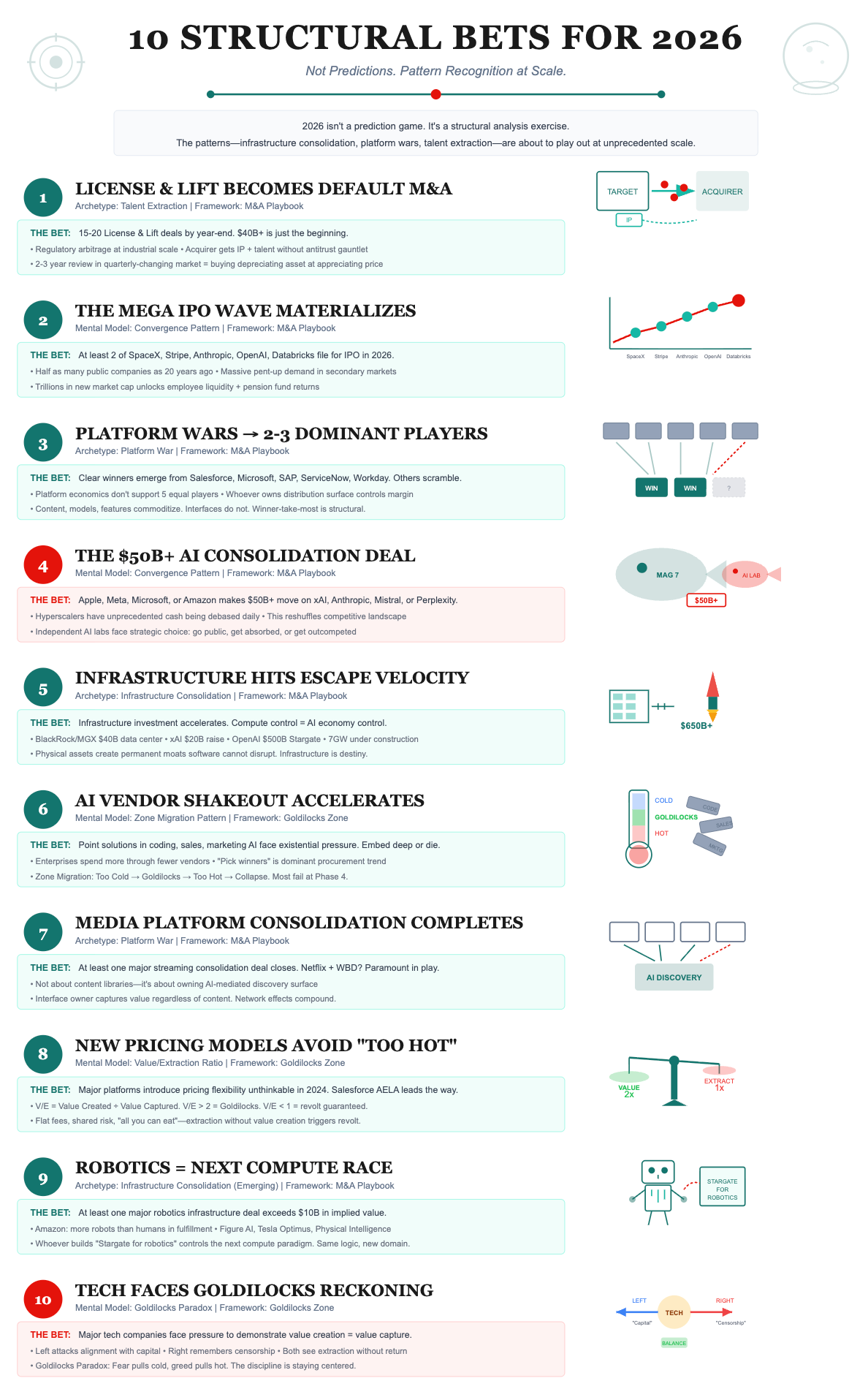

The Business Engineer's Top 10 Bets for 2026

This Week In Business AI [Week #2-2026]

More than a prediction game. This is a structural analysis exercise.

The patterns we’ve been tracking, infrastructure consolidation, platform wars, talent extraction, and embedding dynamics, are about to play out at unprecedented scale.

Here are the 10 bets that follow logically from the frameworks.

If you want to see the reasoning, mental models, and why these bets might consolidate in 2026, keep reading!

