This Week In AI Business: Big Tech & The AI Power Map [Week #45-2025]

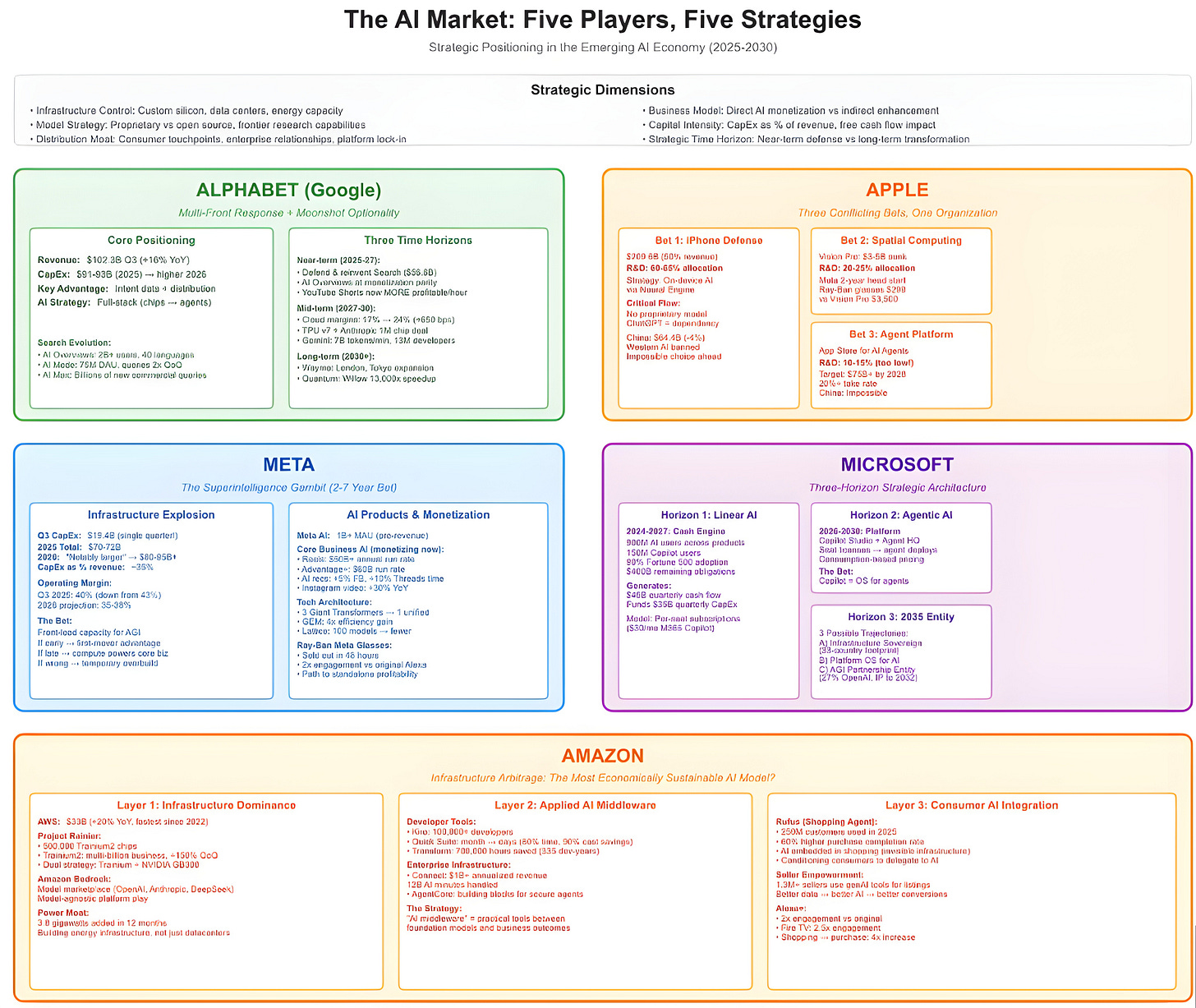

We are at a critical juncture in AI, where the market is finally taking shape in a way that allows each AI player to carve its own niche/vertical, giving us a view into how this market might consolidate in the coming decade.

Let’s see how each of these players is positioned in this market.

For the sake of this analysis, I’m focusing on five players who defined digital distribution in the last decades (Google, Apple, Meta, Microsoft, and Amazon), to assess what and if they’ll play a key role in the future AI market, and how each of these players is evolving.

The AI Bundle is available for purchase below to all subscribers of The Business Engineer.

Read Also:

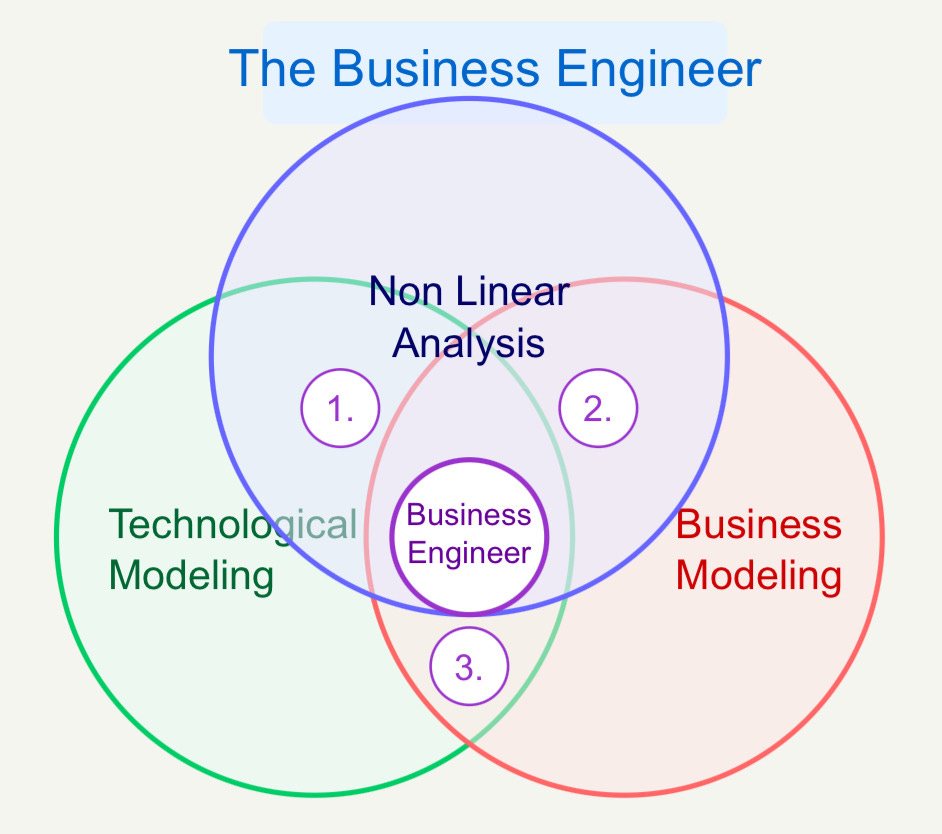

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.