Physical AI Is Crossing the Manufacturing Chasm

This Week In Business AI [Week #5-2026]

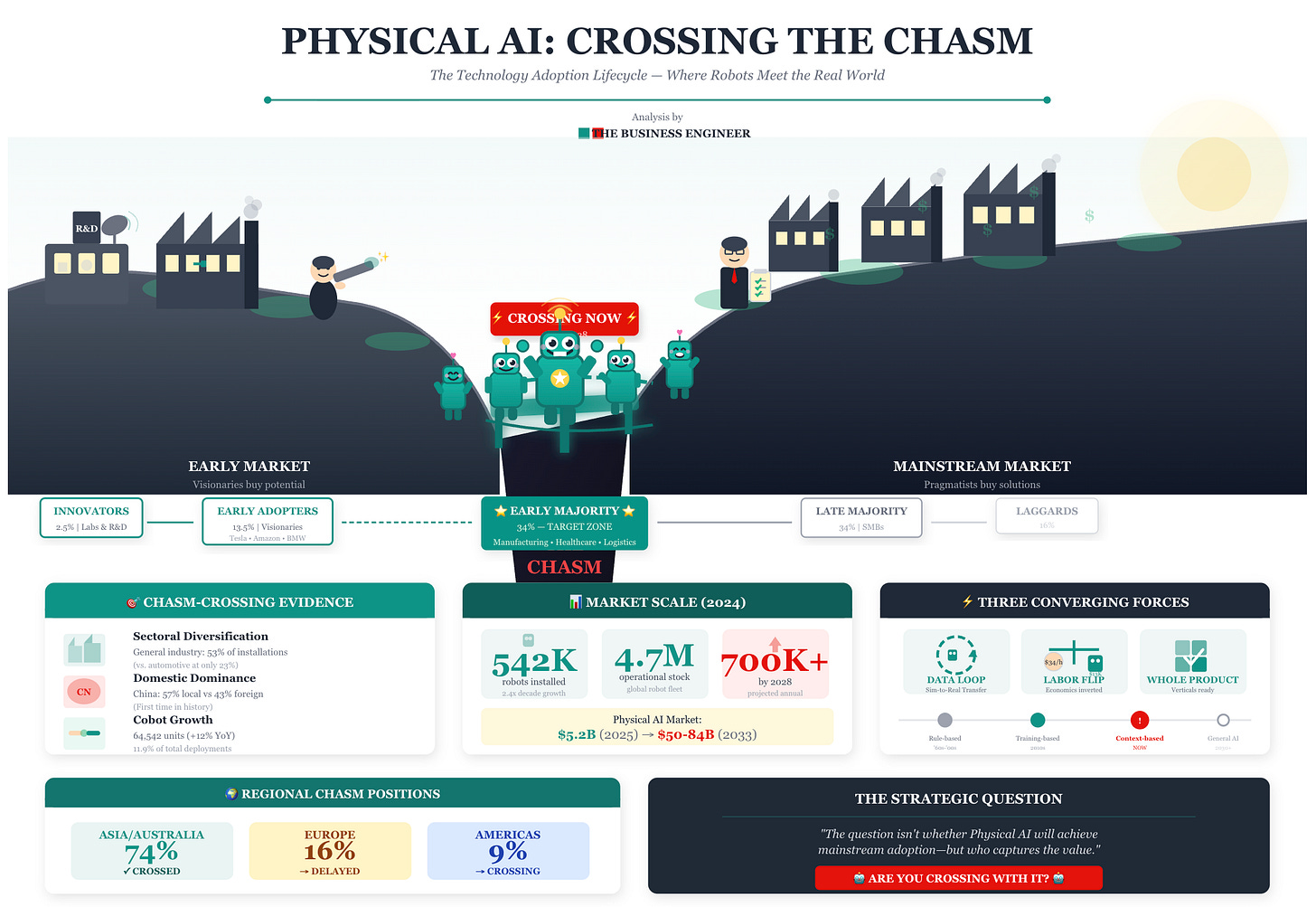

Physical AI, the convergence of artificial intelligence with robots that perceive, decide, and act in the real world, has reached the critical inflection point Geoffrey Moore identified as “crossing the chasm.”