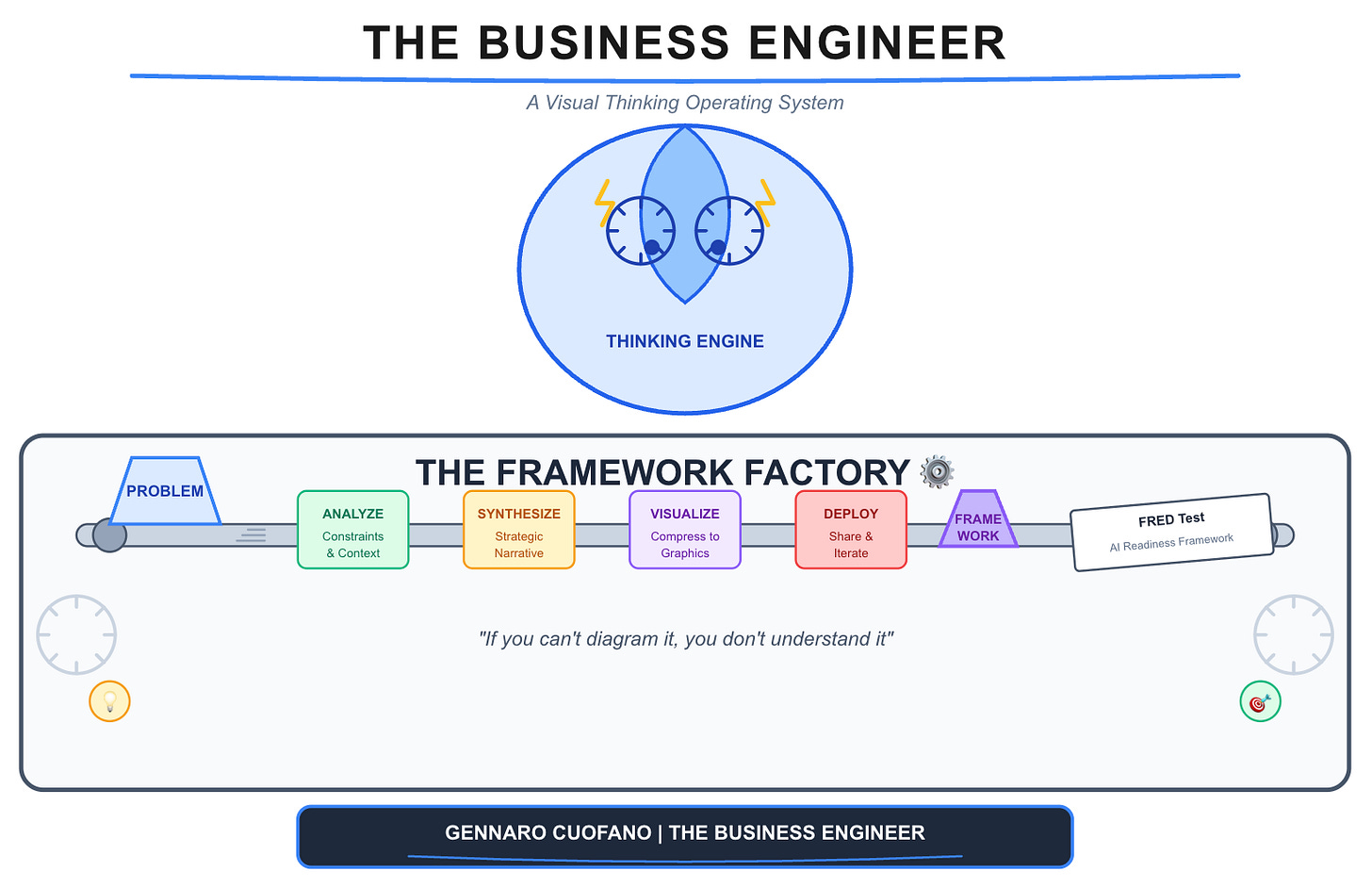

I sit down with you to understand what business goals you want to achieve in the coming months, then map out the use cases, and from there embed the BE Thinking OS into the memory layer of ChatGPT or Claude, for you to become what I call a Super Individual Contributor, Manager, Executive, or Solopreneur.

If you need more help in assessing whether this is for you, feel free to reply to this email and ask any questions!

Read Also:

