This Week In AI Business: The Shape of The AI Economy [Week #47-2025]

What’s the shape of the AI market? Is it a monopoly, oligopoly, or a completely fragmented market? Well, the answer will surprise you, as the shape of it will really be determined by the vertical market dynamics, and there is no single answer to it.

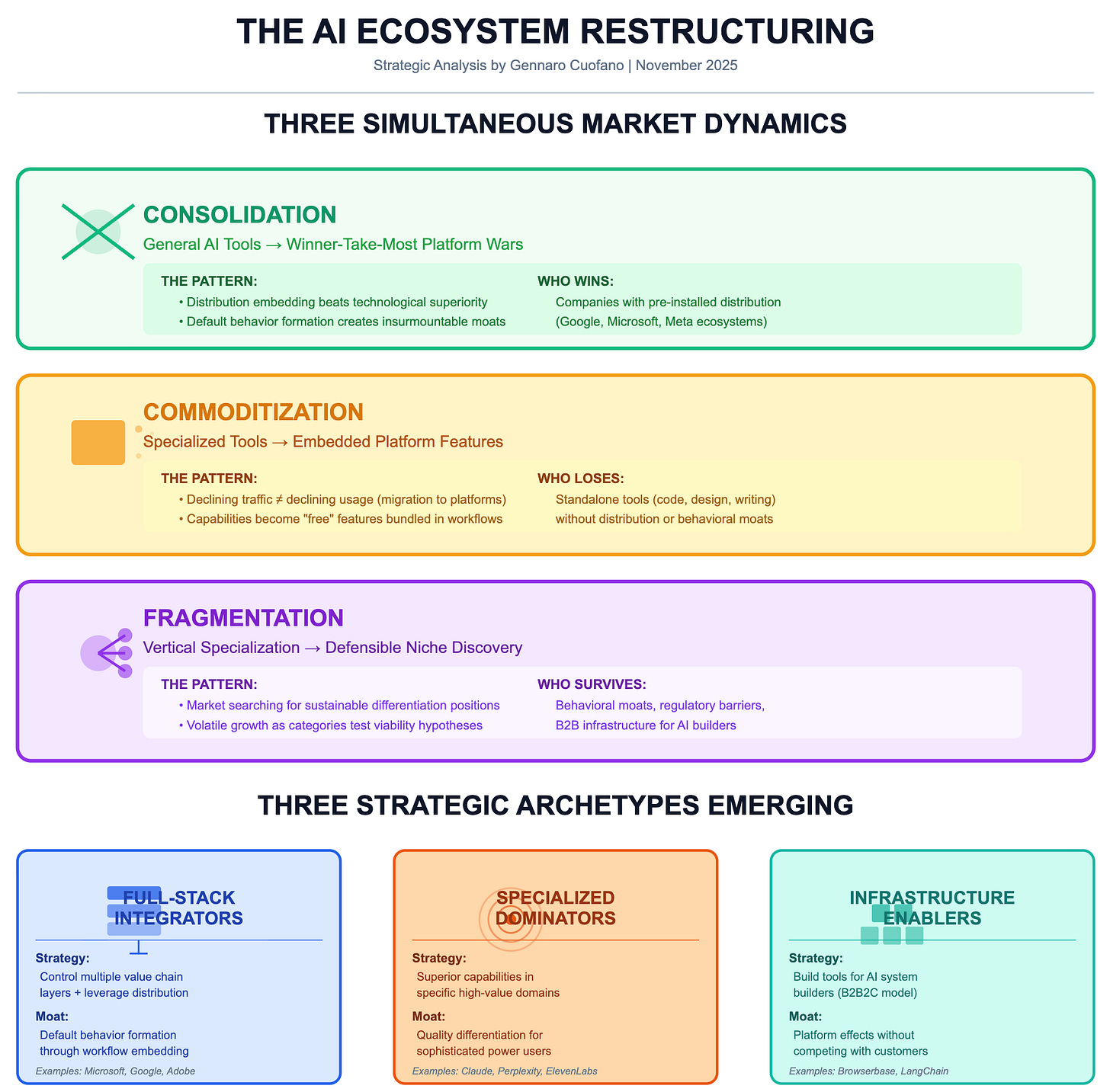

The Similarweb traffic data ending November 2025 reveals a fundamentally bifurcated AI ecosystem experiencing simultaneous consolidation, commoditization, and fragmentation across different value chain layers. This analysis identifies three distinct market dynamics:

