peak in 2022.

AI investment surged by 82% year-over-year, now representing 27% of all venture funding, while non-AI funding fell by 11%, highlighting the sector’s growing reliance on AI innovation.

France remains Europe’s third-largest tech ecosystem, behind the U.K. and Germany, with Paris ranking as the second-largest European city for tech funding after London.

The country added three new unicorns in 2024—Pennylane, Pigment, and Poolside—bringing its total unicorn count to 45. However, large-scale bankruptcies from startups like Ynsect, Cubyn, Luko, and Cityscoot underscore challenges posed by macroeconomic conditions.

Promising French AI startups include Mistral AI, Owkin, Aqemia, PhotoRoom, Dust, and Poolside. Several late-stage companies, such as Back Market, Dataiku, Doctolib, Qonto, and Content Square, are nearing IPO readiness, though most are expected to list in the U.S., given domestic IPO market challenges.

Exit activity saw a 14% decline in volume, although exit value held steady at €12 billion for the third consecutive year.

Reduced participation from U.K. investors raises concerns about the ecosystem’s future funding prospects, with British funding historically playing a key role in France’s growth.

Indeed, the UK, out from the EU, is focusing back on London.

The UK Plan for Change

The U.K. has unveiled a £14 billion “Plan for Change” to accelerate AI development, aiming to create 13,250 new jobs and establish AI Growth Zones, a National Data Library, and a new supercomputer.

This ambitious initiative shifts focus toward economic gains, setting aside earlier concerns about AI safety and ethics.

Massive AI Investment: The plan includes £14 billion ($17 billion) in funding, with significant contributions from private tech firms, and government-backed initiatives to drive AI innovation.

AI Growth Zones: The first zone is in Culham, Oxfordshire, featuring supercomputers, data centers, and dedicated AI R&D hubs, providing infrastructure to support advanced AI research and applications.

National Data Library: A centralized resource for storing and utilizing public data, aimed at enabling more efficient AI development and fostering collaboration across sectors.

Focus Shift: The government has deprioritized safety and ethical concerns to maximize economic benefits, signaling a clear pivot toward growth-driven policies.

Global AI Standing: As the third-largest AI market globally, the U.K. aims to solidify its position through targeted investments and strategic policymaking, reinforcing its role as a leader in the AI space.

London Up

London has solidified its position as the third global AI innovation hub, following New York and San Francisco.

In 2024, London-based AI startups raised a record $3.5 billion, a 52% increase from 2023, accounting for 32% of the city’s total VC funding and cementing its status as Europe’s AI leader.

Health AI startups in London raised $556 million, the second-highest annual total, with 33 companies, including Flo Health, Huma, and LabGenius, securing funding.

The city also saw the emergence of eight new unicorns, such as Wayve, Lighthouse, and ElevenLabs, reflecting its growing strength in AI-driven innovation.

Mega funding rounds included 20 deals exceeding $100 million, featuring companies like Wayve, Monzo Bank, and Flo Health. London’s venture capital firms raised $9.9 billion, nearly doubling the $5 billion raised in 2023, showcasing a boom in VC fundraising.

As part of its 10-year Growth Plan, London aims to focus on AI and life sciences, reinforcing its role as a global hub for talent, innovation, and partnerships.

The city’s strong universities, supportive regulations, and vibrant tech and creative sectors make it a top destination for AI talent. Record investments are driving job creation and innovation, with startups addressing real-world challenges across various industries.

Synthesia, another UK-based AI startup enabling businesses to create lifelike video avatars, also raised $180 million in a Series D round led by NEA Management, doubling its valuation to $2.1 billion. Synthesia is the latest one of Britain’s largest AI unicorns.

Also, London-based Nothing, a smartphone startup backed by Google Ventures and Tony Fadell, is raising $100 million in Series C funding to expand operations.

Founded in 2021 and led by OnePlus co-founder Carl Pei, it has surpassed $1 billion in lifetime sales and is exploring new markets beyond phones and wearables.

Might the next hardware form factor for AI coming out of London?

As someone based here, that would be epic to watch!