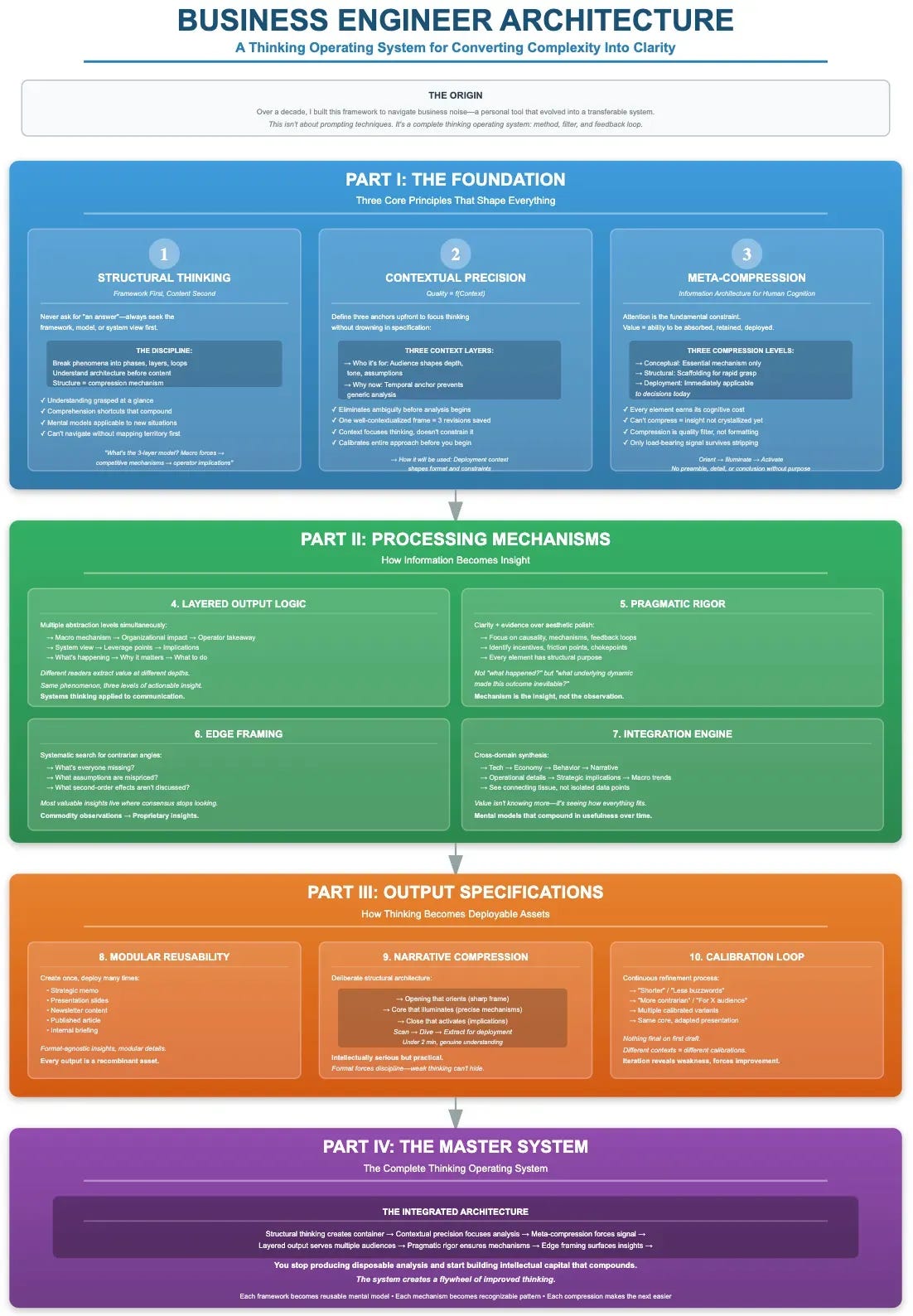

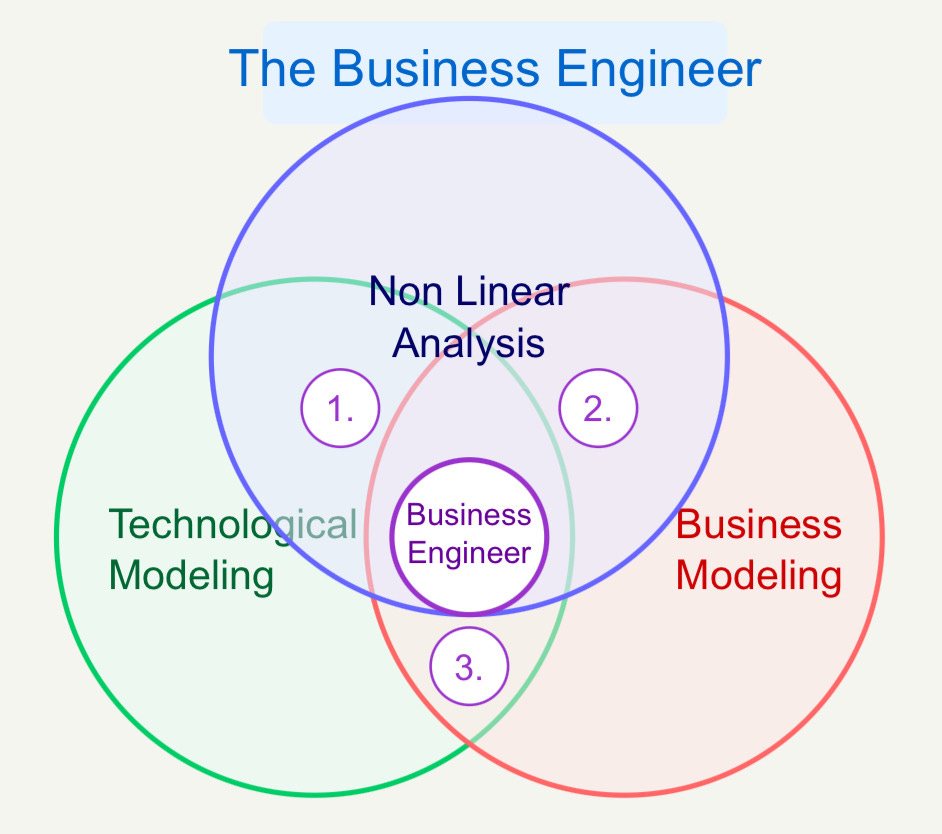

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.

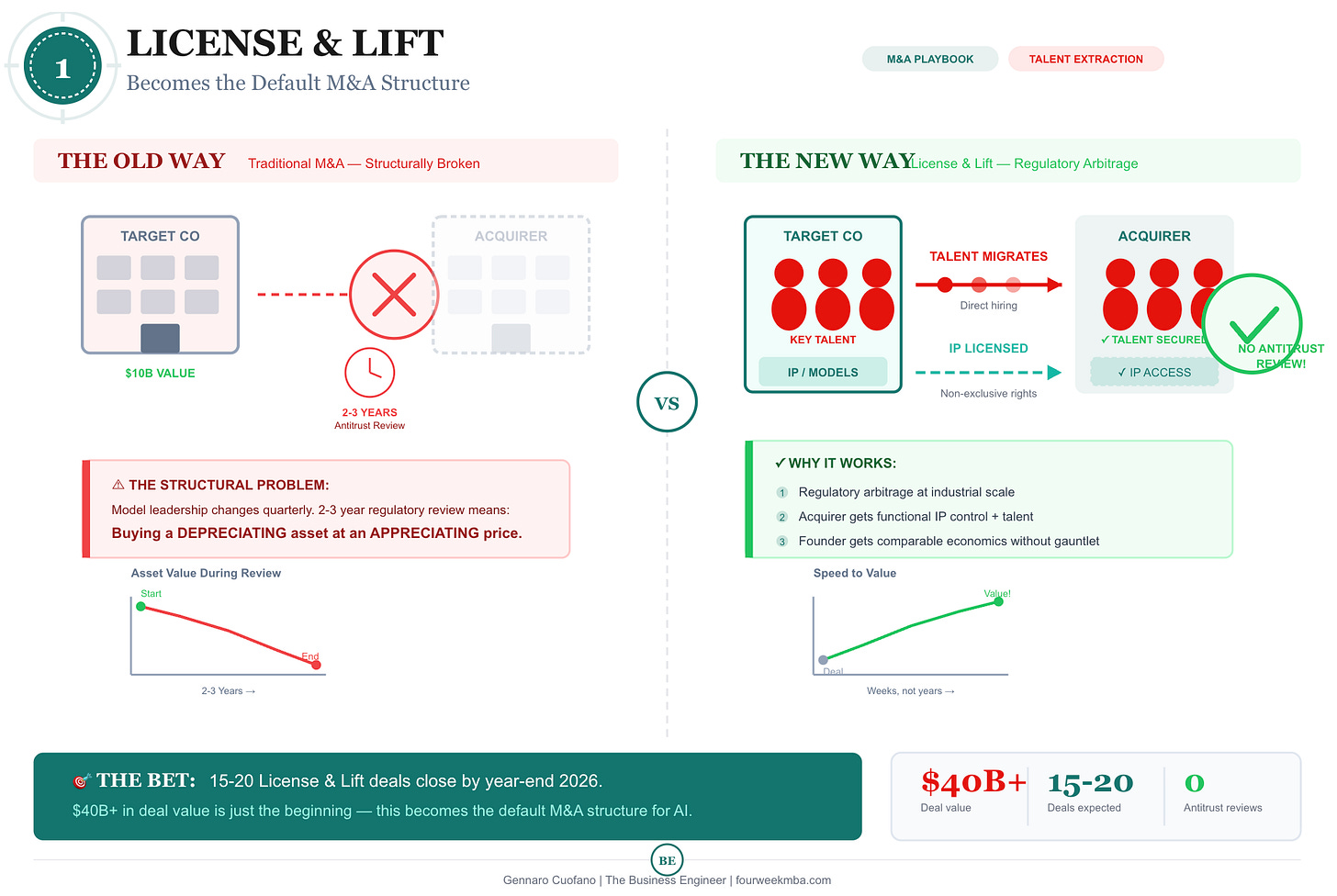

Bet #1: License & Lift Becomes the Default M&A Structure

The Pattern: Traditional M&A is structurally broken for transformational AI deals. A 2-3 year regulatory review in a market where model leadership changes quarterly means you’re buying a depreciating asset at an appreciating price.

