The Venture Capital OS for SaaS

This Week In Business AI [Week #1-2026]

The SaaS industry is undergoing a fundamental structural transformation. The traditional middle market, companies with $20-100K ACV, sales-assisted motions, and feature-based differentiation, is being crushed between two extremes.

This is not a cyclical trend or a temporary market correction. It is a permanent structural shift driven by four converging forces: AI commoditization, zero-marginal-cost economics, buyer sophistication, and the end of ZIRP.

For investors, this bifurcation demands a complete rethinking of the SaaS investment thesis. The old playbook, ”find product-market fit, grow fast, figure out unit economics later, land SMB and expand to enterprise,” no longer works. In fact, it destroys capital.

The new investment mandate is simple but unforgiving: every deal must be classified as Floor or Ceiling from day one. There is no optionality premium for the middle. There is no “we’ll go enterprise later.” There is only structural reality.

Key Thesis: Middle-market SaaS companies face a 60%+ probability of total capital loss. The only viable investment strategies are Floor (viral, zero-CAC, AI-native) or Ceiling (deep integration, high NRR, irreversibility premium).

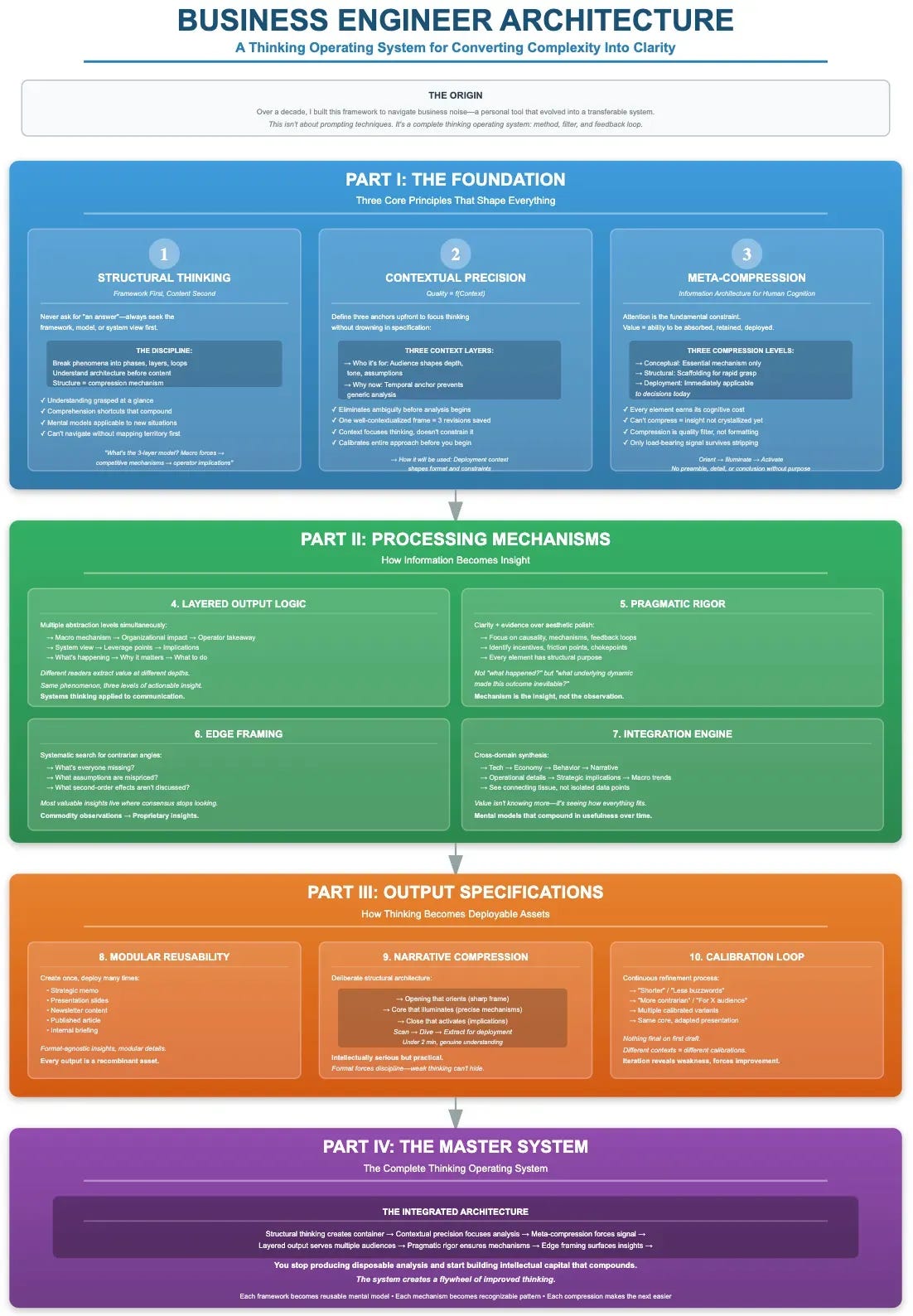

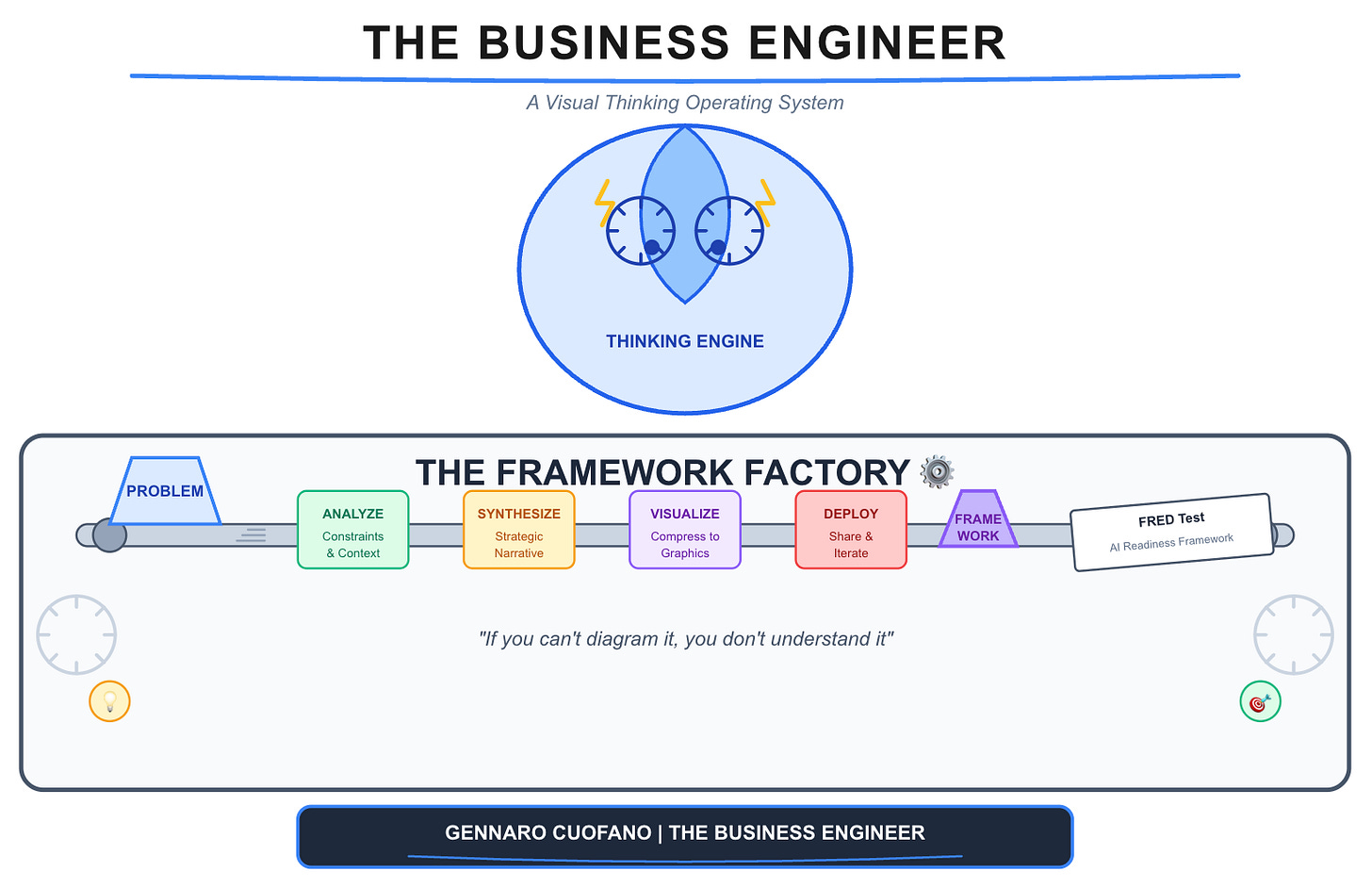

