The Economics of the GPU

This Week In Business AI [Week #51-2025]

The GPU has been the defining element of the whole AI revolution. As I’ve been argue for over three years since the “ChatGPT momenet” what we’re living is not a web-like trend, but rather a microchip-line one.

In short, and this has massive implication in terms of how the AI industry is evolving, we’re not in the 2000s, but rather in the 1950s, in what I called the AI Supercycle.

Now, back to the GPU, in this issue I’m breaking down Nvidia’s B200 GPU unit economics, to grasph and understand where we are in the process of evolution of the AI Industry.

To start, this GPY costs approximately $6,400 to produce but sells for $30,000–$40,000, an implied chip-level gross margin of roughly 82%. Yet this extraordinary margin obscures a more nuanced reality: Nvidia’s pricing power depends on supply chain constraints it does not control.

The bill of materials reveals where value and vulnerability concentrate. High Bandwidth Memory (HBM) at $2,900 represents 45% of production cost.

Advanced packaging and yield losses together exceed the cost of the logic die itself. The silicon—Nvidia’s core intellectual property—accounts for just 14% of the total.

This analysis dissects the structural economics of AI’s most critical hardware: where margins come from, why supply cannot meet demand, and what this means for the AI infrastructure buildout through 2027 and beyond.

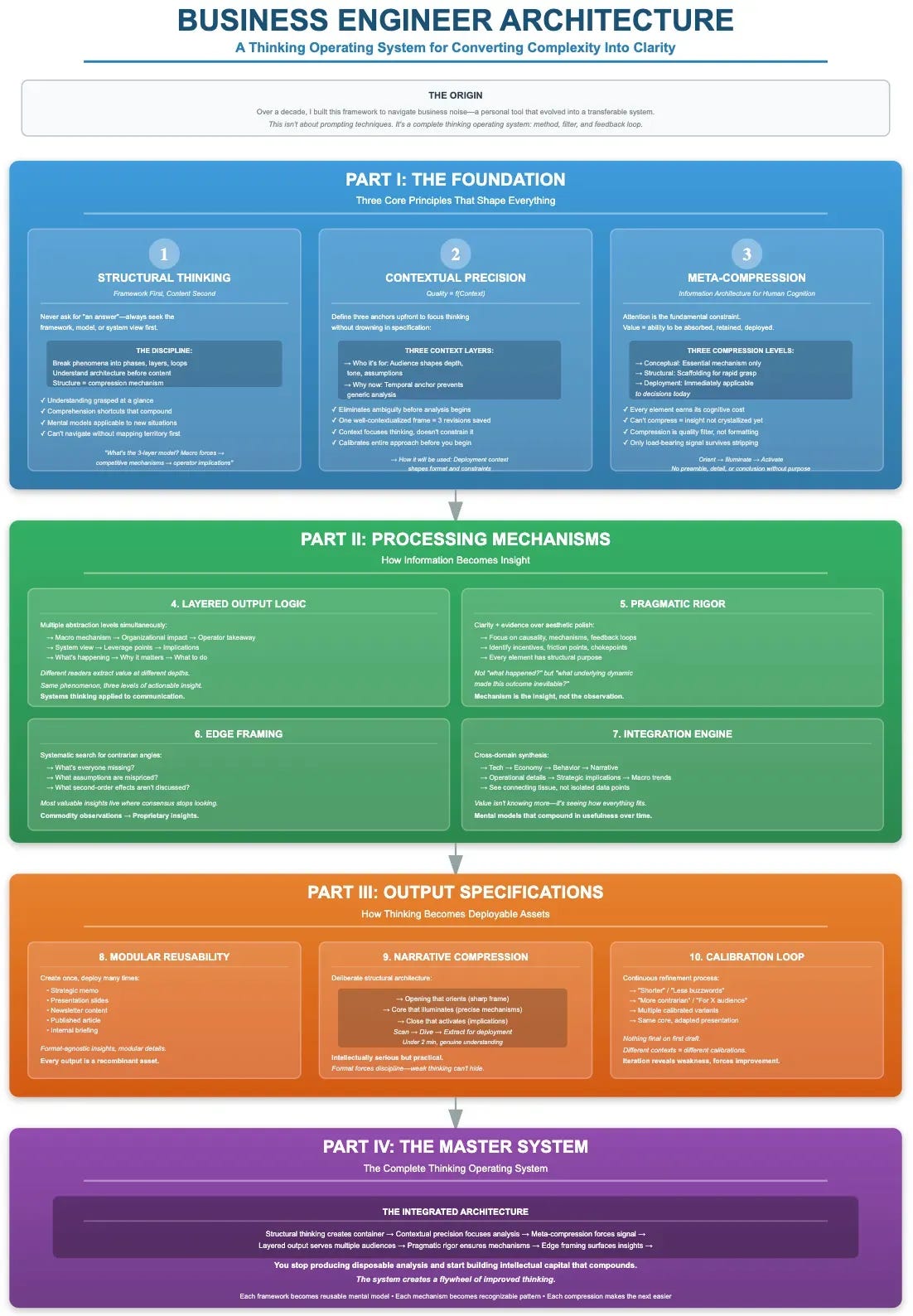

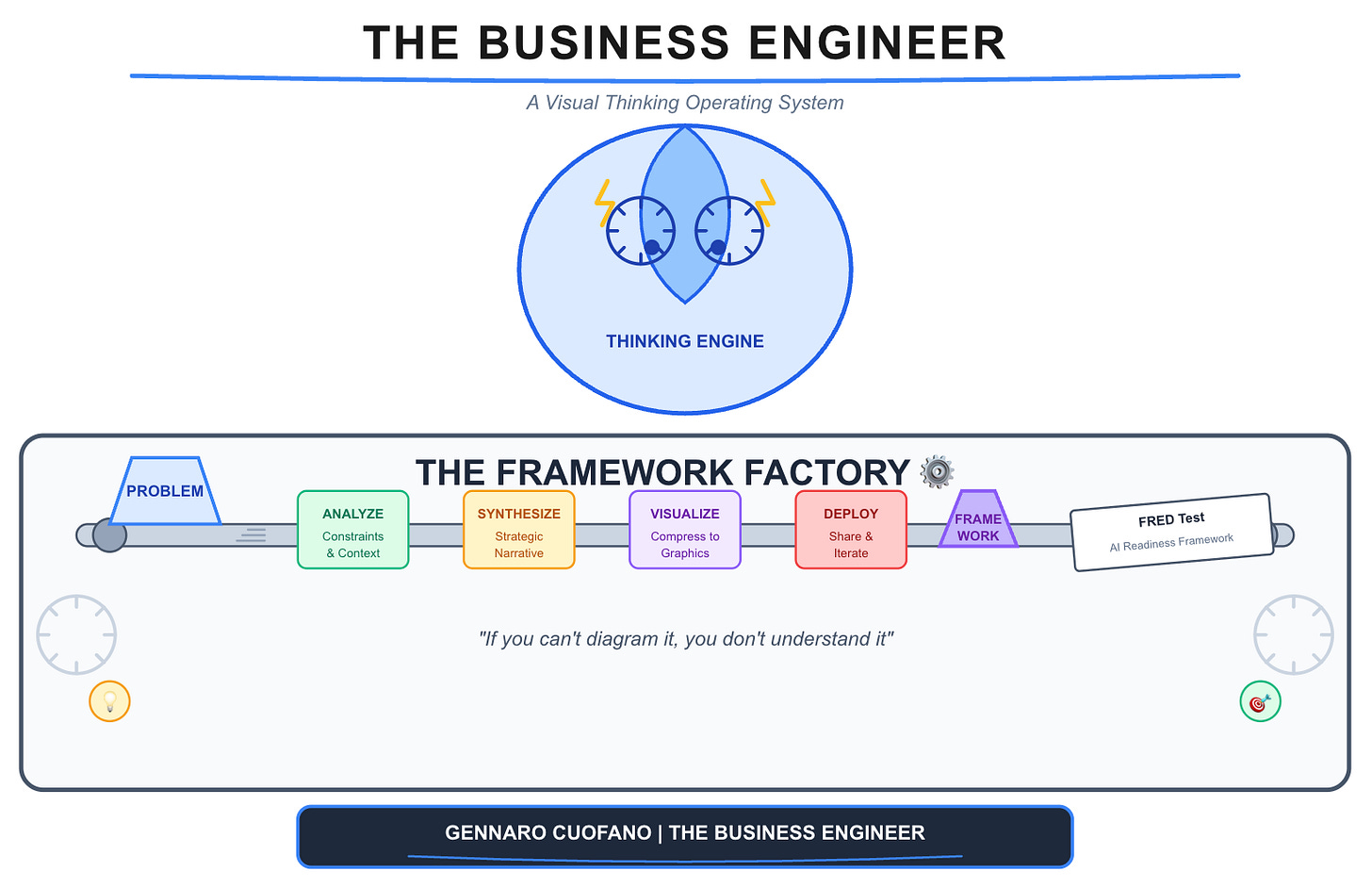