THE CONSOLIDATION LAYER (General AI Tools): Winner-take-most dynamics with 7% YoY growth dominated by infrastructure players leveraging distribution advantages.

THE COMMODITIZATION LAYER (Code/Design/Content Tools): Collapsing traffic (-16% to -8% YoY) as capabilities become embedded features rather than standalone products.

THE FRAGMENTATION LAYER (Vertical Applications): Emerging specializations showing volatile growth as the market searches for sustainable differentiation.

The critical insight: We’re witnessing the end of the “AI tool” category and the beginning of “AI-augmented everything.” Traffic patterns reveal which players are winning the platform wars, which categories are being absorbed, and where value will concentrate in the next phase.

Read Also:

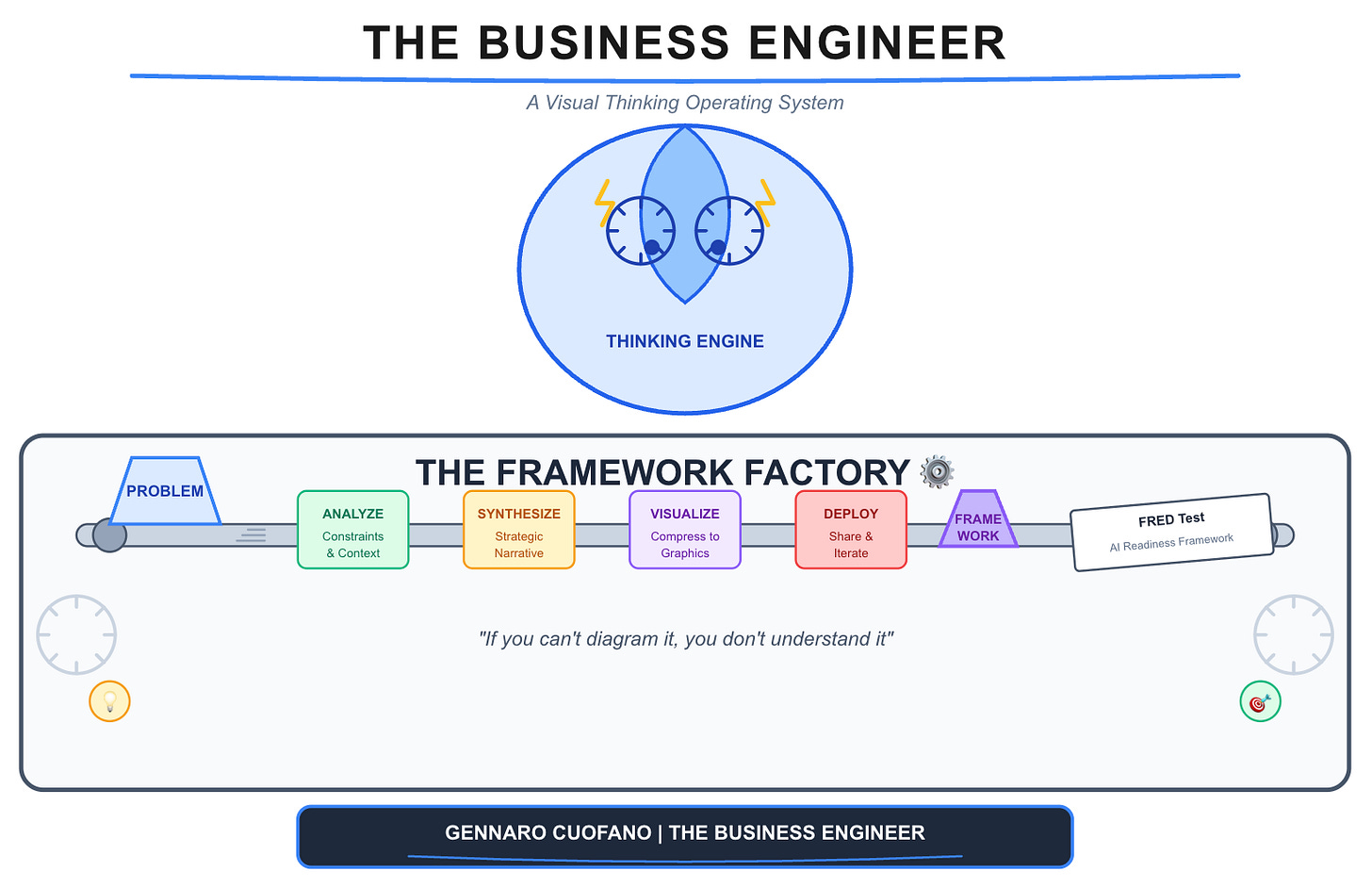

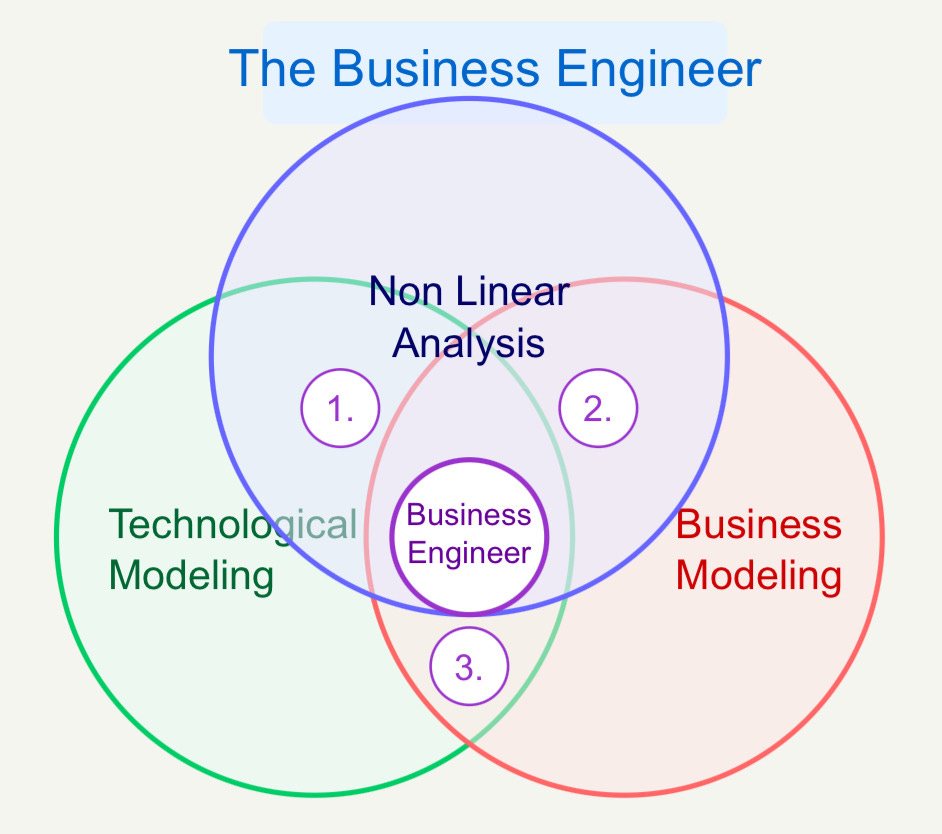

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.