I sit down with you to understand what business goals you want to achieve in the coming months, then map out the use cases, and from there embed the BE Thinking OS into the memory layer of ChatGPT or Claude, for you to become what I call a Super Individual Contributor, Manager, Executive, or Solopreneur.

If you need more help in assessing whether this is for you, feel free to reply to this email and ask any questions!

You can also get it by joining our BE Thinking OS Coaching Program.

Read Also:

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

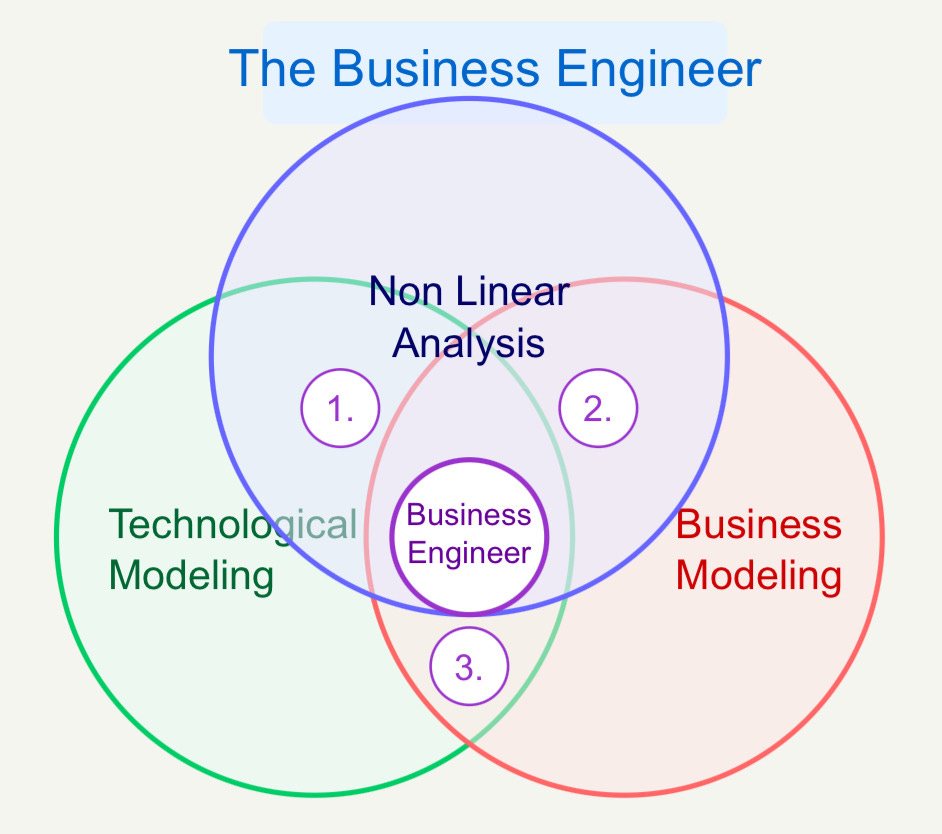

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.