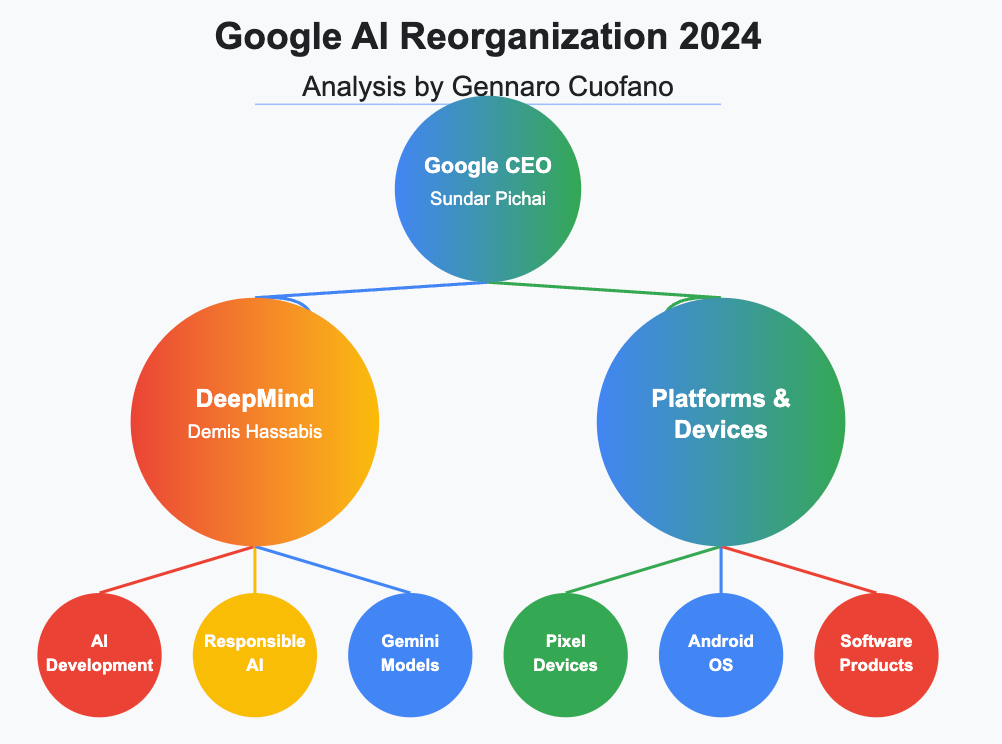

Google’s AI Re-Orged To The Catch Last AI-Consumer Search Train

The strength of Google has always been its bottom-up consumer traction. Without it, there would be no Google.

That’s why Google, as a consumer-first company, is aware that not having an AI product as strong as ChatGPT would disrupt its core search business model.

If Google doesn’t aggressively gain market shares by this year to ChatGPT, with an AI native product detached from search, Google might have lost the “AI Chatbots” train for good.

Google consolidated more AI teams into its London-based DeepMind division, led by Demis Hassabis, to streamline development and enhance its AI research-to-deployment pipeline.

Teams managing the AI Studio developer platform and Gemini API are moving to DeepMind, following earlier transfers of the Gemini chatbot and responsible AI teams.

Indeed, Google’s Gemini AI aims to rival ChatGPT with a target of 500 million users by 2025. Will it achieve that?

Also, we’re witnessing the rise of Demis Hassabis. Is it possible for the next Google CEO to lead from his London office?

Microsoft AI Re-Orged In a Bloody Enterprise Race With Salesforce

Following Google’s recent reorganization under Google DeepMind, Microsoft has launched CoreAI – Platform and Tools, a new division unifying AI Platform, Dev Div, and other key teams. Led by Jay Parikh, CoreAI focuses on advancing AI-first applications and infrastructure, including Azure-powered AI, Copilot development, and agentic tools to reshape software development.

This change reflects a broader AI platform shift in 2025, as model-forward applications transform the software stack, compressing decades of technological evolution into a few years. Microsoft’s vision centers on a new AI-first app stack, prioritizing agentic applications with memory, entitlements, and action space, along with innovative UI/UX patterns and tools.

Azure will act as the foundation for AI infrastructure, powered by platforms like Azure AI Foundry, GitHub, and VS Code. The creation of CoreAI unites Microsoft’s engineering teams, including Dev Div, AI Platform, and groups from the Office of the CTO, into a single organization to streamline development.

Under Jay Parikh’s leadership, CoreAI will focus on Copilot, AI development stacks, and enhancing developer productivity, with an emphasis on operating as “One Microsoft” to drive innovation, accountability, and customer satisfaction. This restructuring highlights Microsoft’s commitment to AI-driven transformation and customer-centric solutions.

Salesforce AI Re-Orged To Survive And Dominate The Enterprise AI Wave

You might think the Microsoft re-org is all to compete against Google, but in reality, this is a bloody war for who grabs most of the enterprise market, and Salesforce is quite good at that…

I’ve been tracking the Salesforce average revenue per enterprise customer for years, and that’s impressive.