The Bet: “License & Lift” deals—IP licensing plus talent migration—become the dominant deal structure for AI capability acquisition. By year-end, expect 15-20 of these deals with increasingly sophisticated structures.

Why It Matters:

Regulatory arbitrage at industrial scale

The $40B+ in License & Lift deals is the beginning, not the end

Acquirer gets functional IP control + talent

Founder gets comparable economics without regulatory gauntlet

BE Analysis: The M&A Playbook of the AI Economy

Mental Model: Archetype 3: Talent Extraction

License & Lift lets big tech acquire capabilities without triggering antitrust review. In AI, talent is the scarce resource—regulation shapes how it’s acquired.

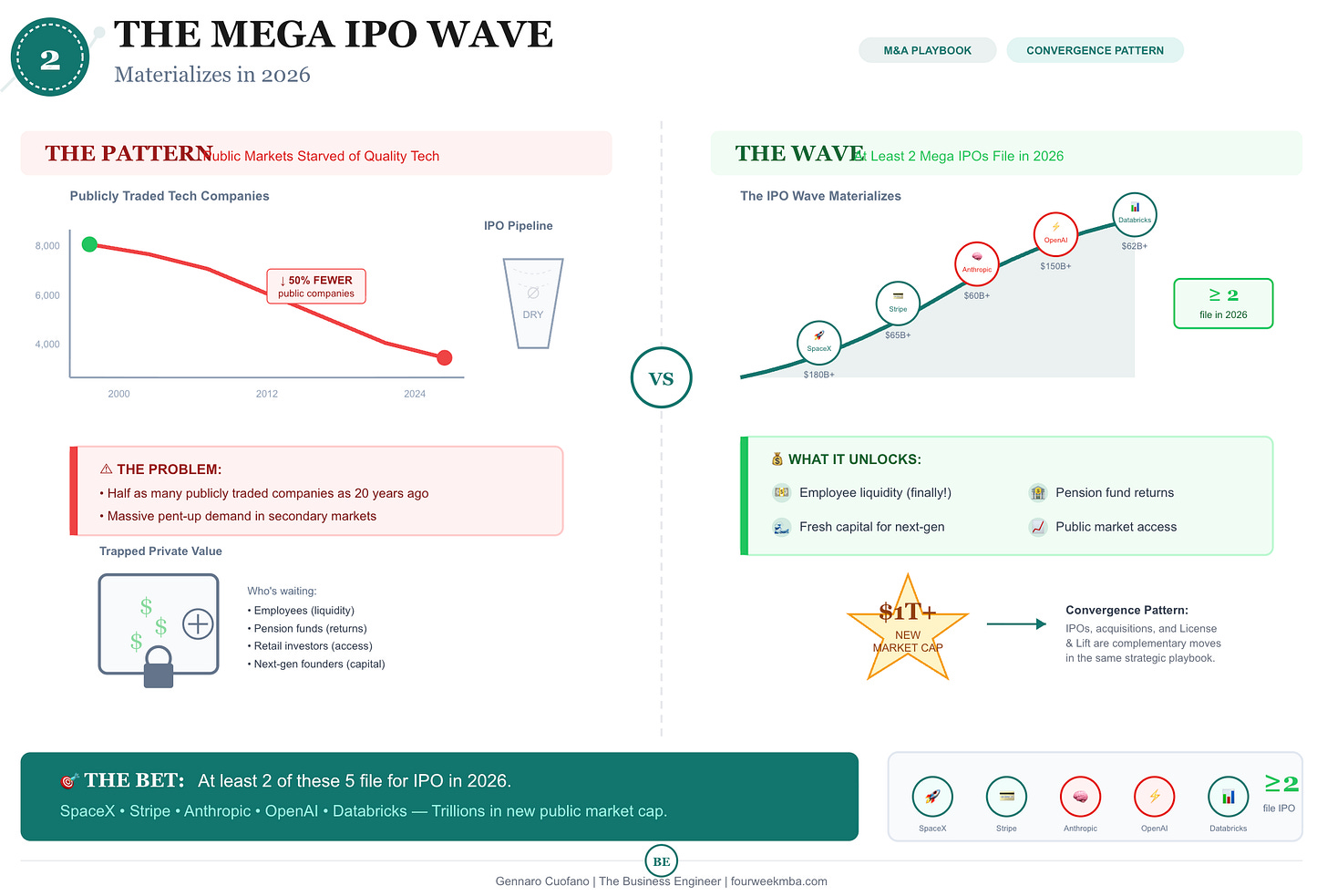

Bet #2: The Mega IPO Wave Materializes

The Pattern: Public markets have been starved of high-quality tech offerings. We have half as many publicly traded companies as two decades ago. Secondary market activity suggests massive pent-up demand.