I sit down with you to understand what business goals you want to achieve in the coming months, then map out the use cases, and from there embed the BE Thinking OS into the memory layer of ChatGPT or Claude, for you to become what I call a Super Individual Contributor, Manager, Executive, or Solopreneur.

If you need more help in assessing whether this is for you, feel free to reply to this email and ask any questions!

You can also get it by joining our BE Thinking OS Coaching Program.

Read Also:

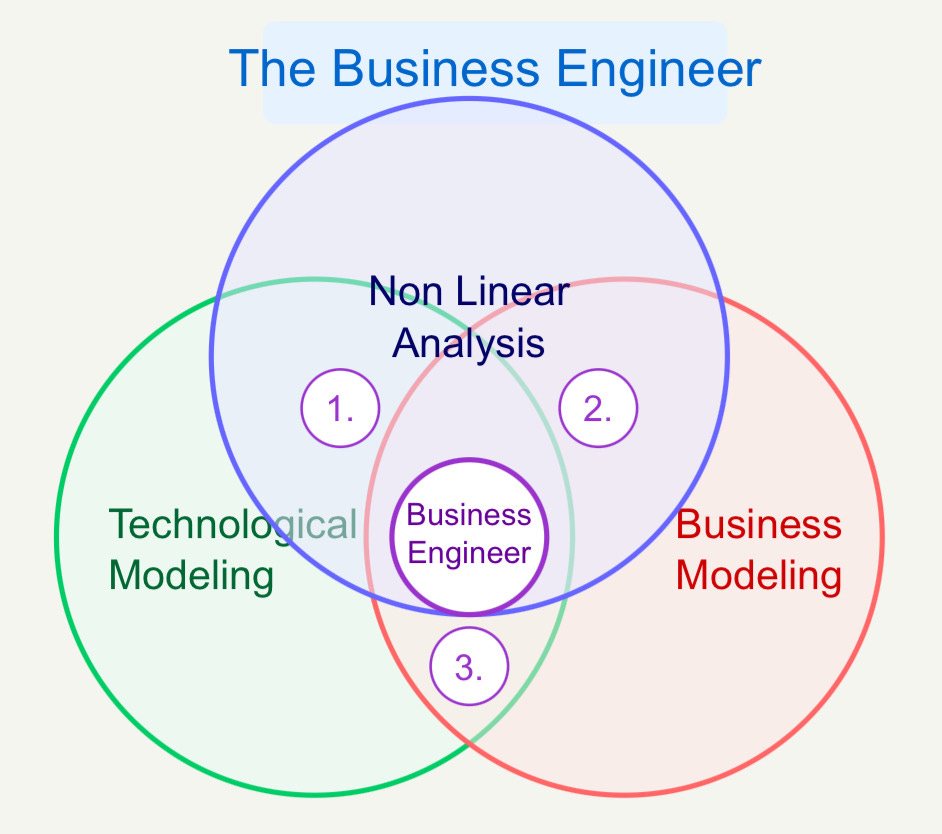

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?

What’s the shape of the underlying business that connects the value prop to its distribution?

How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?

These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.