Indeed, Salesforce has already organized to be quite competitive in this phase…

As it ramps up AI product sales, Salesforce is hiring 2,000 AI-focused salespeople, doubling its previous target.

With Marc Benioff right back at it!

Indeed, the next-gen Agentforce AI agent will launch in February 2025 and enhance customer support efficiency.

Salesforce’s AI tools reduce human escalations and position the company as a leader in AI-powered customer service solutions.

Salesforce is perfectly applying the incumbent playbook to stay on top of a new, developing market!

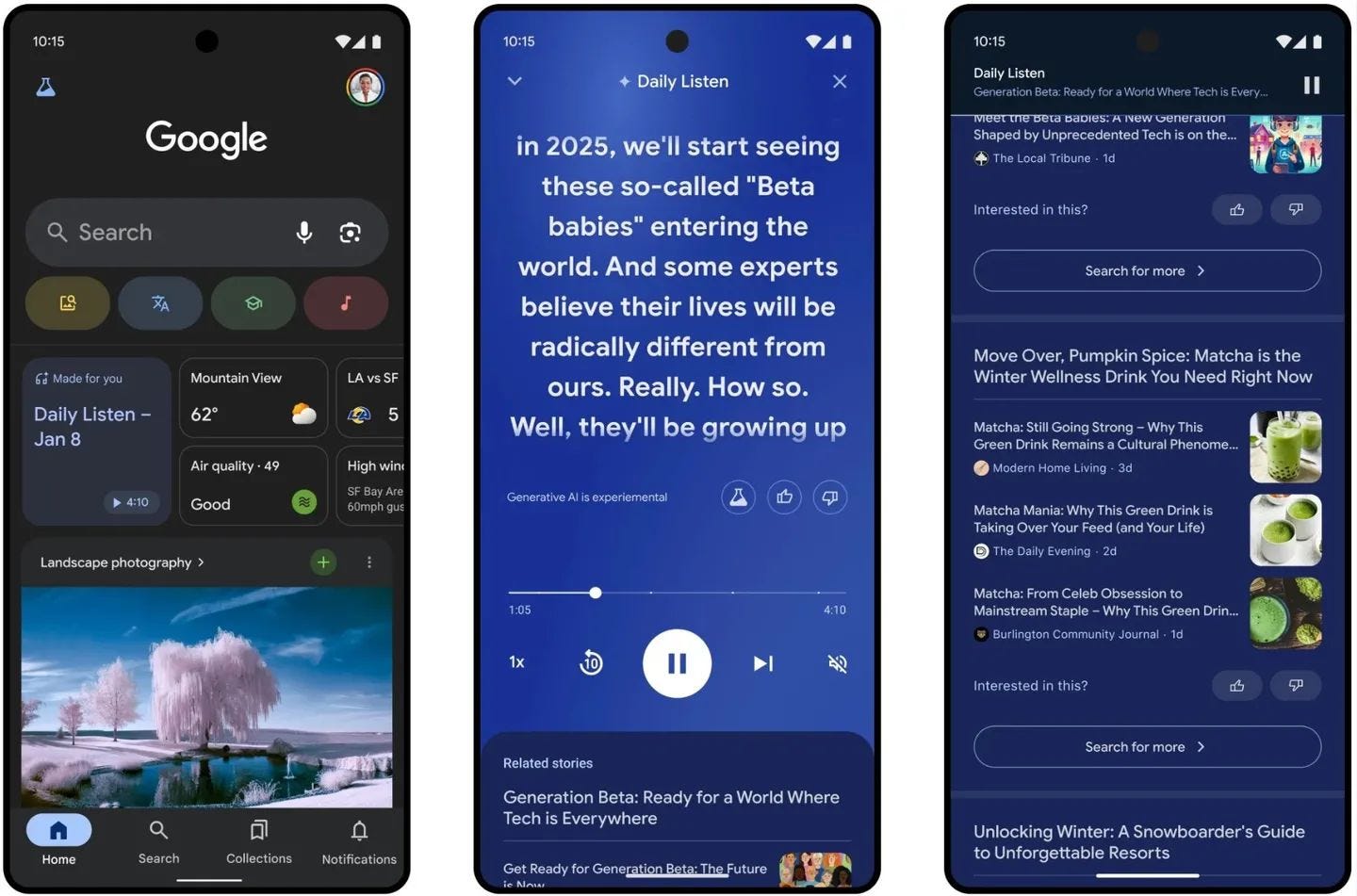

NotebookLM Wins The Prize for The Coolest AI product by Google so far

As NotebookLM has probably become the most successful AI app Google has launched so far, it seems the company is further testing an experimental “Daily Listen” feature, which generates five-minute AI podcasts summarizing news based on users’ Search and Discover feed history.