The Bet: At least two of the following file for IPO in 2026:

SpaceX

Stripe

Anthropic

OpenAI

Databricks

Why It Matters: Trillions of dollars in new public market cap unlocks liquidity for employees, returns for pension funds, and fresh capital for next-gen company building.

BE Analysis: The AI Convergence

Mental Model: The Convergence Pattern

The capital cycle is part of the broader M&A architecture. IPOs, acquisitions, and License & Lift deals are complementary moves in the same strategic playbook.

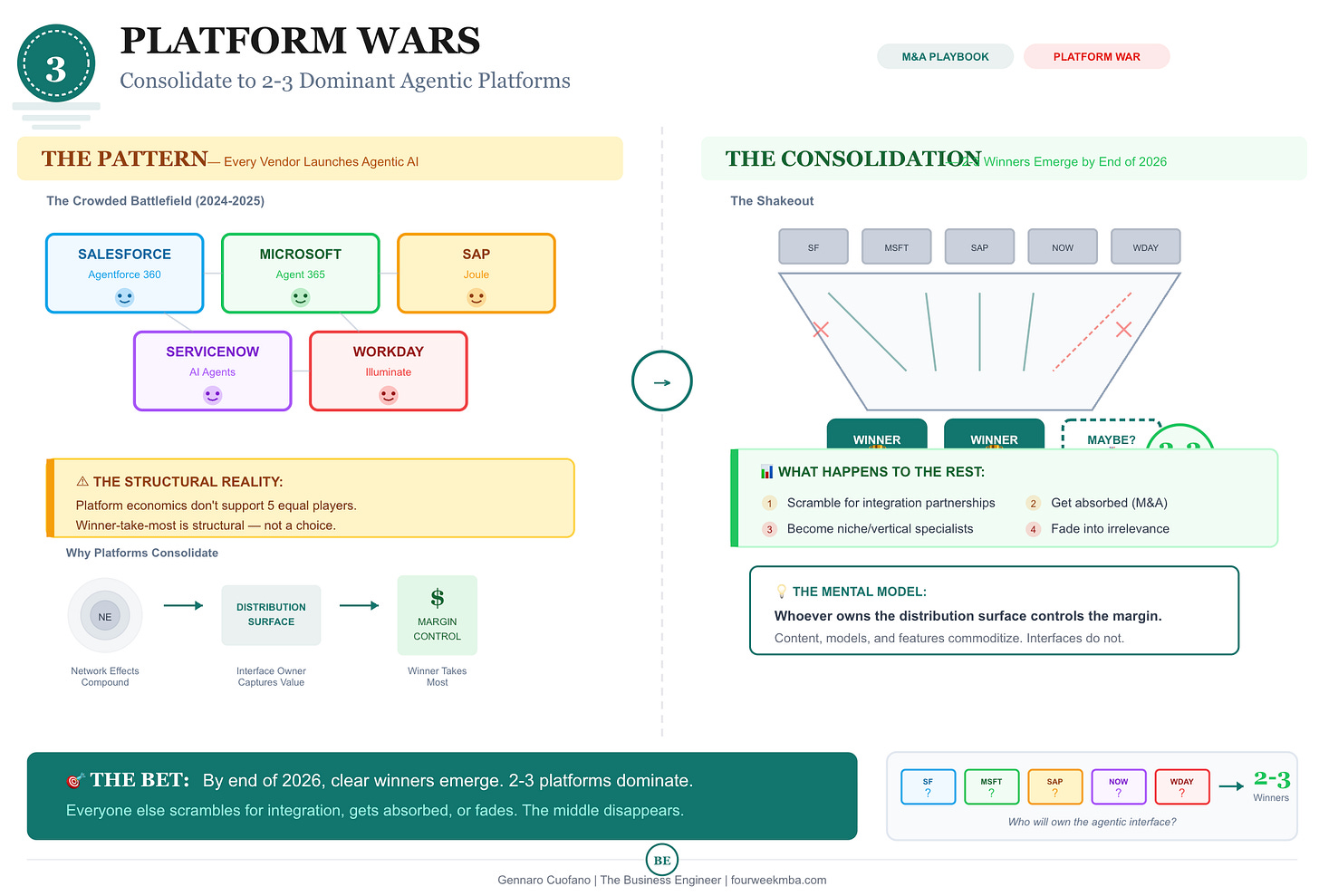

Bet #3: Platform Wars Consolidate to 2-3 Dominant Agentic Platforms

The Pattern: Every major enterprise vendor has launched their agentic AI play:

Salesforce’s Agentforce 360

Microsoft’s Agent 365

SAP’s Joule

ServiceNow’s AI Agents

Workday’s Illuminate

But platform economics don’t support five equal players.