Not though just any chasm, but a very relevant one, to make it succeed: the manufacturing chasm.

In short, the technology is transitioning from early adopter territory (visionary manufacturers, tech giants, and well-funded pilots) into the early majority of pragmatic industrial buyers who demand proven ROI, whole product solutions, and reference customers in their own industries.

The evidence is structural: 542,000 industrial robots installed globally in 2024 (double the figure from a decade ago), 4.7 million robots now in operational use, and—critically—general industry now accounts for 53% of robot installations, overtaking the traditional automotive stronghold (23%) for the first time. This sectoral diversification signals that robotics is no longer a technology enthusiast's toy or an automotive-exclusive tool. It’s becoming industrial infrastructure.

The strategic question isn’t whether Physical AI will achieve mainstream adoption—the IFR forecasts 700,000+ annual installations by 2028—but who captures the value as the technology moves from high-variability visionary deployments to standardized pragmatic solutions.

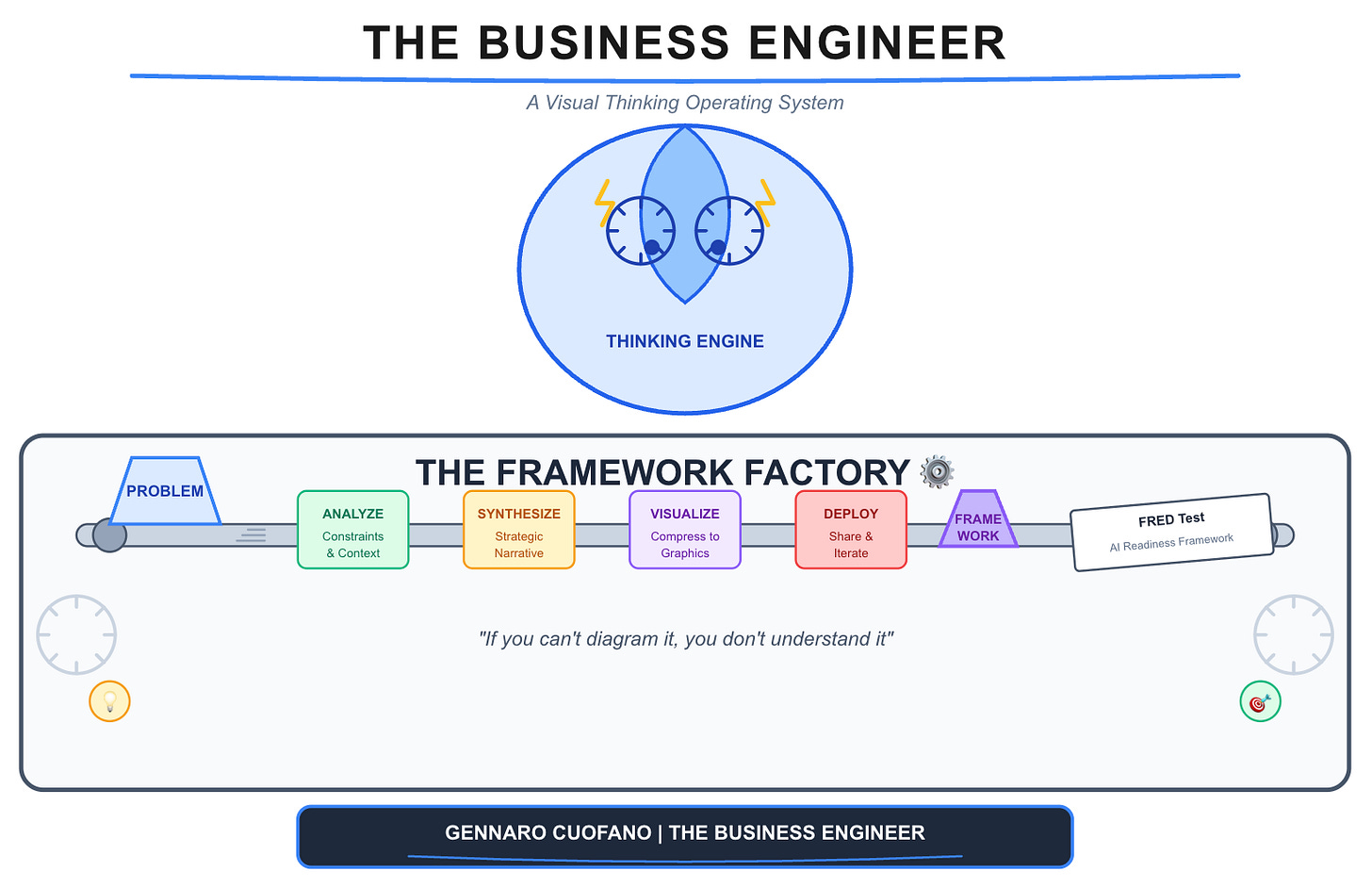

I sit down with you to understand what business goals you want to achieve in the coming months, then map out the use cases, and from there embed the BE Thinking OS into the memory layer of ChatGPT or Claude, for you to become what I call a Super Individual Contributor, Manager, Executive, or Solopreneur.

If you need more help in assessing whether this is for you, feel free to reply to this email and ask any questions!

You can also get it by joining our BE Thinking OS Coaching Program.

Read Also:

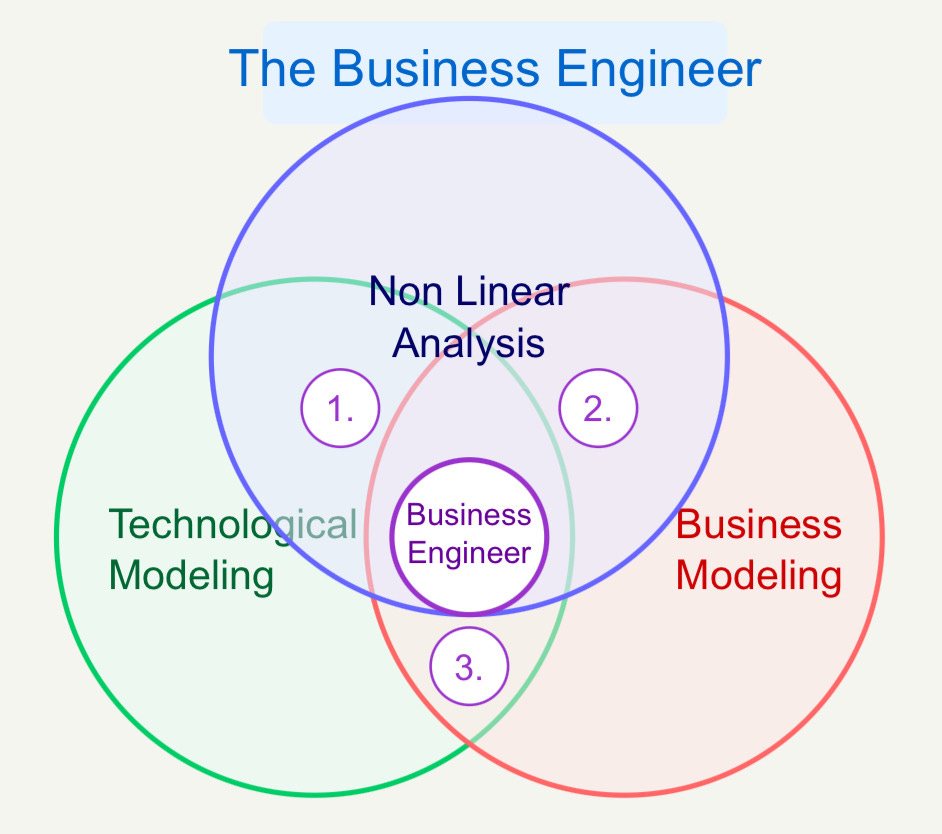

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.