Available in Search Labs for US Android and iOS users, it offers playback controls, transcripts, and related story recommendations.

A broader public release is unconfirmed but could follow AI Search Overviews’ rollout.

Can AI Resurrect Alexa?

If it’s not clear to you, Amazon has already turned into an AI infrastructure player; I’ve explained it here:

That is why Amazon is redesigning Alexa with generative AI to transform it into an advanced assistant capable of practical tasks like personalized recommendations and smart home control.

Yet the company is facing many technical challenges, including addressing hallucinations, reliability, and integration with legacy systems.

Leveraging Nova models, Amazon aims for scalable, customer-focused AI while exploring monetization through subscriptions and sales cuts.

OpenAI Turning Agentic

OpenAI’s ChatGPT has introduced a new “tasks” feature in beta, enabling paying users to schedule reminders and recurring requests, marking a step toward more advanced, agentic AI systems. Available for Plus, Team, and Pro users, this functionality reflects OpenAI’s efforts to expand ChatGPT’s practical capabilities.

The tasks feature allows users to set reminders like “Remind me when my passport expires in six months” or recurring actions such as “Provide a daily news briefing at 7 a.m..” While currently limited, it enables ChatGPT to act semi-independently by handling scheduled tasks, signaling OpenAI’s move toward more autonomous AI agents.

Access to tasks is provided through ChatGPT’s web app under a dedicated tasks manager tab, allowing users to create and manage tasks across platforms. However, the feature has limitations—it cannot perform continuous background actions or make purchases. For instance, it can check monthly for concert tickets but cannot notify users immediately upon availability or complete purchases.

OpenAI is using this beta rollout to understand user engagement before expanding the feature to the mobile app and free tier. Future plans include introducing more advanced agents, such as “Operator,” capable of handling complex tasks like coding or booking travel, paving the way for a new era of AI-driven assistance.

Recap: In This Issue!

AI Industry Trends:

AI Funding Dominance: AI accounts for 35.7% of global VC funding ($100B in 2024), with the U.S. contributing nearly half.

"Winner-Take-All" Trend: Hardware, foundational, and consumer AI layers concentrate power among a few players, while enterprise AI remains fragmented.

Global AI Growth: London, San Francisco, and Paris are leading AI hubs, with significant funding and innovation across regions.

Job Market Shifts:

Technical Roles in Demand: High demand for systems engineers, cloud architects, and senior developers, while junior roles face challenges.

Leadership Growth: 428% surge in AI C-suite roles reflects the need for strategic vision in navigating AI transformations.

Middle Management Decline: Middle management (e.g., MBAs) faces reduced importance as organizations flatten structures.

Regional Focus:

London: Cemented as Europe’s AI leader, raising $3.5B in AI funding with strong health AI and unicorn growth.

France: AI funding surged by 82%, despite challenges in IPO activity and U.K. investor pullback.

U.K. Plan for Change: £14B initiative emphasizes AI innovation with Growth Zones, National Data Library, and supercomputing hubs.

Key Corporate Moves:

Google DeepMind: Reorganizes to push Gemini AI and compete in consumer AI.

Microsoft CoreAI: Focuses on AI-first applications, Copilot tools, and unifying development teams.

Amazon: Redesigns Alexa with generative AI, aiming for smarter and practical capabilities.

Innovations and Future Outlook:

OpenAI’s Agentic Shift: Introduced “tasks” for ChatGPT, signaling a move toward autonomous AI systems.

Enterprise AI Growth: Specialized models spread across industries, mirroring the SaaS market evolution.

"Aildorado" Economy: Companies profiting from AI infrastructure (e.g., NVIDIA, AWS) reflect the "picks and shovels" of the AI gold rush.

With Massive ♥️ Gennaro, The Business Engineer

![Navigating The AI Supercycle [Video Version]](https://substackcdn.com/image/fetch/$s_!2_TI!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-video.s3.amazonaws.com%2Fvideo_upload%2Fpost%2F154910360%2F53e6608e-b2f4-4f0d-8007-33172839dbb9%2Ftranscoded-360419.png)