The Bet: By the end of 2026, clear winners will emerge. Two or three platforms establish dominant positions; everyone else scrambles for integration or gets absorbed.

BE Analysis: The State of The Agentic Web

Mental Model: New Platform War

Whoever owns the distribution surface controls the margin. Content, models, and features commoditize. Interfaces do not. The recommendation surface is where value accrues.

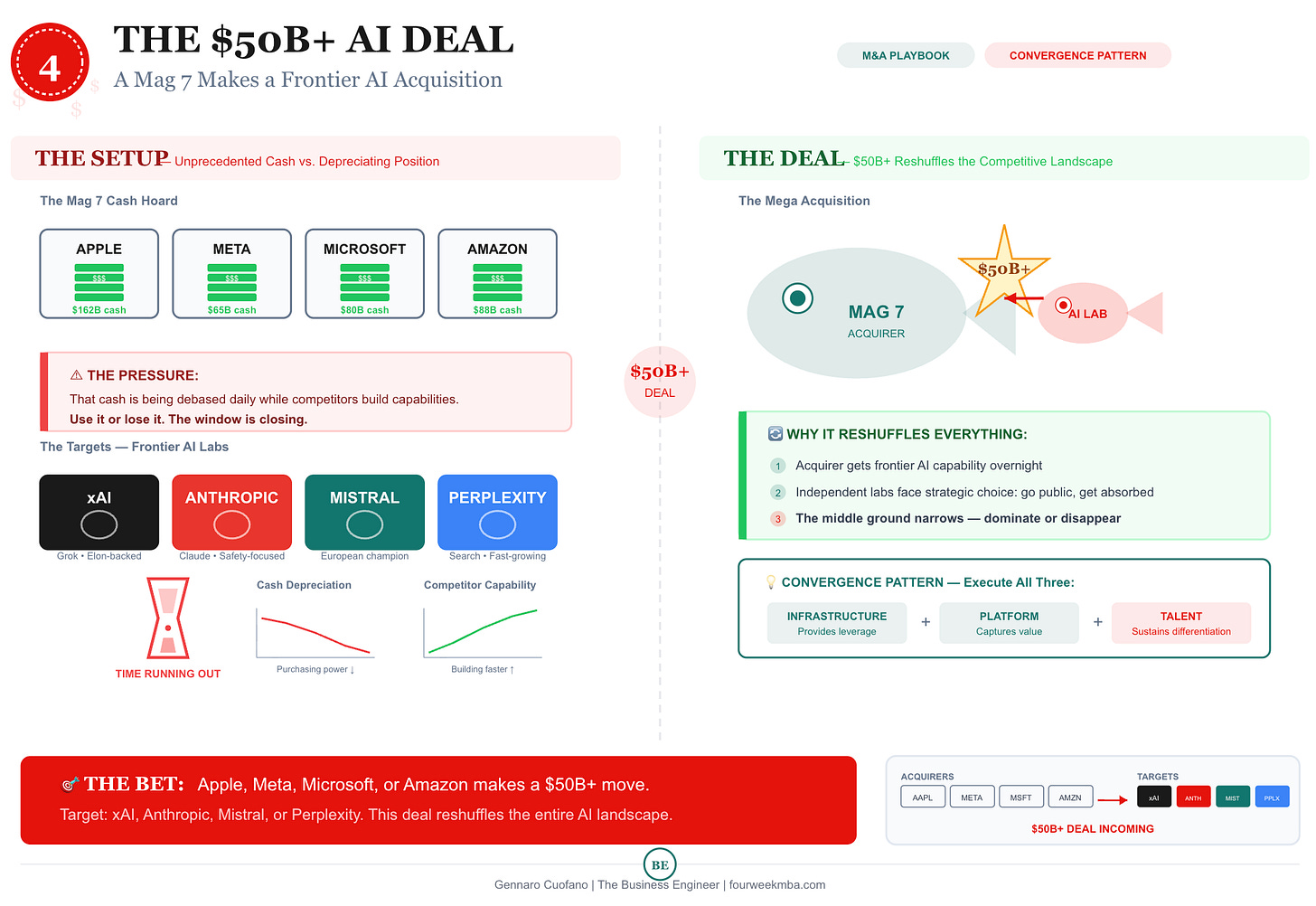

Bet #4: The $50B+ AI Consolidation Deal Happens

The Pattern: The hyperscalers have unprecedented cash on balance sheets. That cash is being debased daily while competitors build capabilities.

The Bet: A Mag 7 company (Apple, Meta, Microsoft, or Amazon) makes a $50B+ move on a frontier AI company (xAI, Anthropic, Mistral, or Perplexity).

Why It Matters:

This deal reshuffles the competitive landscape

Independent AI labs face strategic choice: go public, get absorbed, or get outcompeted

The middle ground narrows

BE Analysis: The Map of AI

Mental Model: The AI Layered Stack

Infrastructure provides leverage. Platform captures value. Talent sustains differentiation. The dominant players execute ALL THREE simultaneously. No single move is sufficient.

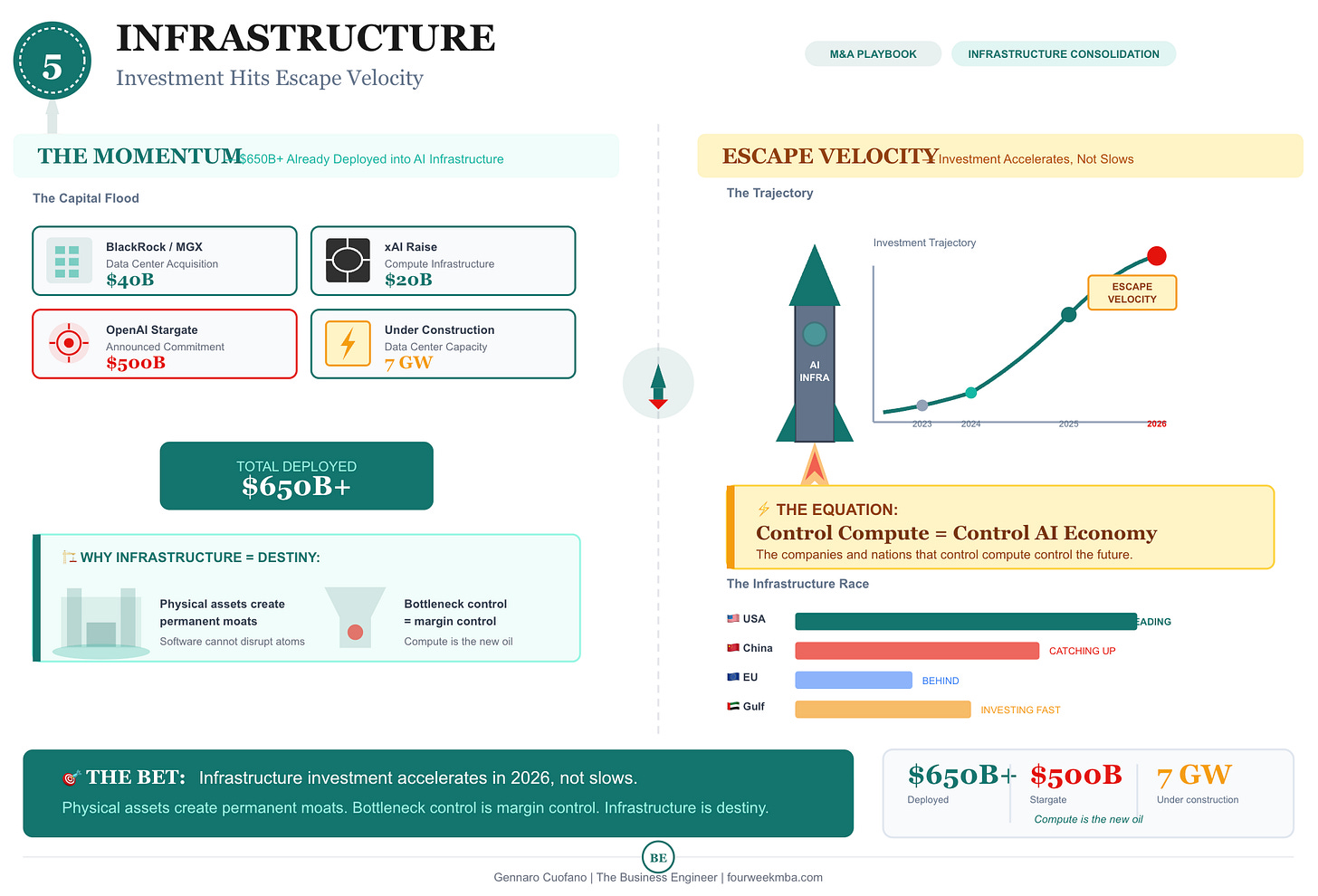

Bet #5: Infrastructure Investment Hits Escape Velocity

The Pattern:

$650B+ deployed into AI infrastructure

BlackRock/MGX $40B data center acquisition

xAI $20B raise

OpenAI $500B Stargate announcement

7GW of data center capacity under construction

The Bet: Infrastructure investment accelerates. The companies and nations that control computing control the AI economy.

BE Analysis: The Map of AI

Mental Model: Infrastructure Consolidation

Physical assets create permanent moats that software cannot disrupt. Bottleneck control is margin control. In the AI economy, infrastructure is destiny.